Beyond the Arches #13: Will 2024 be another banner year for AI investing?

Featured Story

Generative AI is boosting production, productivity, and investment activity

The development and expansion of artificial intelligence (AI) in the past few years has touched nearly every aspect of our lives from health care and manufacturing to finance and retail. And it seems the technology is here to stay: Between 2023 and 2030, the AI industry is projected to expand by a whopping 37.3 percent.

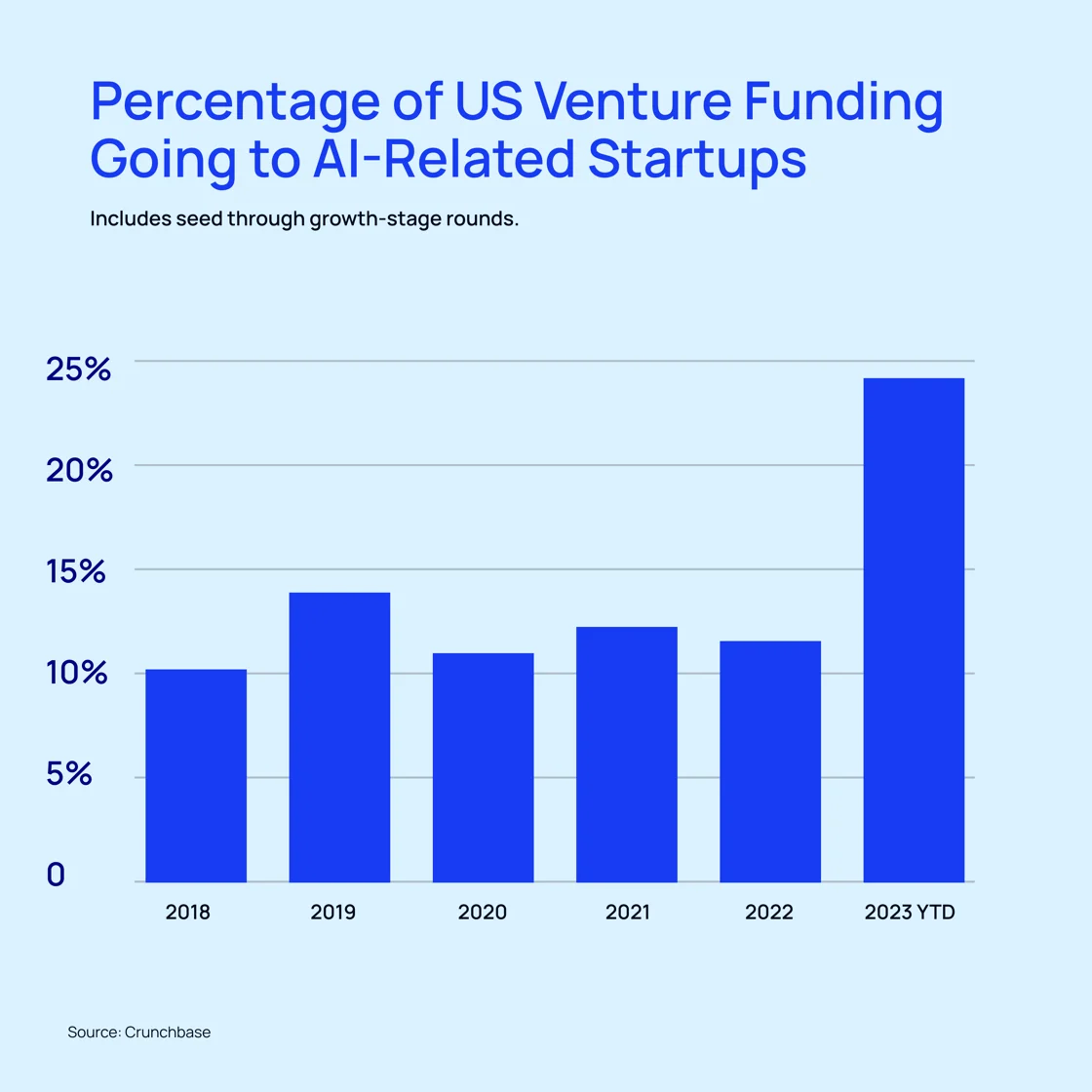

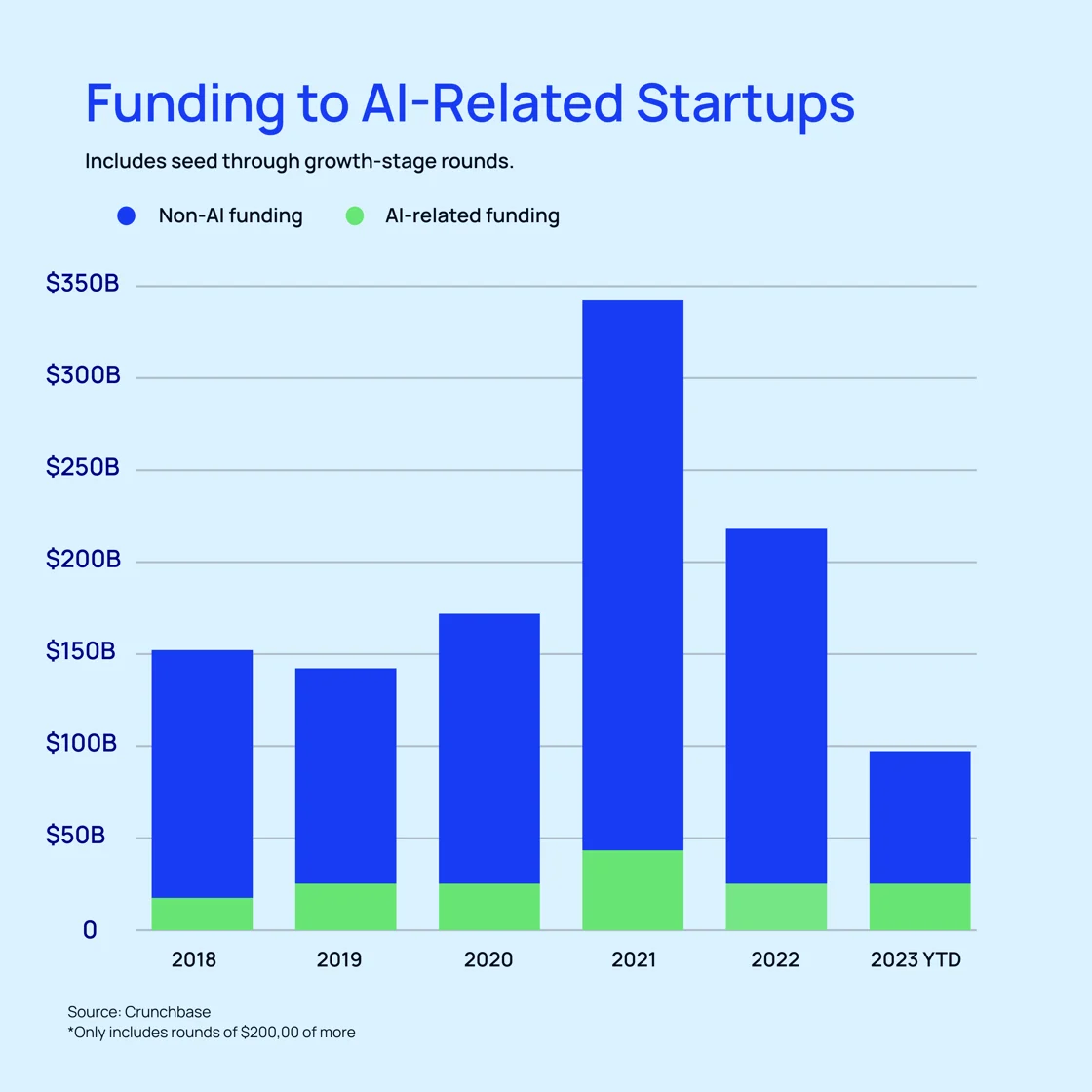

Investment capital, of course, has its part to play in fueling the advanced tech boom. According to data from Crunchbase, more than one out of every four dollars invested in startups in 2023 went to an AI-related company, even as overall startup investment fell across the board.

Interestingly, there is some debate about whether AI is its own distinct investment sector or part of a larger set of technologies that can be applied across sectors.)

As AI-driven technology continues to grow, its real-world impact is becoming more measurable. The Nielsen Norman Group reviewed a series of case studies that revealed using generative AI tools in business environments improved employee productivity by an average of 66 percent. The studies showed that the largest gains were seen in more complex tasks, and less-skilled workers are the ones who benefit the most from AI use.

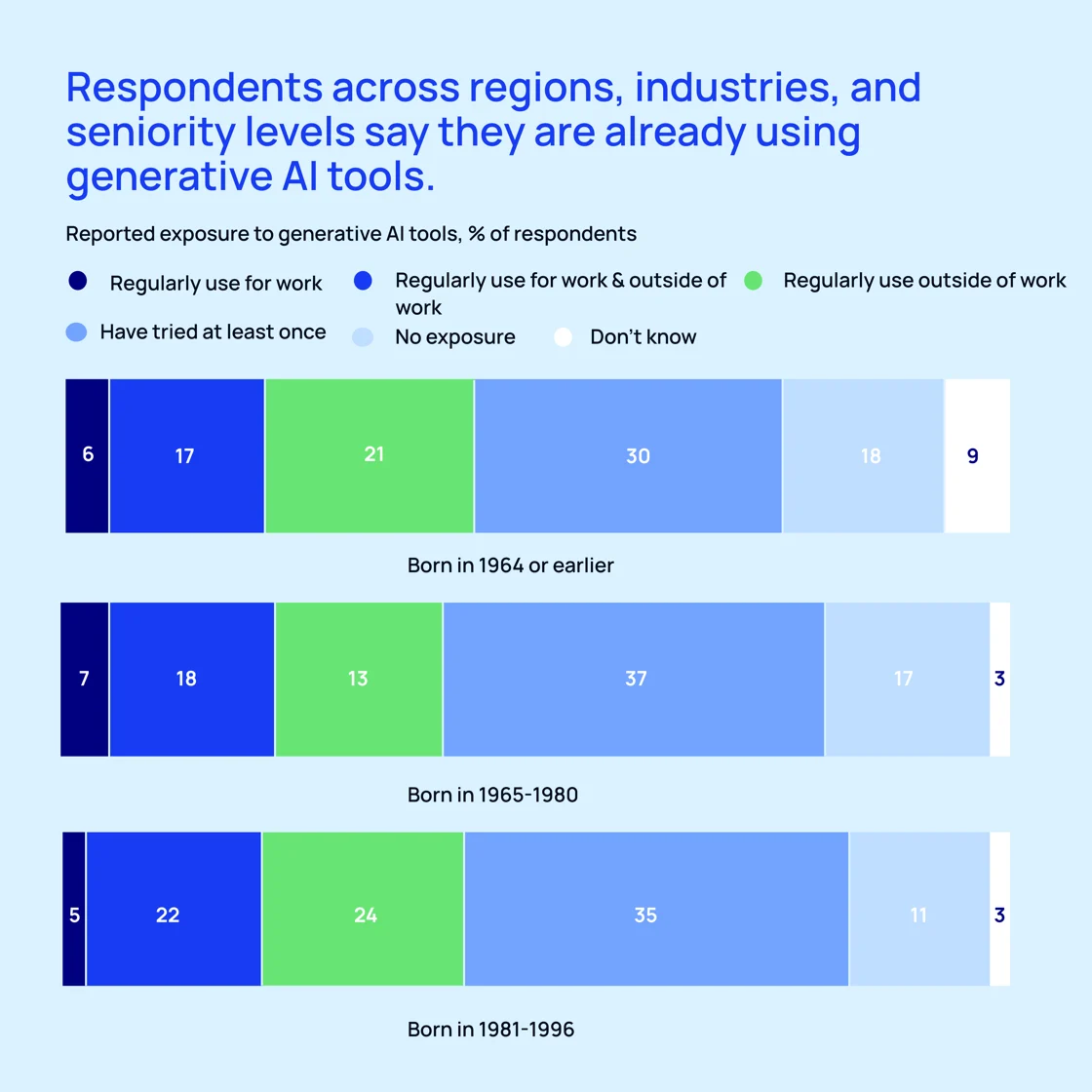

The adoption of AI tools outside the office has continued to grow as well. An April 2023 survey by McKinsey found that the majority of respondents who had some exposure to generative AI were regularly using it outside of work.

Direct investment opportunities

In good news for retail investors, there’s no reason to wait to add AI-powered companies to your portfolio. Here are two direct investment opportunities in AI to leverage right now:

- Clockwork

Clockwork builds AI-powered robots to make beauty services more convenient and accessible. The company’s first product is a robot that paints nails faster and more accurately than a human, at half the price. Powered by an impressive patented tech stack, Clockwork’s custom algorithm directs the robot’s actions while painting the nail, taking into account the complex way nail polish behaves as a non-newtonian liquid, the shape of the nail, its contours, the pressure applied by the robot, and other variables. Through their cloud-based platform, beauty services remain uninterrupted, as robots are efficiently serviced remotely. Already backed by one of the co-founders of Dropbox, Clockwork is currently raising an oversubscribed round of capital via WeFunder. - Artly Coffee

Artly uses cutting-edge AI technology to create authentic specialty coffee experiences with robot baristas. Their standard robot module takes up only 20 square feet, meaning a store with two or three robots averages just one-fifth of the square footage required by an average Starbucks coffee shop. The compact footprint reduces upfront costs and streamlined operations – the startup cost of one Artly-powered store is just one-sixth of the construction cost of a Starbucks location. So far, the company has raised over $10M; launched nine locations in Washington, Oregon, California, and New York; served over 350,000 cups of coffee; and plans to expand through franchisees. Currently, Artly is raising capital via StartEngine.

STR Investment Opportunities

Short-term rentals (STRs) are a flexible and often lucrative way to add real estate to your investment portfolio. Check out these opportunities, courtesy of our friends at The Offer Sheet.

Mid-century dream cottage on the Oregon coast

1410 SW Corona Ct, Waldport, OR 97394 | $899,000

This historic four-bedroom, three-bathroom coastal home with two living areas and two kitchens is steeped in classic Oregon Coast details. Perched high on a cliff above the southern side of Alsea Bay, the home offers breathtaking sea views and panoramic outdoor views of the south and north sand spits, Alsea Bay, and the Pacific. You’ll love the eclectic, old-world details of the cottage, from beamed wood ceilings, antique details, and an amazing rock-and-shell-embedded wood-burning fireplace hearth with a beautiful vintage mantle. Located down a lane in a quiet residential area, this home is just up the hill from Waldport and within walking distance of the Hilltop Cafe-Bistro. The rare, oversized, 1+ acre lot is tucked away from the street and adds a serene and private feel. Ideal as a private home, second home, or income vacation rental (as is its current use).

- Average daily rate: $451

- Expected occupancy rate: 66%

- Monthly expected income: $9,054

- Monthly expected expenses: $6,907

- Monthly expected cash flow: $2,147

- Expected cash on cash return: 10.8%

Move-in-ready chalet in Pine Mountain Lake, California

12596 Fountain Ct, Groveland, CA 95321 | $499,900

This gorgeous, rare A-frame chalet comes with modern amenities and golf course views. The three-bedroom, two-bathroom home has new laminate hardwood floors throughout, as well as new paint, wood vaulted ceilings, new cabinetry, new appliances, waterfall stone countertops, and a new HVAC system. Conveniently located on hole number five, this home is currently a working Airbnb bringing in approximately $60K per year.

- Average daily rate: $381

- Expected occupancy rate: 55%

- Monthly expected income: $6,374

- Monthly expected expenses: $4,364

- Monthly expected cash flow: $2,010

- Expected cash on cash return: 17.5%

Mountain A-frame nestled in the heart of California

399 Maid Marian Dr, Divide, CO 80814 | $320,000

This extraordinary property offers a superb opportunity to live the dream of peaceful, mountain living. Surrounded by trees and a sense of tranquility, this remodeled two-bedroom, two-bathroom cabin boasts breathtaking views as well as all-new electrical, plumbing, insulation, well, metal roof, and deck. The kitchen has a breakfast bar that opens up to the great room and all brand-new appliances. There’s plenty of parking space and outdoor activities like hiking, hunting, fishing, and skiing aren’t far away. This mountain property is perfect for those seeking solitude, adventure, or a combination of both. Whether you want to make this your primary residence, a weekend getaway, or an investment property, the possibilities are endless.

- Average daily rate: $301

- Expected occupancy rate: 59%

- Monthly expected income: $5,402

- Monthly expected expenses: $3,178

- Monthly expected cash flow: $2,224

- Expected cash on cash return: 28.7%

SMB Investment Opportunities

Courtesy of our friends at SMB Deal Hunter

Membership model med-spa in Fairfax County, Virginia

This particular business has more than 48,000 customers. Besides the sizable customer list, this med spa sets itself apart with its membership (aka subscription) business model. This provides stable and predictable recurring revenue, which separates it from other medspas out there. Plus the med spa market is expected to grow at a CAGR of 13.75 percent from 2022 to 2028, so there’s much room to expand either by offering new services or even opening new locations. | View listing

- Asking price: $2,599,999

- EBITDA: $600,000

- Revenue: $2,000,000

- Established: 2010

Wholesale and DTC luxury shoe brand in Tampa, Florida

This unique business has 200+ wholesale accounts (including legit retailers like Nordstrom and Bloomingdale’s) and a wholesale AOV of $10K–$25K. The DTC wing is also worthy of attention, with a $114 AOV and a 27 percent repurchase rate. The retail presence naturally creates a flywheel effect for the DTC business since people who see products in stores often end up buying online, which ultimately lowers DTC marketing costs (the dream). Besides that, the owner wants to roll equity, stay on, and keep running the company in the hope of a second exit down the line. This perfectly aligns incentives, both derisking the transition and making it so you don’t have to be involved on a day-to-day basis. | View listing

- Asking price: $2,975,000

- EBITDA: $849,963

- Revenue: $7,607,351

- Established: 2014

One-of-a-kind US-based amusement park manufacturer

Because of increasing urbanization leading to a demand for leisure activities and experiences within city limits, the amusement park market is projected to grow to a whopping $109.3B by 2032. This has led to private equity players getting into the space (e.g., Permanent Equity bought Chance Rides last year). Well, this is a similar type of business. This company manufactures a certain type of popular ride product – and they are the ONLY one in the United States that does so. The next closest competitor is in Europe. The owner is retiring but looking to roll equity and stay involved, which is a great sign of faith. Who knows, maybe you’ll grow it and be flipping this to a PE firm in a few years. | View listing

- Asking price: Undisclosed

- EBITDA: $1,144,420

- Revenue: $9,893,140

- Established: 1971

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.