Beyond the Arches #26: Global economies depend on faster, safer trading and business innovation, which means new opportunities for tech-minded investors

Featured Story

New era in Mexican politics highlights need for monetary stability, security, and access

It’s official – Mexico has elected its first female president. In an exciting new era for the traditionalist, conservative nation, Nobel laureate and former mayor of Mexico City Claudia Sheinbaum captured nearly 60 percent of the vote – the highest level of support for any presidential candidate since the country ended single-party rule in 2000.

The momentous day marks a triumph for women in a nation where gender equality and pay equity experience considerable headwinds. But the work is only beginning. Sheinbaum now takes the reins of a nation struggling to modernize amid economic hardship, heightened violence, and drug cartel control. She must address the strained relationships with its northern neighbor at a time when border tensions and dangerous illegal crossings are at an all-time high.

Mexico’s economy reacted strongly to the news of wider results in the national election. The Peso suffered a 4 percent dip on news that its current ruling Morena party looked set to secure a supermajority in its lower house and a simple majority in the Senate – results that surprised analysts who had predicted more conservative levels of support. The potential for Sheinbaum to make more ambitious reforms than her predecessors created uncertainty for investors interested in maintaining the country’s current fiscal conservatism.

Even as Sheinbaum and her administration look toward a better future for Mexico and its wider place in the world economy, the Biden Administration moves toward his presidency’s most restrictive border policies this week. President Biden is expected to sign an executive order to enable asylum restrictions during surges in immigration. The move is likely to draw backlash from within his own party, and could further stress relations with Mexico.

How to invest in tools for the future of the economy

Mexico’s prosperity, as well as the larger global economy, rely on monetary stability, security, and data access. The modernization of economies also calls for modernizing the platforms and technologies that drive trade and investment. Fortunately, many startups focus on meeting the challenges of trading and innovating in the digital economy. Here are two startups to consider when diversifying into the finance tech and security sector:

- Atakama: Making the web more secure is a step in the right direction for every facet of society, and Atakama helps make your web browser a safer place for work and trade. Its managed browser security platform allows any browser to become a secure workspace. It helps individuals and companies protect the people, data, and applications that drive industry and economy forward. CEO and co-founder Daniel H. Gallancy leads Atakama along with COO and co-founder Dimitri Nemirovsky and CRO Scott Glazer.

- LUMEOVA: The world runs on data – increasingly, wireless data. The demand for wireless data will increase tenfold in the next decade thanks to advances in AI, mobile connectivity, and streaming quality. Wireless providers currently struggle to meet these demands as they expand 5G cellular and wifi. LUMEOVA is helping move the world toward terabit-per-second connectivity by expanding access to optical spectrum communications using its WiRays photonics technology. Founder and CEO Mohammad Ali Khatibzadeh, Head of Systems Bill Croughwell, and Director of Engineering Charley Wilson have secured 20 patents for LUMEOVA’s technology.

On Our Radar This Week

- he International Air Transport Association (IATA) is predicting shareholder-friendly skies with airlines on track for a $30B profit in 2024 – projected earnings that are $2.5B above 2023. Rising expenses are blunting the effect, however; despite gains, higher costs are holding back the per-passenger earnings. This news comes even in light of more conservative consumer spending on travel and leisure.

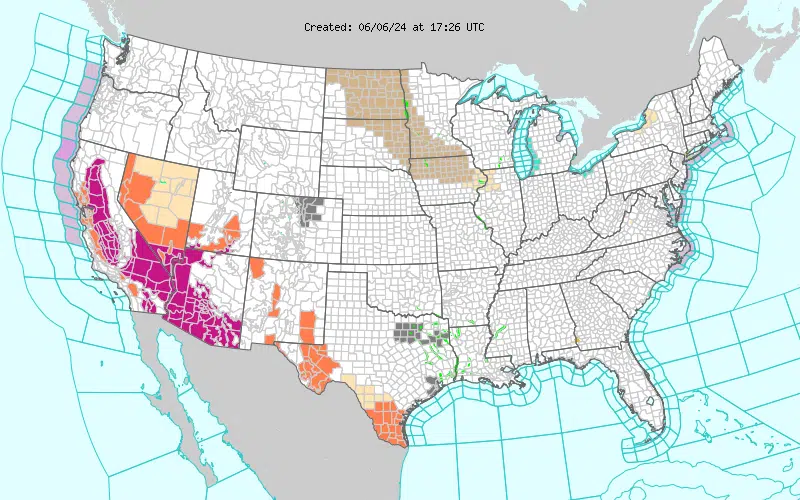

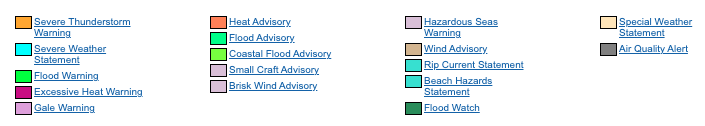

- Another week of severe weather in the West and South. A massive heat dome looms over the western half of the United States as wind and dry conditions push fires across California, including the Corral fire. Texas also faces the potential for life-threatening heat, precipitation, and hail.

- Zero down-payment mortgages make a comeback. A dubious financial vehicle most closely associated with the last mortgage crisis debuts in a new incarnation. Many say the move ignores the larger factors driving the housing crisis, such as institutional investors locking up available housing and driving up home prices.

Macro Bites

- Toyota halts sales on three models as safety scandal deepens. According to internal examinations, Toyota and Honda mishandled safety results for dozens of models over the last decade.

- A dozen stocks faced technical glitch, trading halts on Monday. Berkshire Hathaway stocks plunged 99 percent before the halt, but the technical issue was resolved within two hours.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.