Beyond the Arches #12: Investing in the freelancer revolution

Featured Story

The rise of the freelancers

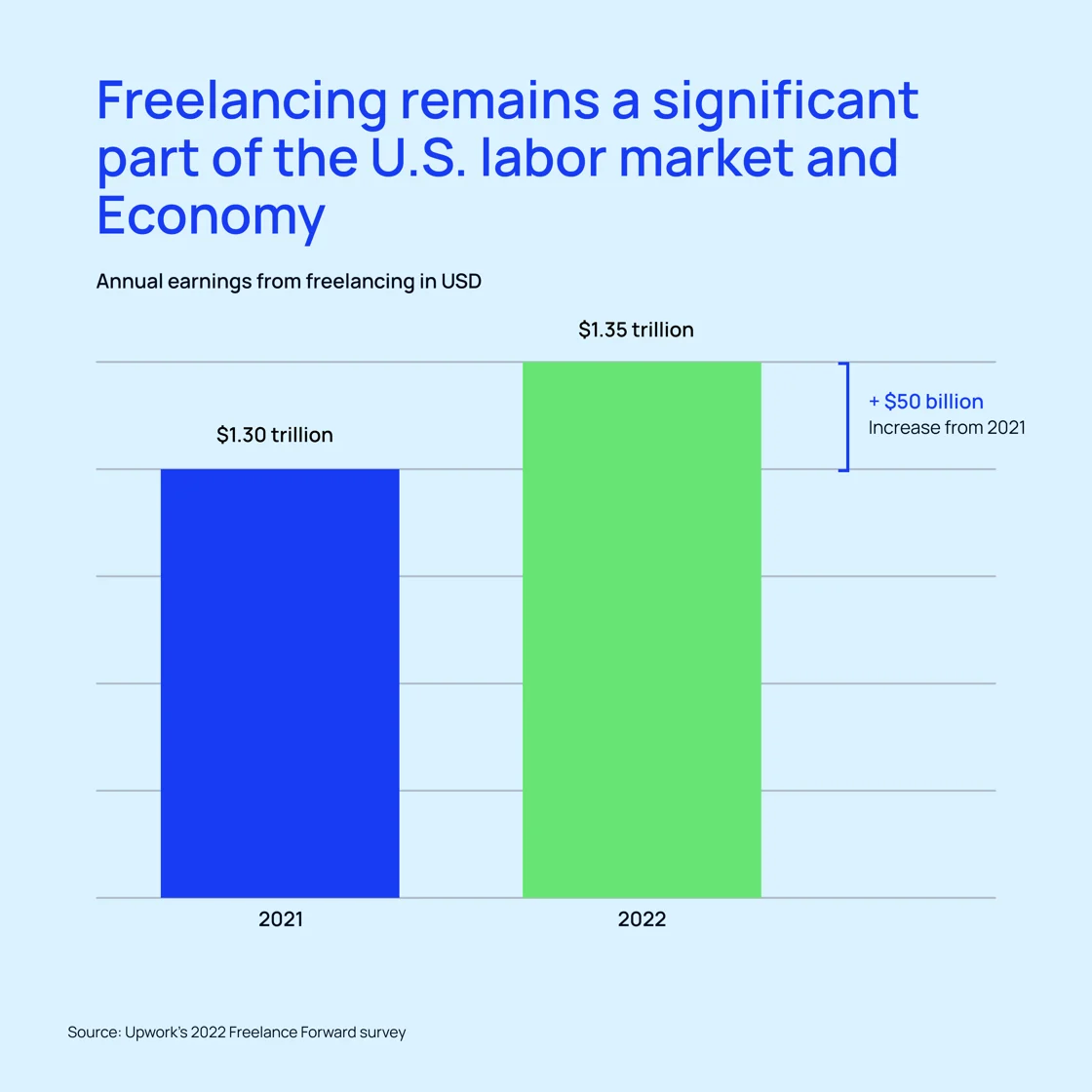

The number of independent contract workers in the U.S. is on the rise. According to Upwork’s annual Freelance Forward survey, 60 million Americans (over a third of the workforce) did some kind of freelance work in 2022. This has made a significant impact on the economy, with freelance workers bringing in $1.35 trillion – $50 billion more than the prior year.

This growth can largely be attributed to changing attitudes toward traditional work sparked by the challenges of the pandemic, which led to an explosion of remote work. Today, more and more professionals are turning to freelancing to augment their existing income, find more fulfilling work, create a more flexible work schedule, or some combination of these reasons.

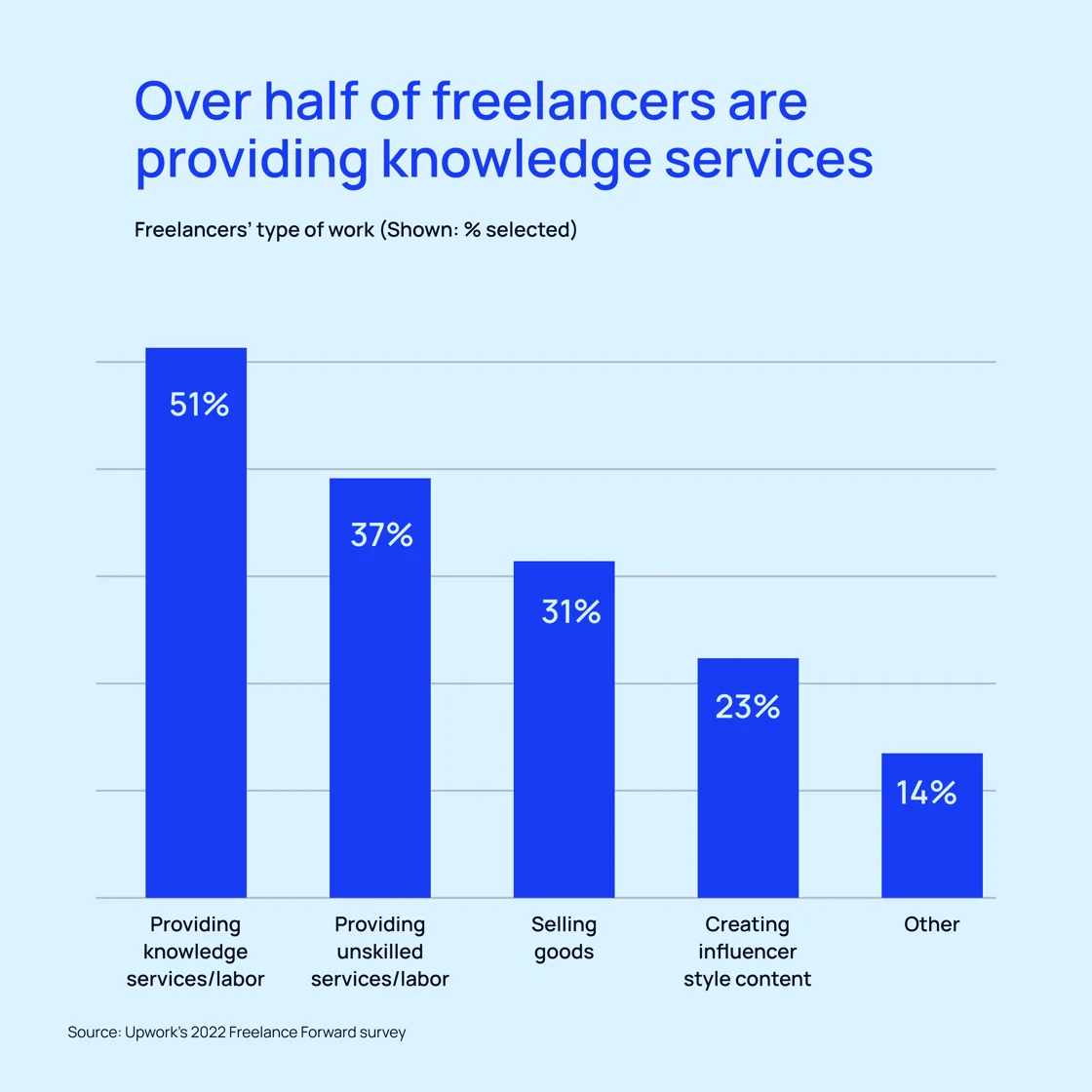

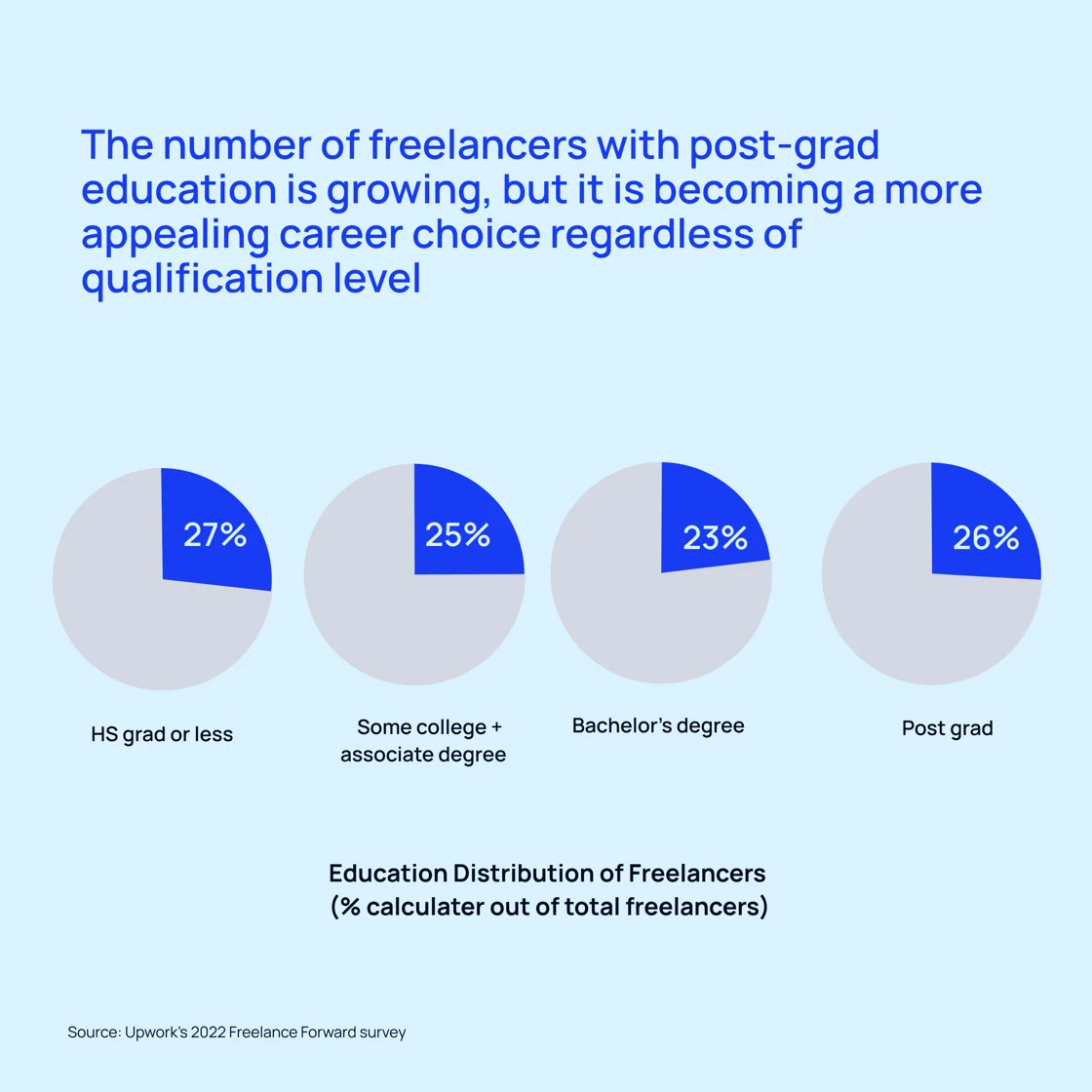

The majority of today’s freelancers offer skilled services, such as IT and computer programming support, business consulting, and marketing. They’re also well-educated, with nearly 75 percent having attended college.

The majority of today’s freelancers offer skilled services, such as IT and computer programming support, business consulting, and marketing. They’re also well-educated, with nearly 75 percent having attended college.

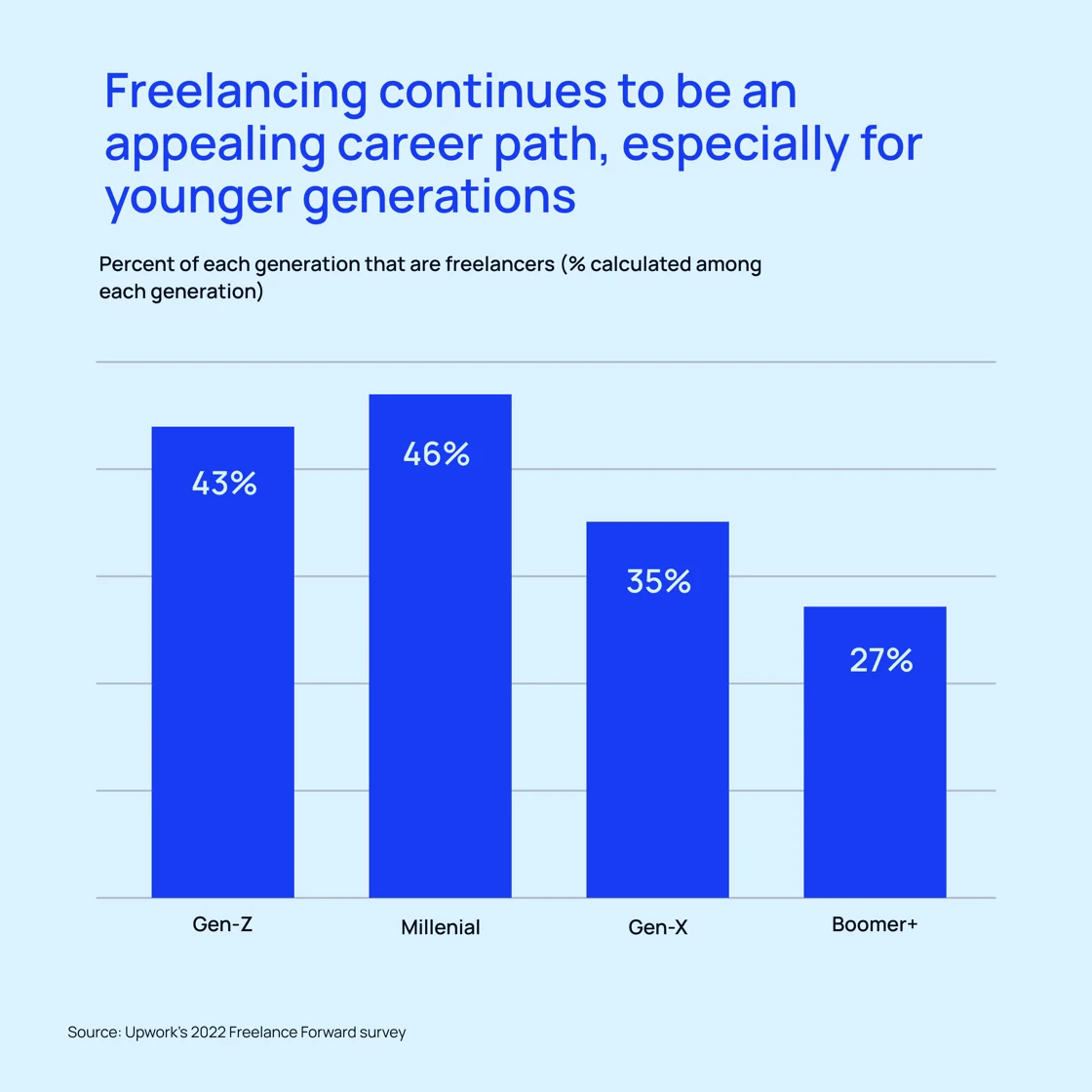

However, the appeal of freelancing is drawing professionals at all levels, especially younger generations, who are highly interested in this career path. Gen-Z and Millennials in particular have taken to freelancing, and their numbers are only expected to increase as work culture continues to evolve.

Direct investment opportunities

While freelancers are by definition independent workers, they still need tools and support to perform at their best. Here are direct investment opportunities in the space to leverage right now:

- Jauntboards

Jauntboards is an interactive content platform that’s out to help freelancers, creators, and other solopreneurs scale their way out of “survival mode.” By documenting existing knowledge and processes into a board, independent contractors can then leverage them as a product, a service, and/or an opportunity for ongoing consulting. The leadership team is made up of second-time founders (ex-Techstars) and world class agency leaders who have an intimate understanding of this unique and emerging economy. Jauntboards is currently raising capital via WeFunder.

- Basil

New York-based Basil is tackling both sides of the independent contractor equation – the freelancer and their clients. The platform aims to streamline this relationship with tools to create proposals, process contracts, set up bookings, and take payments. The company has already seen traction, with over 300 freelance users, enterprise users such as Bose, and ~$225K in revenue. Basil is currently raising capital via WeFunder.

STR Investment Opportunities

Short-term rentals (STRs) are a flexible and often lucrative way to add real estate to your investment portfolio. Check out these opportunities, courtesy of our friends at The Offer Sheet.

An elegant escape in the Poconos

424 Somerset Dr, East Stroudsburg, PA 18301 | $379,000

Just moments away from Route 80, Camelback Mountain Resort, and all the Pocono Mountains attractions, this fully renovated 3-bedroom, 2-bathroom home offers a stylish kitchen with granite countertops and new appliances, plus a spacious loft for extra room. The open concept main living space features skylights, vaulted ceilings, and a stone fireplace. Grill and chill all summer on the back deck overlooking the stream in a private wooded back yard and enjoy your brand-new, never-used hot tub after hours. This property is located in a gated community with multiple lakes and amenities.

- Average daily rate: $291

- Expected occupancy rate: 62%

- Monthly expected income: $5,488

- Monthly expected expenses: $3,602

- Monthly expected cash flow: $1,885

- Expected cash on cash return: 21.0%

A rustic masterpiece in Vermont

2914 Danby Mountain Road, Dorset, VT 05251| $599,000

This offering consists of two separately deeded parcels: a custom-built three-bedroom, two-bathroom contemporary home on 22.23 acres, and an adjacent 91.7-acre vacant lot in current use, for a total of 113.93 acres. (No further subdivision is allowed on these lots.) Designed by renowned local architect Bill Badger, the home is on the market for the first time in more than three decades. It features two elevated sun decks, living room with cathedral ceiling, large wood stove, and floor-to-ceiling windows on two walls.

- Average daily rate: $399

- Expected occupancy rate: 64%

- Monthly expected income: $7,767

- Monthly expected expenses: $5,778

- Monthly expected cash flow: $1,990

- Expected cash on cash return: 14.7%

SMB Investment Opportunities

Courtesy of our friends at SMB Deal Hunter

Diversified e-commerce aftermarket auto parts brand

This business sells specialized auto parts including coilovers, air suspension, and big brake kits mainly to wholesale accounts (65% of revenue), although its D2C audience is growing. The company has been around for 20 years and its customers are sticky, which is seen in the brand’s amazing 90% repeat order rate. The business has diversified by selling on Amazon, eBay, Walmart, and DTC. With a team in place and an established customer base, this looks like a good opportunity to get into the auto accessories aftermarket, which is expected to grow at a GACR of 5.5% from 2023 to 2033 – putting it at $984 billion. | View listing

- Asking price: $1,500,000

- EBITDA: $535,286

- Revenue: $1,828,757

- Established: 2003

Efficient salon and spa business in Washington, D.C.

Have you ever wondered why PE firms rolled up European Wax Centers? Well, a big reason is that the service naturally leads to repeat customers. Salon and spa businesses, like this one in D.C., benefit from the same effect. Because it has been around for 10 years, it likely has loyal customers – which doesn’t hurt the repeat rate. The margins, the multiple (only 2x EBITDA), and team of 40 employees to run things day-to-day are all upsides. Unfortunately, the owner recently passed away, so the family is looking to sell and is willing to offer sellers financing and rolling equity. | View listing

- Asking price: $2,450,000

- EBITDA: $1,200,000

- Revenue: $3,000,000

- Established: 2012

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.