Everbowl Texas Franchise Fund

- Food

$10,000 Min. Investment

IRA Eligible on AltoIRA

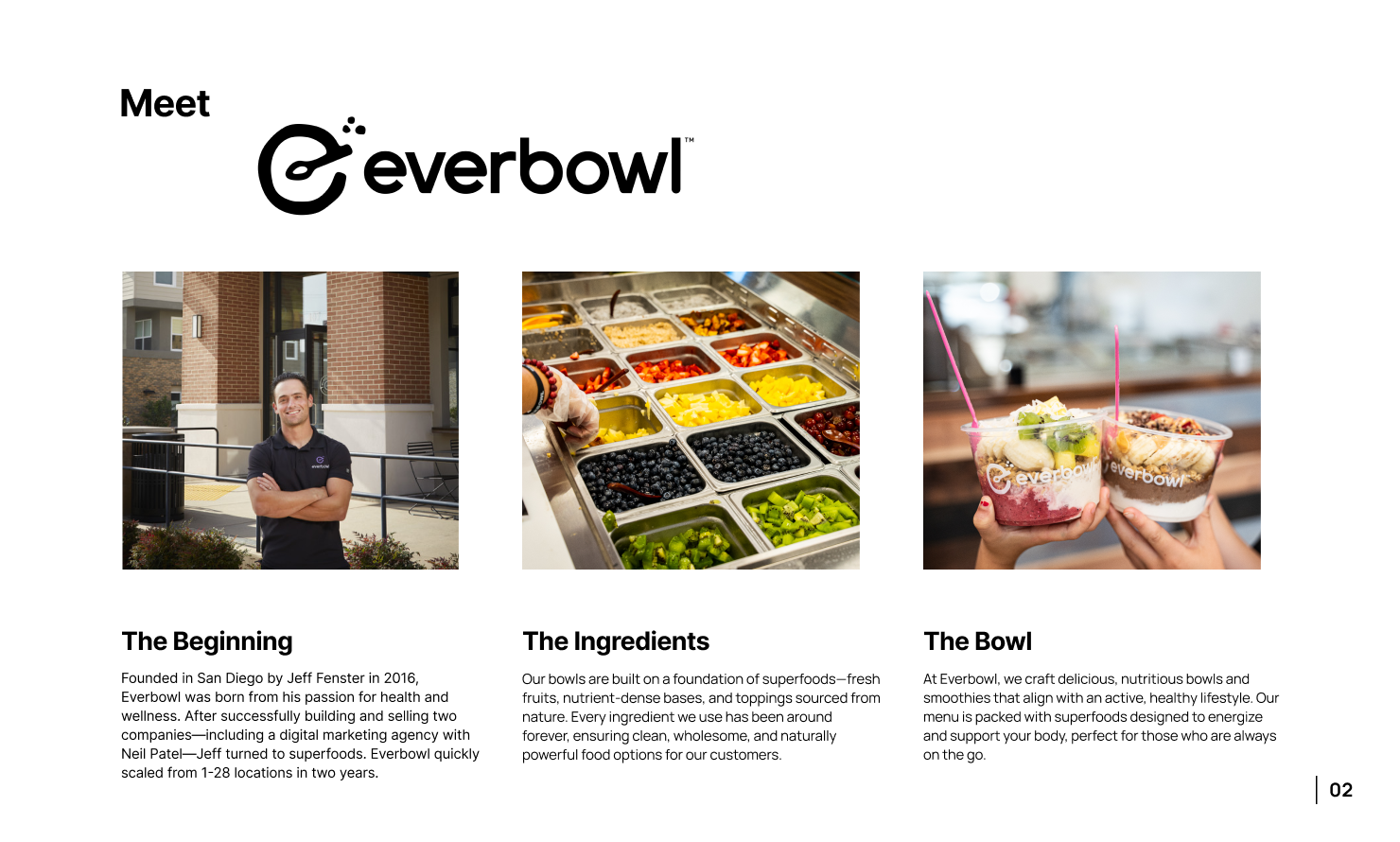

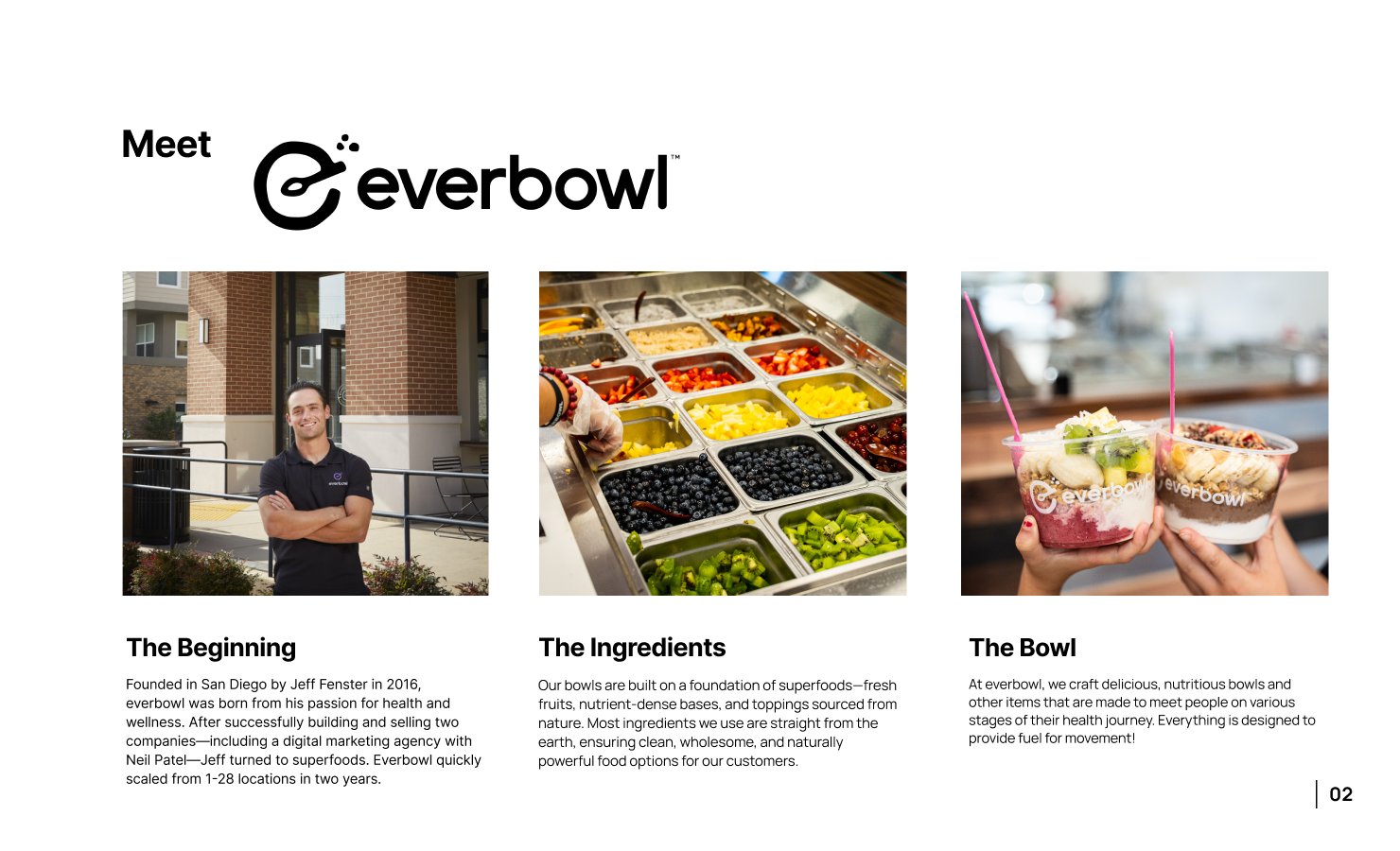

Meet everbowl

Overview

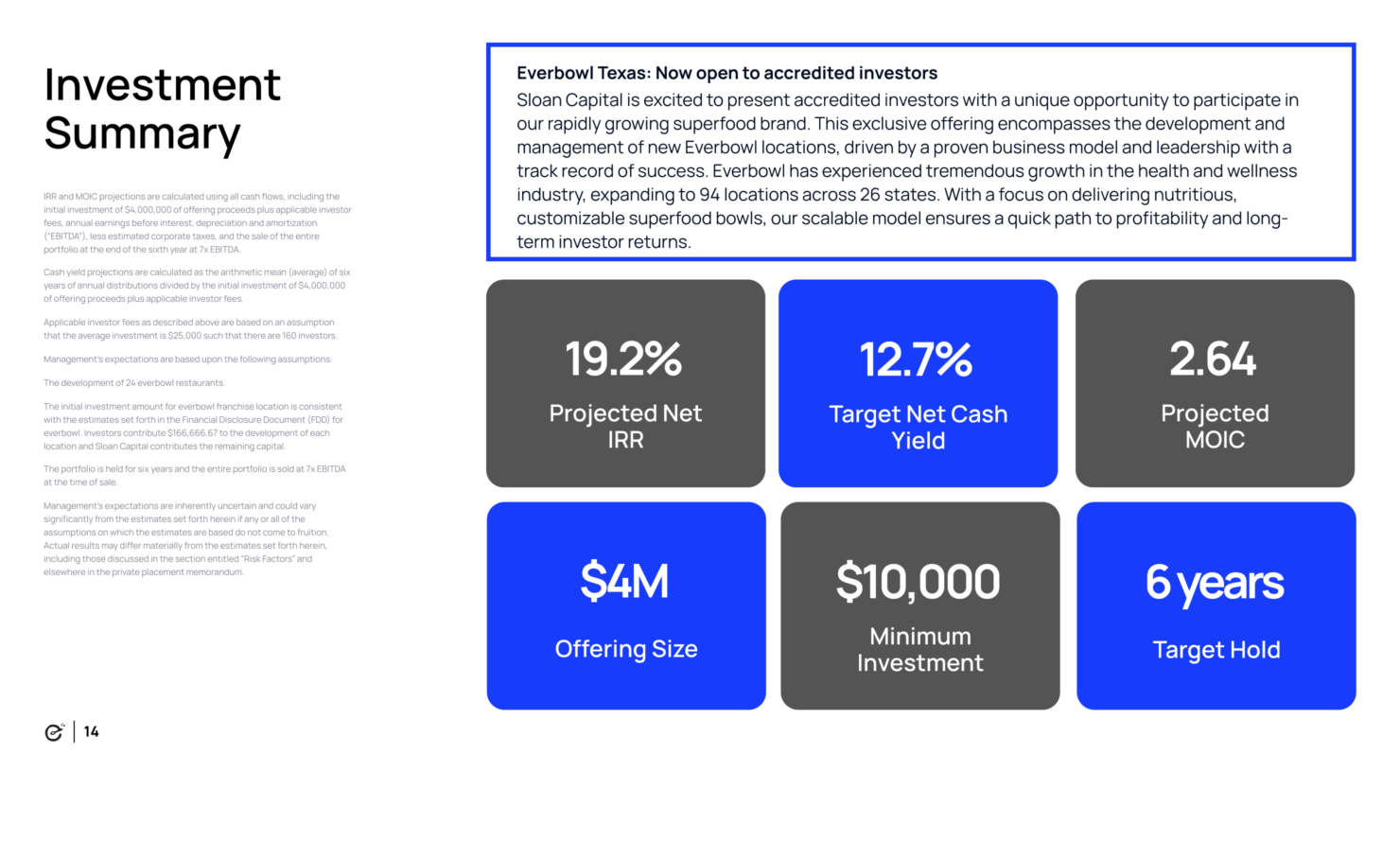

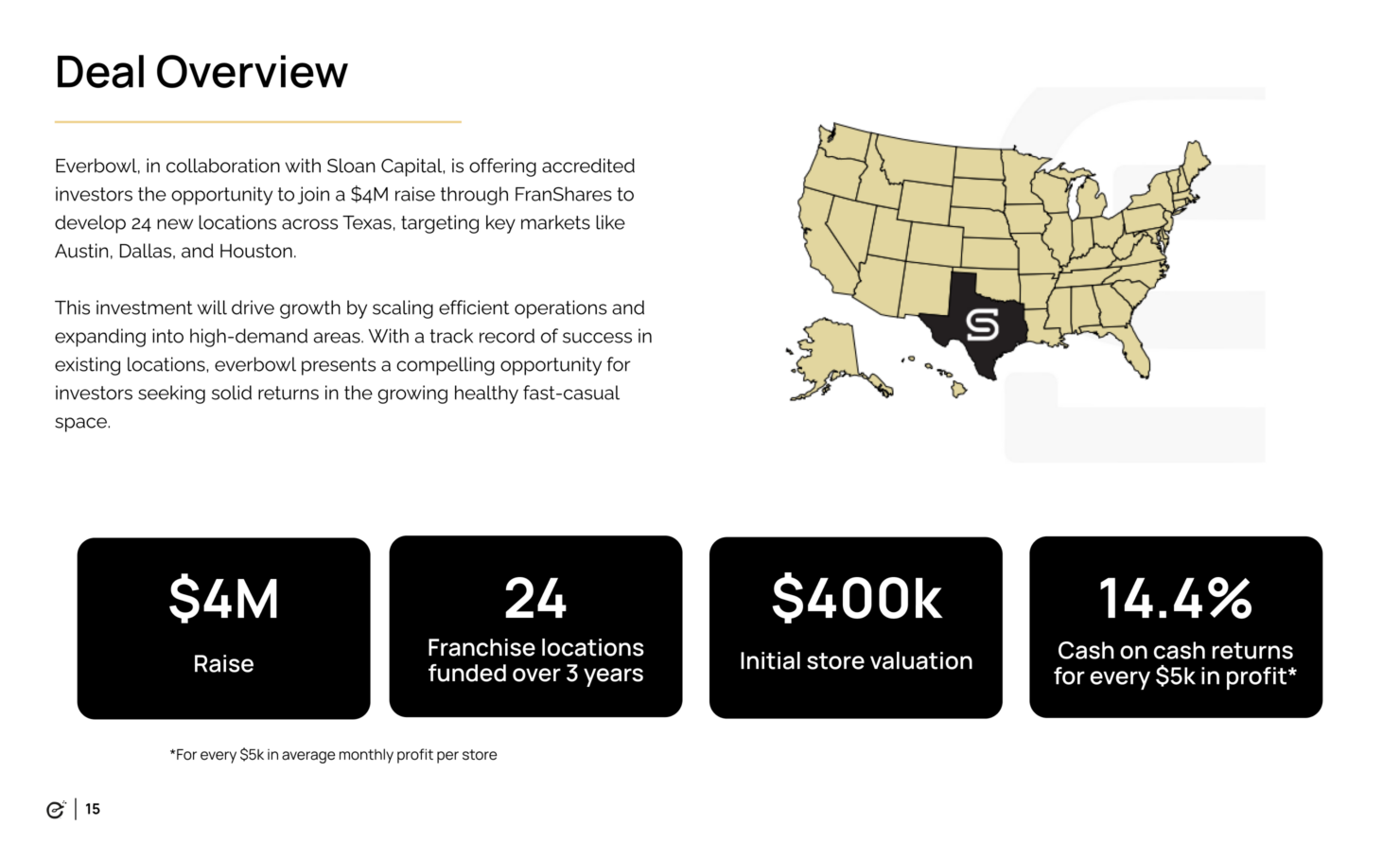

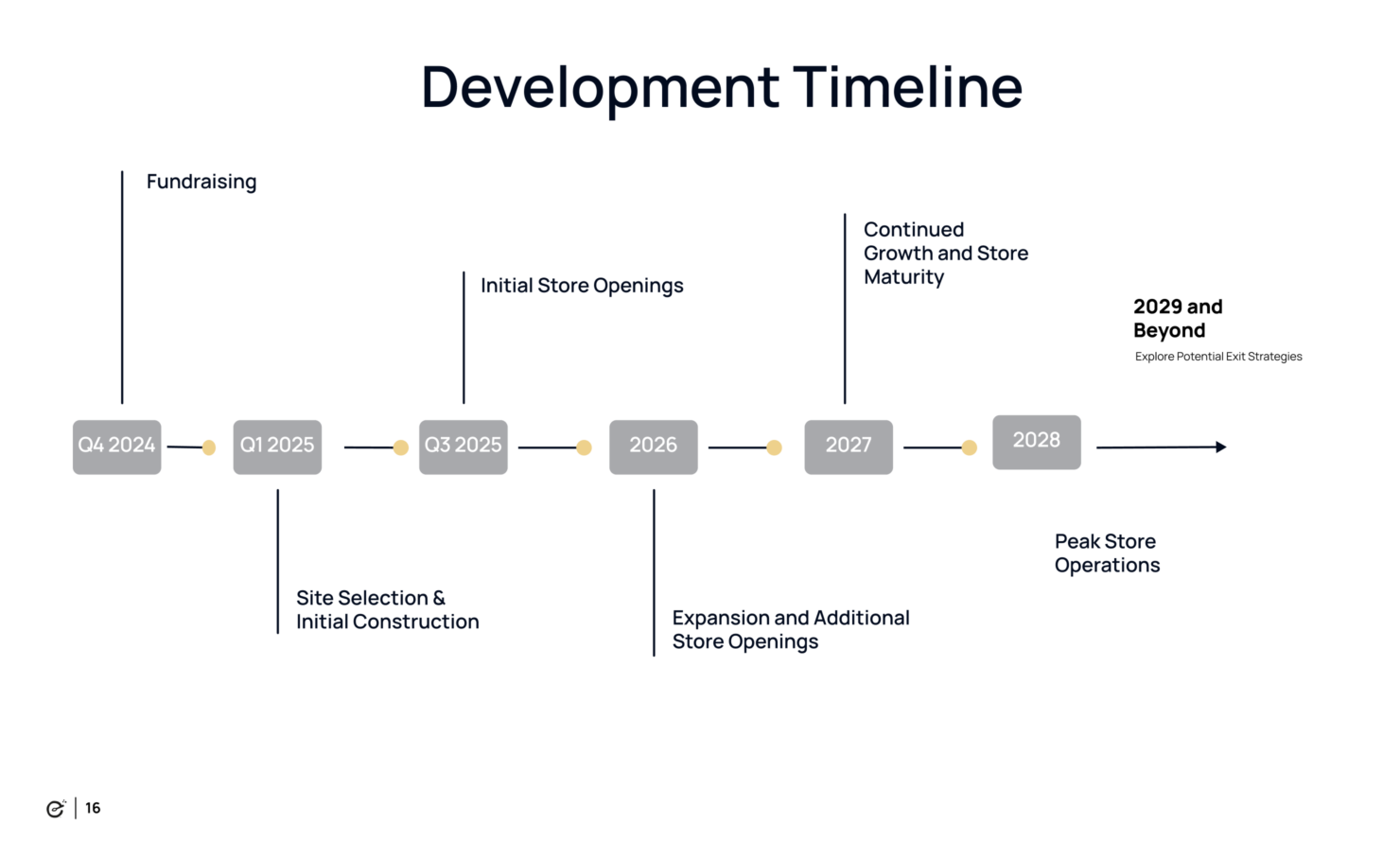

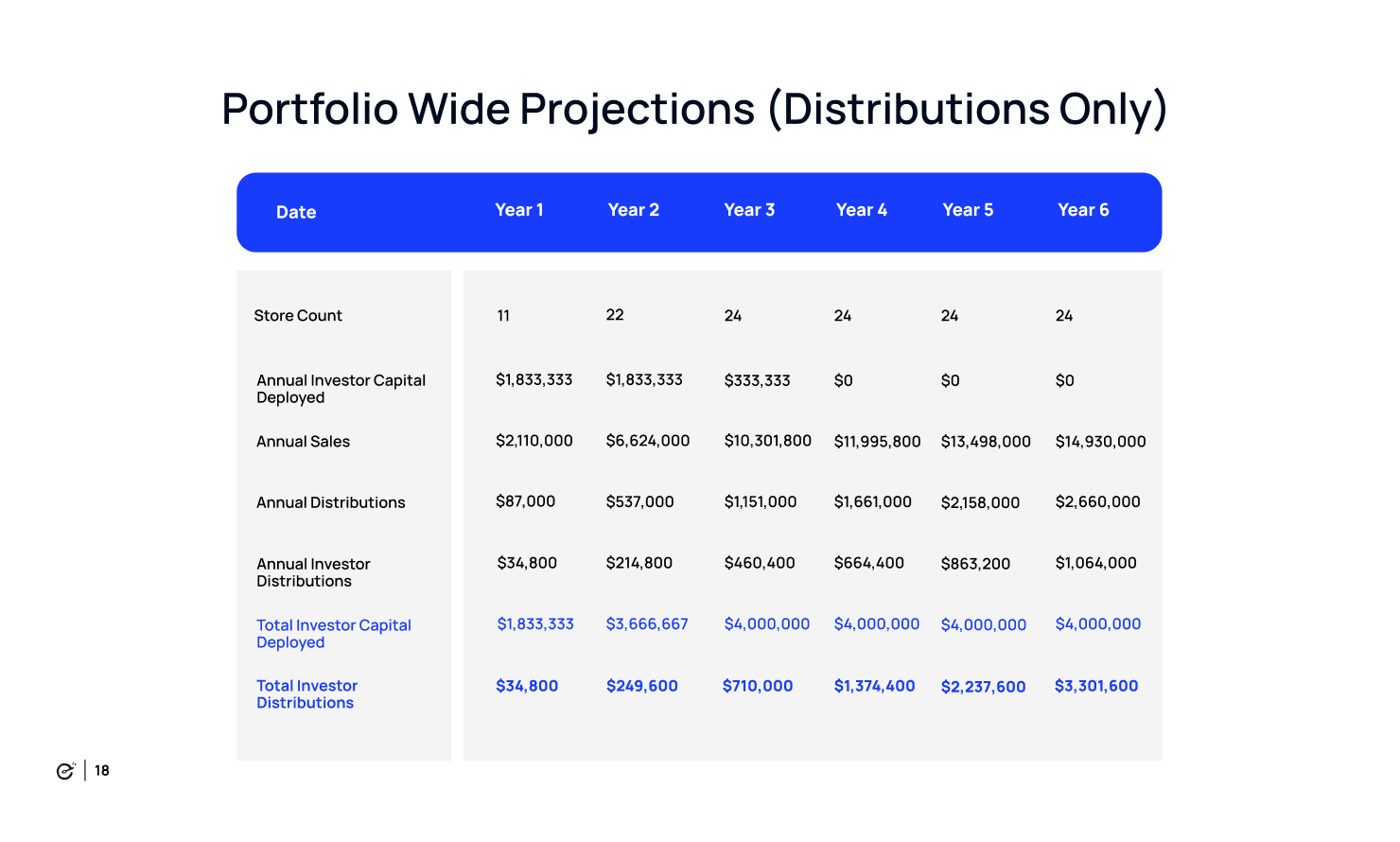

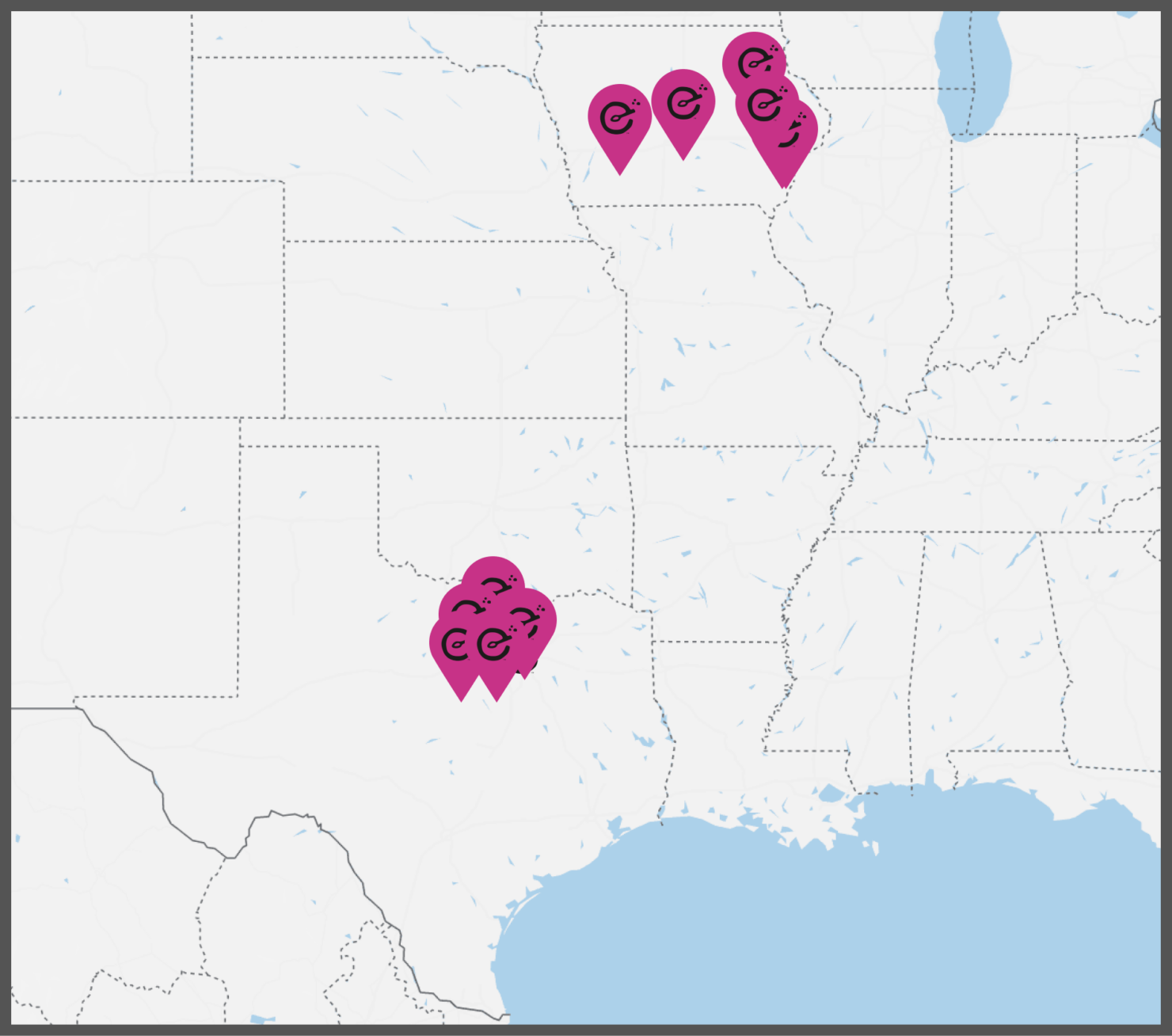

Sloan Capital, in collaboration with everbowl, is offering accredited investors the opportunity to join a $4M raise through FranShares to develop 24 new locations across Texas, targeting key markets like Austin, Dallas, and Houston.

This investment will drive growth by scaling efficient operations and expanding into high-demand areas. With a track record of success in existing locations, everbowl presents a compelling opportunity for investors seeking solid returns in the growing healthy fast-casual space.

Growth Through Strategic Partnerships

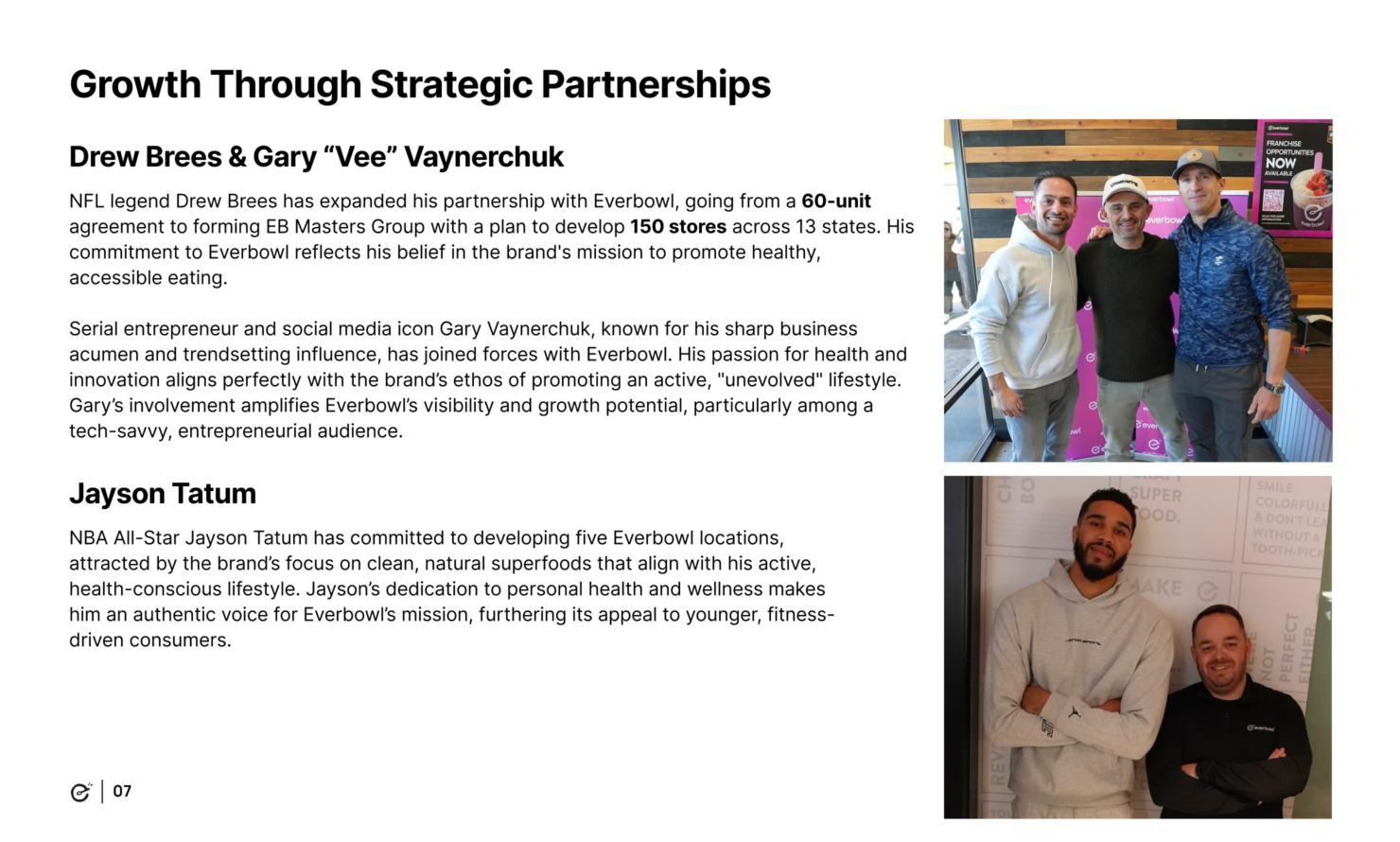

Drew Brees & Gary “Vee” Vaynerchuk

NFL legend Drew Brees has expanded his partnership with everbowl, going from a 60-unit agreement to forming EB Masters Group with a plan to develop 150 stores across 13 states. His commitment to everbowl reflects his belief in the brand’s mission to promote healthy, accessible eating.

Serial entrepreneur and social media icon Gary Vaynerchuk, known for his sharp business acumen and trendsetting influence, has joined forces with everbowl. His passion for health and innovation aligns perfectly with the brand’s ethos of promoting an active, “unevolved” lifestyle. Gary’s involvement amplifies everbowl’s visibility and growth potential, particularly among a tech-savvy, entrepreneurial audience.

Jayson Tatum

NBA All-Star Jayson Tatum has committed to developing five everbowl locations, attracted by the brand’s focus on clean, natural superfoods that align with his active, health-conscious lifestyle. Jayson’s dedication to personal health and wellness makes him an authentic voice for everbowl’s mission, furthering its appeal to younger, fitness-driven consumers.

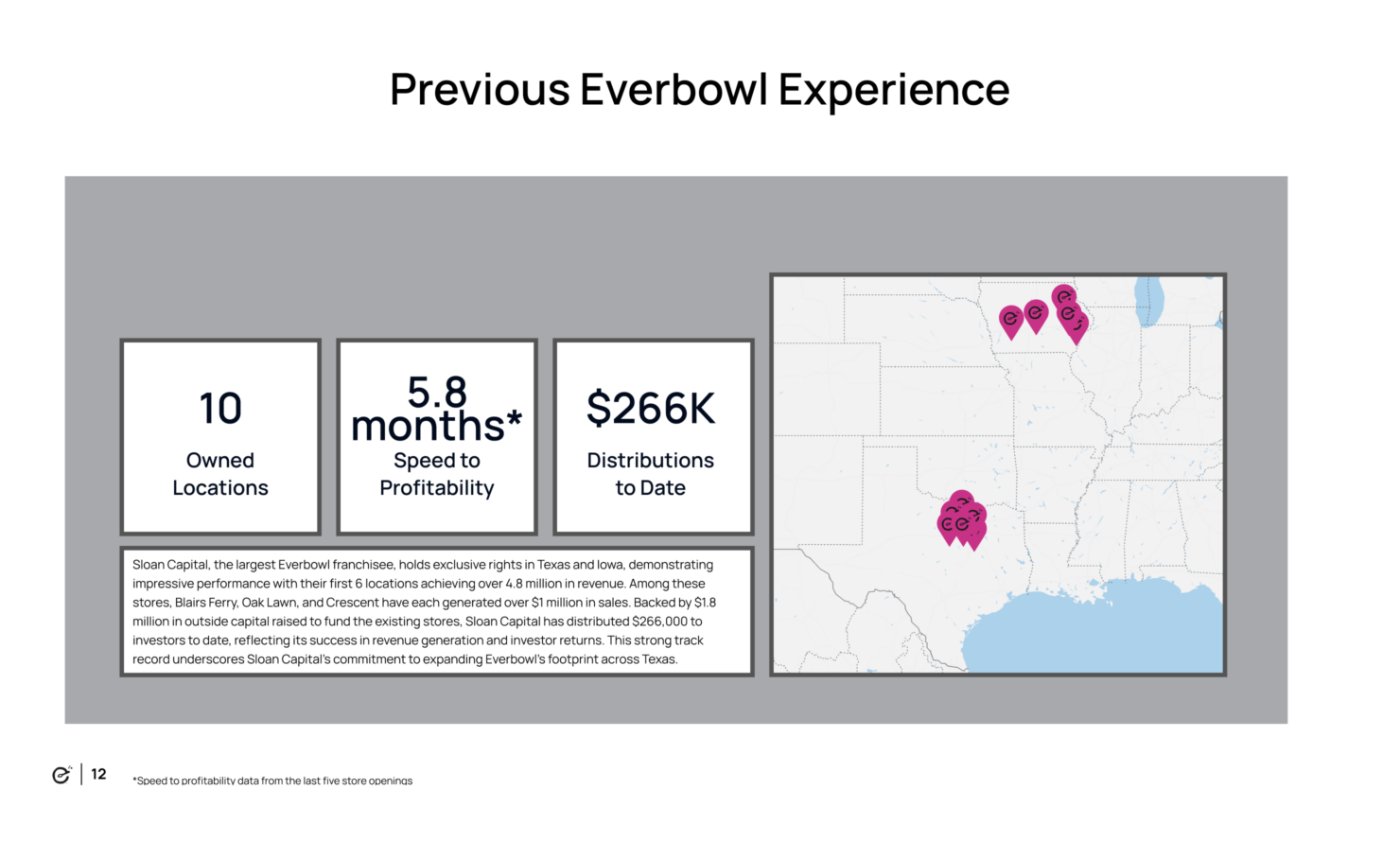

Meet the everbowl Texas Operators

Sloan Capital, the largest everbowl franchisee, holds exclusive rights in Texas and Iowa, demonstrating impressive performance with their first 6 locations achieving over 4.8 million in revenue. Among these stores, Blairs Ferry, Oak Lawn, and Crescent have each generated over $1 million in sales. Backed by $1.8 million in outside capital raised to fund the existing stores, Sloan Capital has distributed $266,000 to investors to date, reflecting its success in revenue generation and investor returns. This strong track record underscores Sloan Capital’s commitment to expanding everbowl’s footprint across Texas.

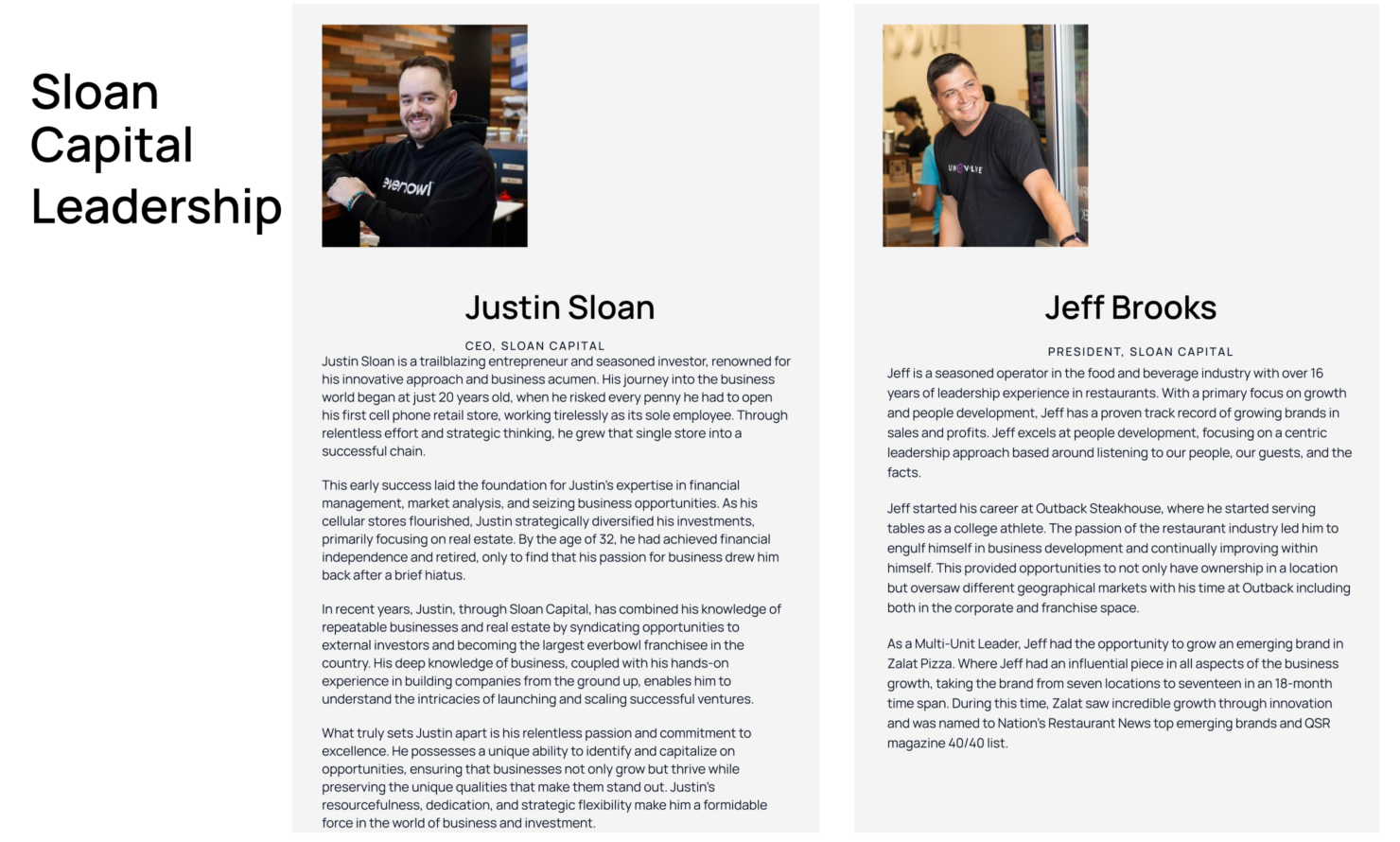

Justin Sloan

CEO, Sloan Capital

Justin Sloan is a trailblazing entrepreneur and seasoned investor, renowned for his innovative approach and business acumen. His journey into the business world began at just 20 years old, when he risked every penny he had to open his first cell phone retail store, working tirelessly as its sole employee. Through relentless effort and strategic thinking, he grew that single store into a successful chain.

This early success laid the foundation for Justin’s expertise in financial management, market analysis, and seizing business opportunities. As his cellular stores flourished, Justin strategically diversified his investments, primarily focusing on real estate. By the age of 32, he had achieved financial independence and retired, only to find that his passion for business drew him back after a brief hiatus.

In recent years, Justin, through Sloan Capital, has combined his knowledge of repeatable businesses and real estate by syndicating opportunities to external investors and becoming the largest everbowl franchisee in the country. His deep knowledge of business, coupled with his hands-on experience in building companies from the ground up, enables him to understand the intricacies of launching and scaling successful ventures.

What truly sets Justin apart is his relentless passion and commitment to excellence. He possesses a unique ability to identify and capitalize on opportunities, ensuring that businesses not only grow but thrive while preserving the unique qualities that make them stand out. Justin’s resourcefulness, dedication, and strategic flexibility make him a formidable force in the world of business and investment.

Jeff Brooks

President, Sloan Capital

Jeff is a seasoned operator in the food and beverage industry with over 16 years of leadership experience in restaurants. With a primary focus on growth and people development, Jeff has a proven track record of growing brands in sales and profits. Jeff excels at people development, focusing on a centric leadership approach based around listening to our people, our guests, and the facts.

Jeff started his career at Outback Steakhouse, where he started serving tables as a college athlete. The passion of the restaurant industry led him to engulf himself in business development and continually improving within himself. This provided opportunities to not only have ownership in a location but oversaw different geographical markets with his time at Outback including both in the corporate and franchise space.As a Multi-Unit Leader, Jeff had the opportunity to grow an emerging brand in Zalat Pizza. Where Jeff had an influential piece in all aspects of the business growth, taking the brand from seven locations to seventeen in an 18-month time span. During this time, Zalat saw incredible growth through innovation and was named to Nation’s Restaurant News top emerging brands and QSR magazine 40/40 list.

Investment Highlights

Return on investment

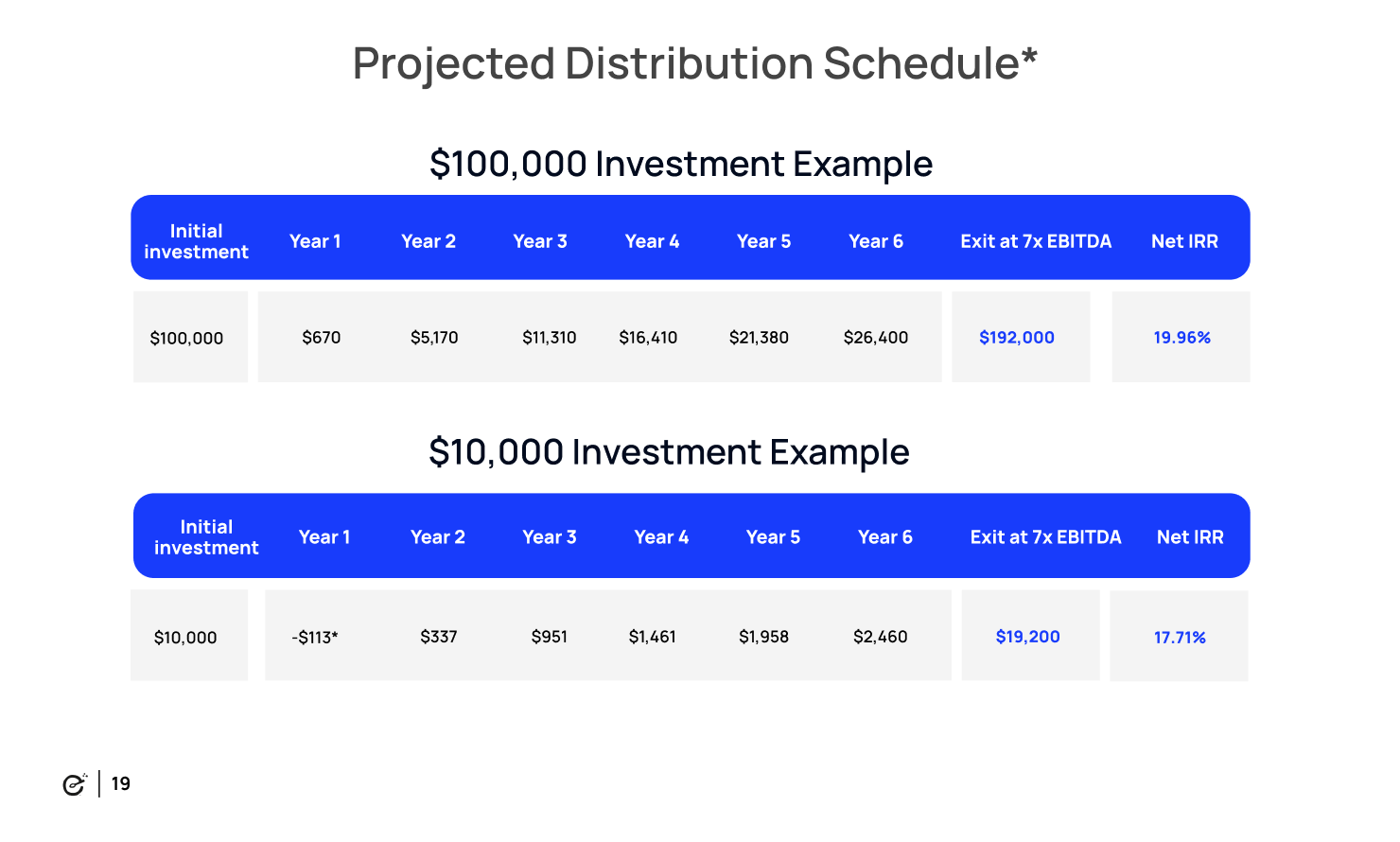

Expected Total Returned Capital: $26,254*

*net of fees

Growth

Availability

Leadership

Competition and competitive advantage

Exit Strategy

Deep Dive

Introducing everbowl Texas Franchise Fund

Steps to Invest through FranShares

- Review the Offering

Start by exploring all the details of the everbowl investment opportunity. Ensure it aligns with your financial objectives by reviewing the projected returns, growth strategy, and business model.

- Register for the Offering

Click the invest now button to sign up for the investment, which is managed through our partner Securitize, a trusted platform specializing in investor onboarding, compliance, and management.

Securitize helps streamline the investment process by handling registration, accreditation, and funding securely and efficiently. You can register as either an individual or an entity.

For assistance during this process, contact: investorsupport@securitize.io.

- Verify Your Identity

Complete the Know Your Customer (KYC) process in your Securitize portal, which includes submitting a government-issued ID and personal information. This is required to comply with regulations and prevent fraud.

- Make a Non-binding Investment Pledge

Indicate the amount you intend to invest. This pledge is non-binding and helps us understand your level of interest without any commitment at this stage.

- Sign the Subscription Agreement

After reviewing your investment pledge, sign the subscription agreement to confirm your investment and finalize the amount.

- Prove Your Accreditation Status

Once you’ve signed the subscription agreement, the next step is to verify your accreditation status.

The easiest way to complete this is through a third-party verification document from your accountant, attorney, or financial advisor. Simply upload the completed document directly via the Securitize platform.

Alternatively, you can provide income documents (showing at least $200k individually or $300k jointly) or evidence of a net worth of $1M.

- Fund Your Investment

Once your accreditation is confirmed, you will receive detailed instructions on how to transfer your funds. Use the provided wire instructions through Securitize to complete your investment.

For questions about the investment process please reach out to support@franshares.com.

FAQ

-

- Review the investment overview deck: Gain a comprehensive understanding of Sloan Capital’s previous experience and growth strategy.

- Watch the Inside the Deal video: This is an excellent opportunity hear from the Sloan Capital team and learn about the offering in-depth.

-

Yes, investors can place investment orders for this fund now. Simply create an account (takes less than 10 minutes) and you can place an order today! If you’re having trouble creating an account, please email support@franshares.com for assistance.

-

This offering operates on a rolling close basis, meaning investments will be accepted until the total fundraising target is reached. We recommend investing as soon as possible to ensure your participation, as the offering could close at any time once the target is met.

-

The minimum investment size is $10,000, while the maximum investment size can be up to the remaining available amount in the offering. For specific investment limits, please refer to the details in the Private Placement Memorandum (PPM) or contact the support team.

-

You need to be accredited to invest in this offering because it is conducted under **Regulation D, Rule 506(c)**, which allows companies to raise capital by offering securities to accredited investors without the need for SEC registration. This rule is designed to ensure that investors have the financial sophistication and ability to bear the risks associated with such investments, as these opportunities often carry higher risk and are less regulated than publicly traded securities.rnrnAn accredited investor is an individual or entity that meets certain financial criteria set by the SEC. Typically, an individual qualifies if they have a net worth of at least $1 million (excluding their primary residence) or have earned an income of $200,000 (or $300,000 with a spouse) in each of the last two years, with the expectation of maintaining that income level. This qualification ensures that accredited investors can handle the potential risks associated with private offerings.

-

Yes, international investors can invest in the Everbowl Sloan Capital EB Texas Fund. However, we recommend reaching out to our support team to verify eligibility based on your specific location.

-

To invest in the Everbowl Sloan Capital EB Texas Fund using AltoIRA, please use the link provided below. For further assistance, you can also visit the offering page or reach out to the support team.

Invest in the Everbowl Sloan Capital EB Texas Fund through AltoIRA

Disclosures

Management’s expectations are inherently uncertain and could vary significantly from the estimates set forth herein if any or all of the assumptions on which the estimates are based do not come to fruition. Actual results may differ materially from the estimates set forth herein, including those discussed in the section entitled “Risk Factors” and elsewhere in the private placement memorandum.

The information set forth (including any written materials provided herewith) is proprietary and shall be maintained in strict confidence. Each recipient hereof acknowledges and agrees that the contents of this document (i) constitute proprietary and confidential information that FranShares, Inc. (together with its affiliates) derive independent economic value from not being generally known and (ii) are the subject of reasonable efforts to maintain their secrecy.

The recipient further agrees that the contents of this document are a trade secret, the disclosure of which is likely to cause substantial and irreparable competitive harm to Sloan Capital/EB Texas and/or FranShares. Any reproduction or distribution of this document, in whole or in part, or the disclosure of its contents, without the prior written consent of Sloan Capital/EB Texas and/or FranShares, is prohibited. This document will be returned to FranShares upon request.

This document contains various estimates of financial information and valuation of securities. While all such information is presented based on the exercise of Sloan Capital/EB Texas’ reasonable judgment, there can be no assurance that such information will prove to be accurate or that such valuations reflect the true fair market value of the securities referenced. In addition, certain factual statements made herein are based on information from various sources prepared by other parties. While such sources are believed by Sloan Capital/EB Texas to be reliable, Sloan Capital/EB Texas does not assume any responsibility for the accuracy or completeness of such information. For avoidance of doubt, this information has not been independently verified by FranShares. FranShares does not assume any responsibility for the accuracy or completeness of such information.

FranShares has entered into an agreement with the issuer to provide marketing services in exchange for the following cash fees: a $30,000 one-time listing fee, a $5,000 fee for each additional close following the first close, and a $1,250 monthly platform fee.

Certain statements in this document constitute forward-looking statements. When used herein, the words “project,” “anticipate,” “believe,” “estimate,” “expect,” and similar expressions are generally intended to identify forward-looking statements. Such forward-looking statements, including the intended actions and performance objectives of the relevant party referenced herein, involve known and unknown risks, uncertainties, and other important factors that could cause the actual results, performance, or achievements of such party to differ materially from any future results, performance, or achievements expressed or implied by such forward-looking statements. All forward-looking statements in this document speak only as of the date hereof. FranShares and Sloan Capital/EB Texas expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in its expectation with regard thereto or any change in events, conditions, or circumstances on which any such statement is based. Furthermore, nothing contained herein is, or should be relied upon as, a promise or representation as to the future performance of any fund sponsored by FranShares.