A quick look at our favorite categories:

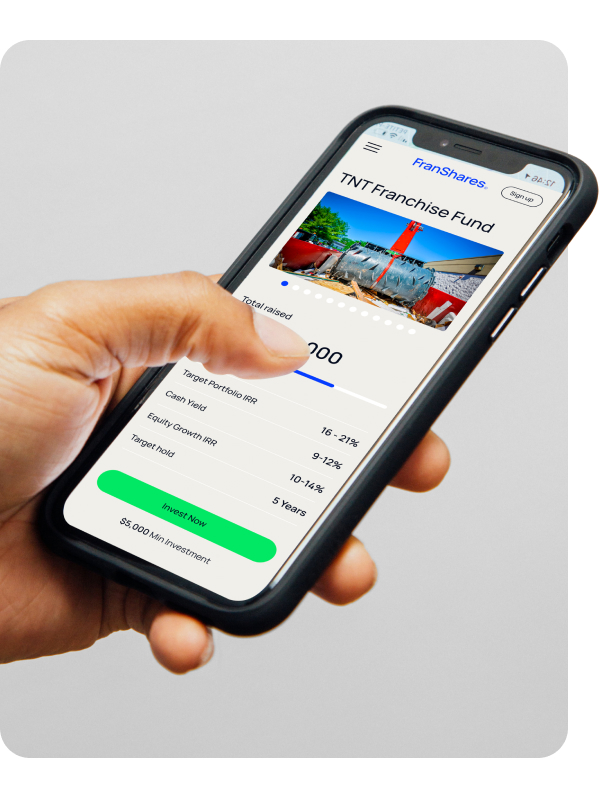

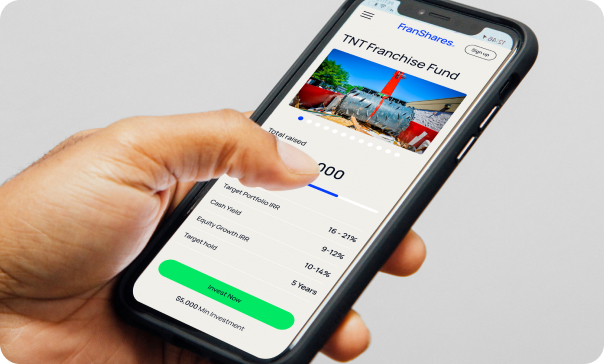

Generate passive income from franchise investing.

Risk-adjusted returns from experienced franchise operators, plus tax-efficient investing through eligible retirement accounts.

Why invest in franchises?

For decades, wealthy investors and private equity firms have used franchise investing as a way to build wealth through consistent income and diversify away from volatile public markets.

With FranShares, anyone can invest in proven franchises and gain the opportunity to generate passive income while leveraging tax-advantaged accounts.

Fitness

- Gyms

- Bootcamps

- Yoga

- Crossfit

Kids

- Apparel

- Activities

- Childcare

- Tutoring

Haircare

- Salons

- Blow Dry Bars

- Barbers

- Hair Removal

Pets

- Daycares

- Food Stores

- Grooming

- Specialty Shops

Automotive

- Car washes

- Auto Repair

- Dealerships

- Tinting

Food

- Restaurants

- Catering

- Delivery

- Fast Food

Home Services

- Cleaning

- Interior Design

- Plumbing

- Electrical

Waste Management

- Recycling

- Junk Removal

- Landfill

- Commercial

B2B

- Fleet Management

- Marketing

- Accounting

- Signage

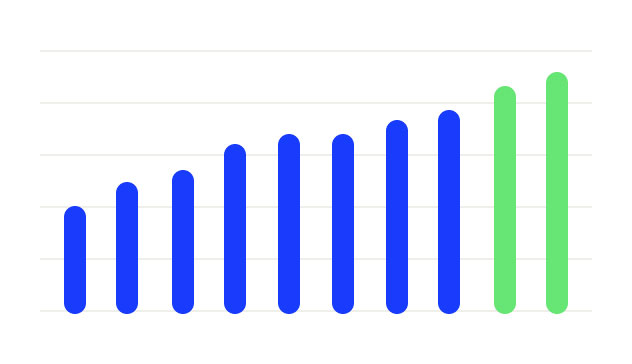

The franchise industry is booming.

Industries in

franchising:

Brands in the industry:

brands

Number of franchised

locations in the U.S.

Franchise Business

Economic Output

billions in 2024

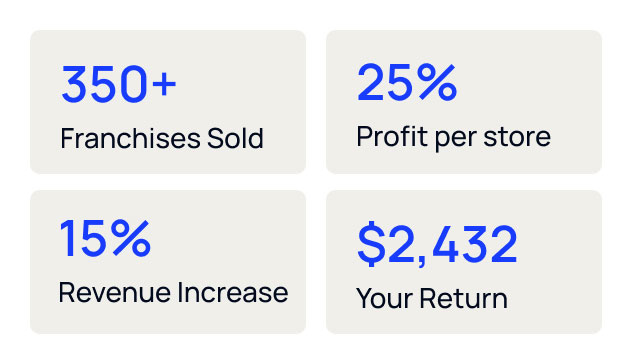

Earn in two ways.

Wealthy investors have used franchising as a diversification and wealth building tool for decades. Now, so can you.

Sign up01.

Distributions.

Franchises will regularly distribute profits to investors after a 12 to 18 month ramp-up.

02.

Franchise value.

The value of each franchise will increase over time.

Our in-house team of experts with experience in franchising, finance, and operations reviews hundreds of franchise investment opportunities to ensure our investors only see the best franchise investment opportunities.

Franchising requires non-stop time, effort, and resources. Purchasing shares in franchises takes just a few button clicks. That’s it.

With FranShares, investors have the opportunity to seek diversification across industries, geography, and business strategies.

Your operators take care of the management and operations of the business. With little to no legwork, you have the potential to earn passive income with FranShares.

At FranShares, we provide you with financial projections, profit reports, growth strategies, and full disclosure of any and all info necessary to create your portfolio.

Discover Franchise Investing with Our Guide.

- Learn the benefits of investing in franchises

- Learn about the size and growth potential of the Franchise Industry

- Find out how FranShares selects franchises to invest in

- See why franchise investing has worked for many

Be the first to know about new franchise opportunities.

Learn about franchising, diversify your assets, and make passive income a reality today.