Beyond the Arches #25: The climate future is uncertain, but innovations in materials and sourcing may provide blue skies for construction-sector investors

Featured Story

Innovations in materials and sourcing may provide blue skies for construction-sector investors amid extreme weather events

The summer got off to a turbulent start in North America, with extreme weather and widespread power outages forming the backdrop to Memorial Day weekend for hundreds of thousands.

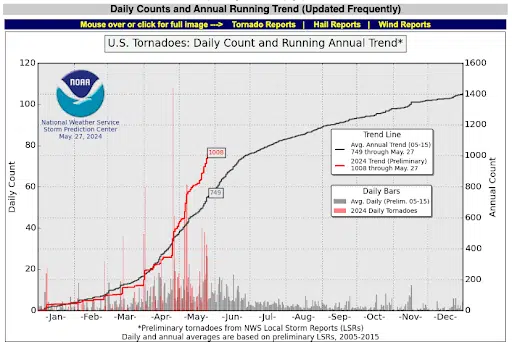

More than 70 confirmed tornados touched down across 15 states, killing 23 people and leaving hundreds of thousands of businesses and homes without power in one of the most active tornado seasons on record for the first half of the year.

For context, 300 storms were reported during April 2024, marking the second-most active April for tornados on record – even though historically, May is the peak of tornado season in the United States. With La Nina bringing systematic weather changes over the summer, the potential for more destructive storm activity grows.

Storm watches and warnings stretched from New York State to as far as Texas, threatening destructive winds and possible hail. This threat of storms snarled air traffic from Boston to Atlanta during one of the busiest travel weekends of the year, in which the Transportation Security Administration (TSA) reported a record 2.9 million air travelers scanned in one day.

Farther south, Mexico finds itself in the grip of extreme heat and weather conditions in and around Mexico City, which increases the potential for torrential rains, hail, flooding, and whirlwinds throughout the country. Eight states in Mexico face the potential for intense rain, including Puebla, where a destructive hail and rainstorm left the capital city (also Puebla) digging out of thick piles of ice. And the country’s danger is not over, as researchers from the National Autonomous University of Mexico warn that the next 10–15 days may feature the highest temperatures recorded in the area’s history.

The National Oceanic and Atmospheric Administration (NOAA) offered further news of extreme storm potential this week, predicting that the 2024 hurricane season could be particularly busy. The same conditions driving active tornado formation can present conditions ripe for damaging, named storm systems in the Atlantic. The Climate Prediction Center (CPC) reports an 85 percent chance that this year’s hurricane season will be more active than normal, with as many as 25 named storms possible. A typical storm season has an average of 14 storms, with seven named and three major storms.

How to invest in climate-resilient building technologies

After storms pass, communities are faced with the daunting task of rebuilding. To speed up this process, and make rebuilding more resilient to face future needs, the construction sector is turning to building innovation. Three companies within the construction sector offer investors opportunities to improve restoration and resilience for those in higher-risk areas:

- Apis Cor: Robotic construction is at the forefront of fast, next-generation building design, with precision-designed, 3D-printed cement-free structures offering the opportunity to cut construction time significantly. This NASA-recognized construction startup has raised $3.5M to fuel faster, more cost-efficient construction. CEO and Cofounder Anna Cheniuntai, along with CTO and Founder Nikita Cheniunta and Director of Construction Technologies Trevor Ragno, have broken ground on the company’s first 3D-printed showcase home in South Florida to demonstrate the potential of printed construction materials.

- The BuildClub: The $250B construction industry is sprawling and inefficient. Every builder struggles to source materials, manage supply chain issues, and keep costs competitive. The BuildClub uses AI and a deep understanding of construction supply logistics to streamline the sourcing process, remove the logjams that plague construction products, and empower builders with reliable technology to overcome challenges. The platform scans more than 15M items daily to price-compare and offers next-day materials delivery to keep projects moving. With a focus on driving the traditional construction materials model forward, Stephen Forte founded the on-demand materials startup along with Director of Engineering Pavel Kirakosyan and Operations Manager Andrew Barron.

- Aquipor: Stormwater pollution and urban flooding are major challenges for city centers. The potential for damaging storms makes the need for innovative solutions all the more pressing. Aquipor’s patent-pending permeable concrete and engineering materials solve extreme weather challenges while maintaining an extremely low CO2 footprint compared to traditional concrete. This combination can drive green building forward while improving human health in high-population areas. Cofounders Greg Johnson and Kevin Kunz draw on their combined expertise in climate tech and green infrastructure to bring this innovative materials concept to the market.

On Our Radar This Week

- Israeli tanks reach Rafah as strikes continue in the region. The tank incursion follows a strike in Rafah that killed dozens of people and displaced hundreds of thousands fleeing Gaza as Israel continues its ingress. A humanitarian aid dock under construction in the area broke apart this week, hampering efforts to deliver food and supplies to civilians there.

- U.S. consumer confidence rises for the first time in four months. An unexpected uptick in consumer confidence beat May estimates, despite looming recession fears. Consumer perceptions of business conditions and the labor market spurred the first gains since January.

- Stock trades move to single-day settlement. In an effort to keep pace with changing investment technology, Wall Street this week imposed a one-day settlement timeline for stocks and other securities. The move comes after investor-driven GameStop stock surges rattled the market in 2021, which highlighted the need for faster stock settlement practices and associated risk.

Macro Bites

- T-Mobile agrees to buy U.S. Cellular in a $4.4B deal. The merger allows T-Mobile to expand its coverage footprint and potentially enhance service to underserved areas across 215 countries.

- Employee revolt leads OpenAI to establish an AI safety committee. Key figures departed the company recently, citing underinvestment in AI safety and security in their exits.

- Elon Musk raises $6B for xAI. Although an impressive Series B raise, the OpenAI competitor’s $24B valuation is similar to Anthropic. OpenAI boasts a whopping $86B valuation.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.