Beyond the Arches #10: How some investors are planning on cashing in on the solar boom

Featured Story

The future is bright for solar

It’s hard to believe that just over a decade ago, solar power made up less than 1 percent of the global power generation capacity. Now, the use of the sun to generate electricity is widespread, with solar panels popping up seemingly everywhere. Given its accelerated adoption rate, the International Energy Agency (IEA) forecasts that solar will overtake all other sources of energy generation by 2027.

Renewable energy investment and demand have been increasing for years – but it has become a national security issue as Russia continues to weaponize gas exports in its full-scale invasion of Ukraine. In response, the already-booming solar sector is gearing up for even more explosive growth.

One of the major appeals of solar is its relatively low-cost scalability. These costs are falling even further thanks to federal incentives included in the Inflation Reduction Act and rebounding supply chains post-COVID.

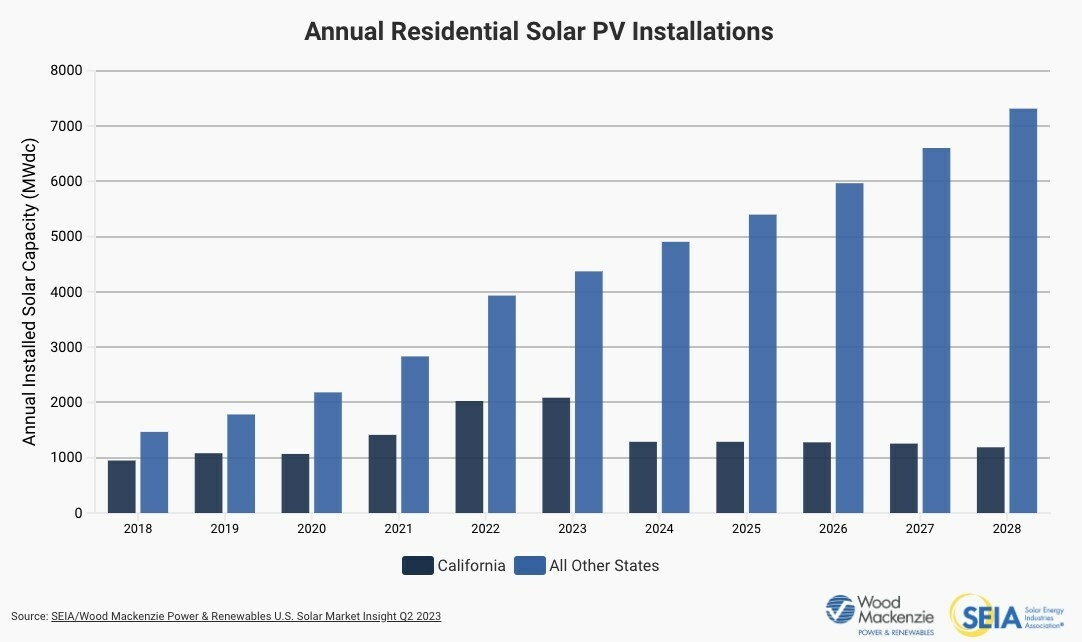

The increasing cost-effectiveness of utility-scale solar has, in turn, driven increased demand, especially in the residential space. Driven by low financing costs and rising home utility bills, 2022 marked the sixth consecutive year of growth for the residential solar market, which jumped 40% over the previous year.

Direct investment opportunities

With capacity and demand rising as costs are decreasing, the solar industry is ripe for investment. Here are a few direct investment opportunities that you can leverage right now:

- Inergy

Inergy is a clean technology company that develops innovative solar power stations and storage units to harness and store renewable energy “for everyday use by everyday people.” The company has earned more than $14 million in revenue over the past two years. Its Flex Tactical Power Station, which is currently available for pre-order, was developed over the course of multiple projects with the U.S. Air Force and Army. Inergy is currently raising a Reg CF round through StartEngine.

- Luma Solar

Luma developed the first fully integrated solar rooftop shingle system in North America and offers the only exchangeable and upgradeable solar shingle system currently in the market. This system removes the need for bulky solar panels; instead, it allows homeowners to maintain a traditional shingled look while generating clean energy via high-efficiency solar cells. Luma is currently raising capital to expand its manufacturing capabilities and distribution network. More information is available via Cultivate Capital.

- Community solar projects via Climatize

Climatize is a digital investment platform that specializes in clean energy projects. Through the app, anyone (regardless of accreditation status) can invest in solar and energy efficiency projects – starting at only $5. Each investment opportunity is subject to a rigorous vetting process that ensures environmental responsibility, financial viability, and positive future impact. Check out some current Climatize projects for more info.

STR Investment Opportunities

Short-term rentals (STRs) are a flexible and often lucrative way to add real estate to your investment portfolio. Check out these opportunities, courtesy of our friends at The Offer Sheet.

A luxurious modern mountain retreat in Tennessee

515 Johnson Ln, Gatlinburg, TN 37738 | $889,000

This four-bedroom, three-bathroom stunner has been renovated from the ground up. Some interior features include a spacious open floor plan, beautiful white-washed-look vinyl plank flooring, recessed lighting, new fixtures and appliances throughout, and a double-sided gas log fireplace. Outside, you’ll find ample parking for multiple vehicles, as well as a sunken hot tub and lighted fire pit area. The property is being sold furnished for use as a short-term rental with projections of $100K or more.

- Average daily rate: $402

- Expected occupancy rate: 65%

- Monthly expected income: $7,948

- Monthly expected expenses: $6,123

- Monthly expected cash flow: $1,825

- Expected cash on cash return: 9.3%

A duo of lakeside cabins in New York

9 (and 11) Api Si Sin Way, Long Lake, NY 12847 | $599,900

This listing includes 9 and 11 Api Si Sin Way – two subdivided lots being sold as one. One lot features an attractive efficiency cabin with an Adirondack fireplace, while the other is a well-appointed studio cabin for a total of three bedrooms and two bathrooms. New stairs lead to an estimated 140 feet of waterfront and dock. This is an ideal property for a family compound or rental program on beautiful Long Lake.

- Average daily rate: $377

- Expected occupancy rate: 63%

- Monthly expected income: $7,224

- Monthly expected expenses: $5,208

- Monthly expected cash flow: $2,016

- Expected cash on cash return: 14.8%

A private woodland hideaway in Pennsylvania

424 Somerset Dr, East Stroudsburg, PA 18301 | $379,000

Just moments away from Route 80, Camelback Mountain Resort, and all the Pocono Mountains attractions, this three-bedroom, two-bathroom home features a newly refurbished kitchen with granite countertops and new appliances, as well as an open-concept main living space with skylights, vaulted ceilings, and a stone fireplace. The back deck and brand-new hot tub overlook a stream in the private wooded backyard. This property is located in a gated community with multiple lakes and amenities.

- Average daily rate: $291

- Expected occupancy rate: 62%

- Monthly expected income: $5,488

- Monthly expected expenses: $3,602

- Monthly expected cash flow: $1,885

- Expected cash on cash return: 21.0%

A rustic masterpiece in Vermont

2914 Danby Mountain Road, Dorset, VT 05251| $599,000

This offering consists of two separately deeded parcels: a custom-built three-bedroom, two-bathroom contemporary home on 22.23 acres, and an adjacent 91.7-acre vacant lot in current use, for a total of 113.93 acres. (No further subdivision is allowed on these lots.) Designed by renowned local architect Bill Badger, the home is on the market for the first time in more than three decades. It features two elevated sun decks, living room with cathedral ceiling, large wood stove, and floor-to-ceiling windows on two walls.

- Average daily rate: $399

- Expected occupancy rate: 64%

- Monthly expected income: $7,767

- Monthly expected expenses: $5,778

- Monthly expected cash flow: $1,990

- Expected cash on cash return: 14.7%

SMB Investment Opportunities

Courtesy of our friends at SMB Deal Hunter

Relocatable marketing agency for gyms & fitness centers in Houston, Texas

This business runs paid marketing for 110+ recurring gym clients and helps them generate new customers. The agency charges gym owners $2,000 per month, with $1,000 of that going toward ad spend. Client LTV is about $10,000, which means the average client sticks around for five months. | View listing

- Asking price: $2,500,000

- Cash flow: $723,000

- Revenue: n/a

- Established: 2020

Well-priced HVAC service & repair business in Cleveland, Ohio

This business comes with a team of 10 seasoned technicians and office staff. Its largest revenue stream is from residential services and repairs, with the average residential job size being an impressive $8,500. Its sales and profit growth have consistently increased year after year, and the company has a strong reputation with 4.9 Google ratings. It also has a strong cash conversion cycle with little to no accounts receivables and is SBA pre-approved. | View listing

- Asking price: $1,180,000

- Cash flow: $489,650

- Revenue: $2,693,130

- Established: 2009

High-volume liquor store chain with seven locations in Clark County, Nevada

This seven-location liquor store chain is for sale because its owner is retiring, but it comes with 30 employees. Liquor stores are fairly recession-proof and easy to operate, and liquor itself has a long shelf life compared to perishables, which makes inventory management easier. This one is based in Clark County (where Las Vegas is located), which means a lot of foot traffic from the famed city’s 32 million visitors annually. Las Vegas is a 24/7 economy so there could be opportunities for extended hours of operation. | View listing

- Asking price: $7,500,000

- Cash flow: $1,940,000

- Revenue: $9,000,000

- Established: 1996

Remote specialty hand tools e-commerce business

This business sells specialty hand tools to the woodworking and woodturning market on its own e-commerce site (43% of revenue) and on Amazon (53% of revenue). The woodworking tools market is surprisingly large – expected to reach $13.3 billion by 2031. These tools are used in many industries including construction, oil and gas, automobile, plumbing, carpentry, and more. The business has grown its top line by 15% YOY and its bottom line by 96% YoY. | View listing

- Asking price: $14,650,000 + inventory

- Cash flow: $3,256,060

- Revenue: $15,562,443

- Established: 2010

Franchise Investment Opportunities

A selection of franchises you can invest in right now

Booming juice bar franchise in Nashville, Tennessee

This Clean Juice location is perfectly situated in the middle of high-income demographics and faces Hillsboro Pike – on which an estimated 28,000 cars travel daily. High traffic and a growing population ensure a constant stream of income for this 1258-square-foot storefront. The 100% certified organic business comes fully equipped and ready for any new owner to step in and go. The parent company has more than 100 locations nationwide and in 2021 was named the number-one fastest-growing franchise by Franchise Gator. | View listing

- Asking price: $169,900

- Cash flow: $87,000

- Revenue: $714,000

- Inventory: $7,800

- Established: 2019

Turnkey bespoke clothing franchise in New Orleans, Louisiana

This high-end 100% custom-made tailoring franchise is a perfect addition for anyone looking to add passive revenue or make a career change. The business is currently being run part-time, but could easily be run full-time for potentially double or triple the earnings. The franchise is the official clothier of LSU Football and other sports teams and enjoys high margins of around 70%. | View listing

- Asking price: $85,000

- Cash flow: $140,000

- Revenue: $200,000

- Inventory: n/a

- Established: 2021

Profitable mobile donut franchise in Ankeny, Iowa

This donut franchise is an interactive, mobile business opportunity that is fun to operate and is profitable. Locations serve hot mini donuts, freshly squeezed lemonade and other juices, and hot and iced coffee. Turnkey, one-of-a-kind trailers are built from the ground up and include exclusive donut machines and LED viewing windows. Guests can watch not only the donuts being made fresh, but also citrus being squeezed and the juices and beverages bubbling. Proprietary donuts are made to order and have high margins with low waste. This is a sweet franchise opportunity: Set your schedule by booking events, flat weekly royalties (no penalty for success), and minimal labor overhead (two to three people per truck). | View listing

- Asking price: $229,000

- Cash flow: $70,000

- Revenue: $180,000

- Inventory: $5,000

- Established: 2022