Beyond the Arches #15: Why investors view data centers as a potentially lucrative investment

Featured Story

Soaring demand for data centers is creating an emerging market for investors

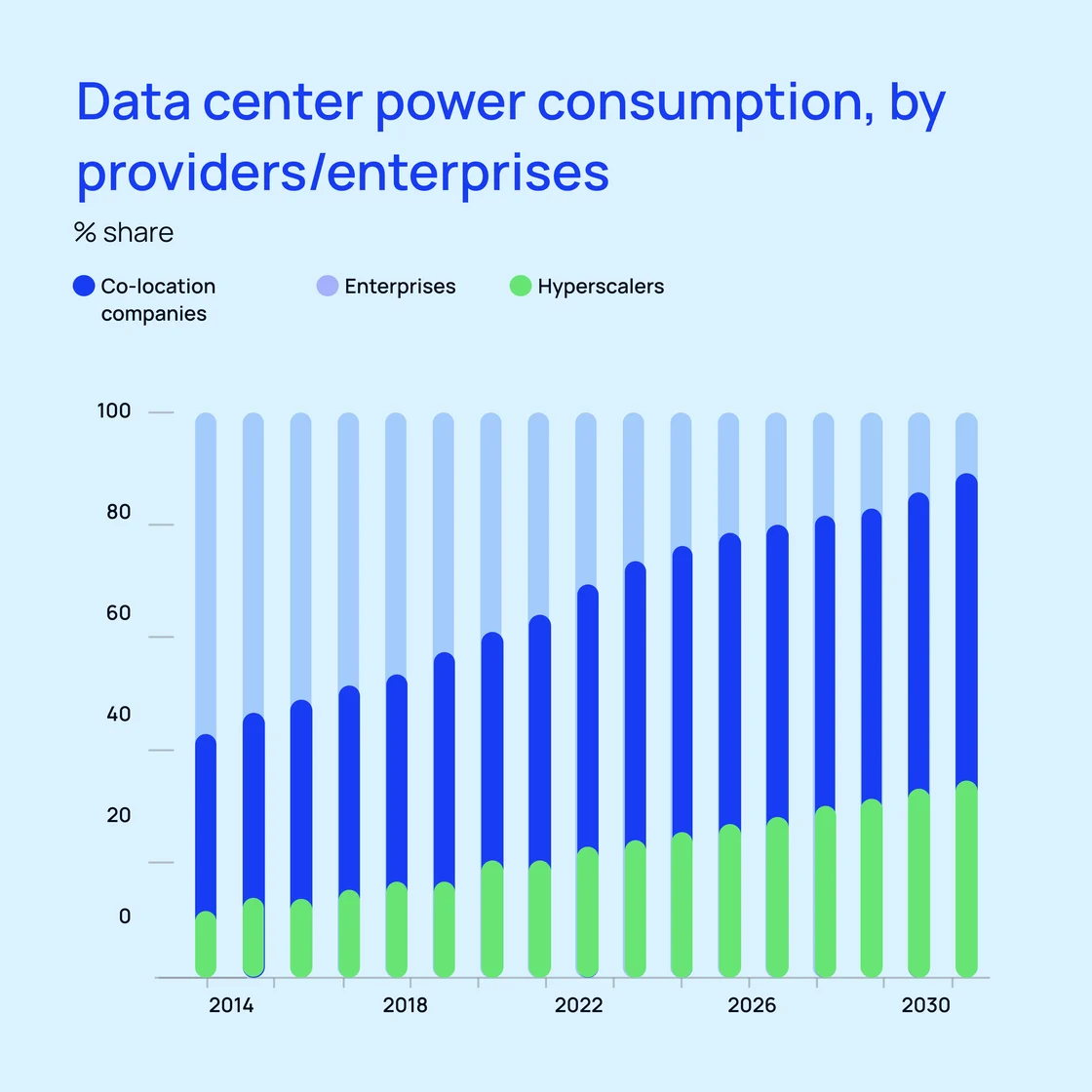

Did you know that the U.S. accounts for about 40% of the global demand for data centers? Co-location companies are leading the charge to meet current demand. These entities own and maintain data hosting facilities, leasing out the space to tenants who need somewhere to house their equipment in exchange for supplying network capacity, cooling equipment, and power.

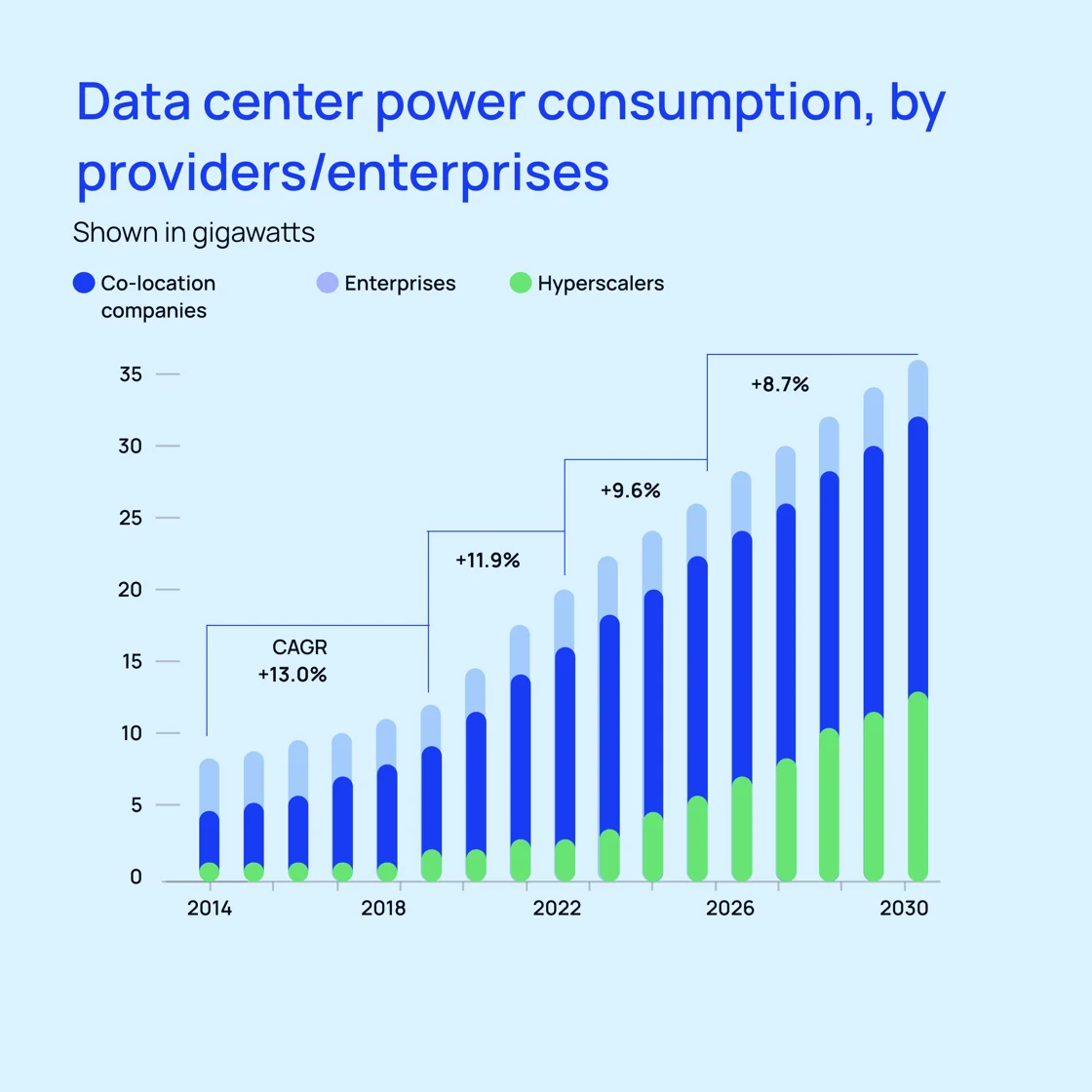

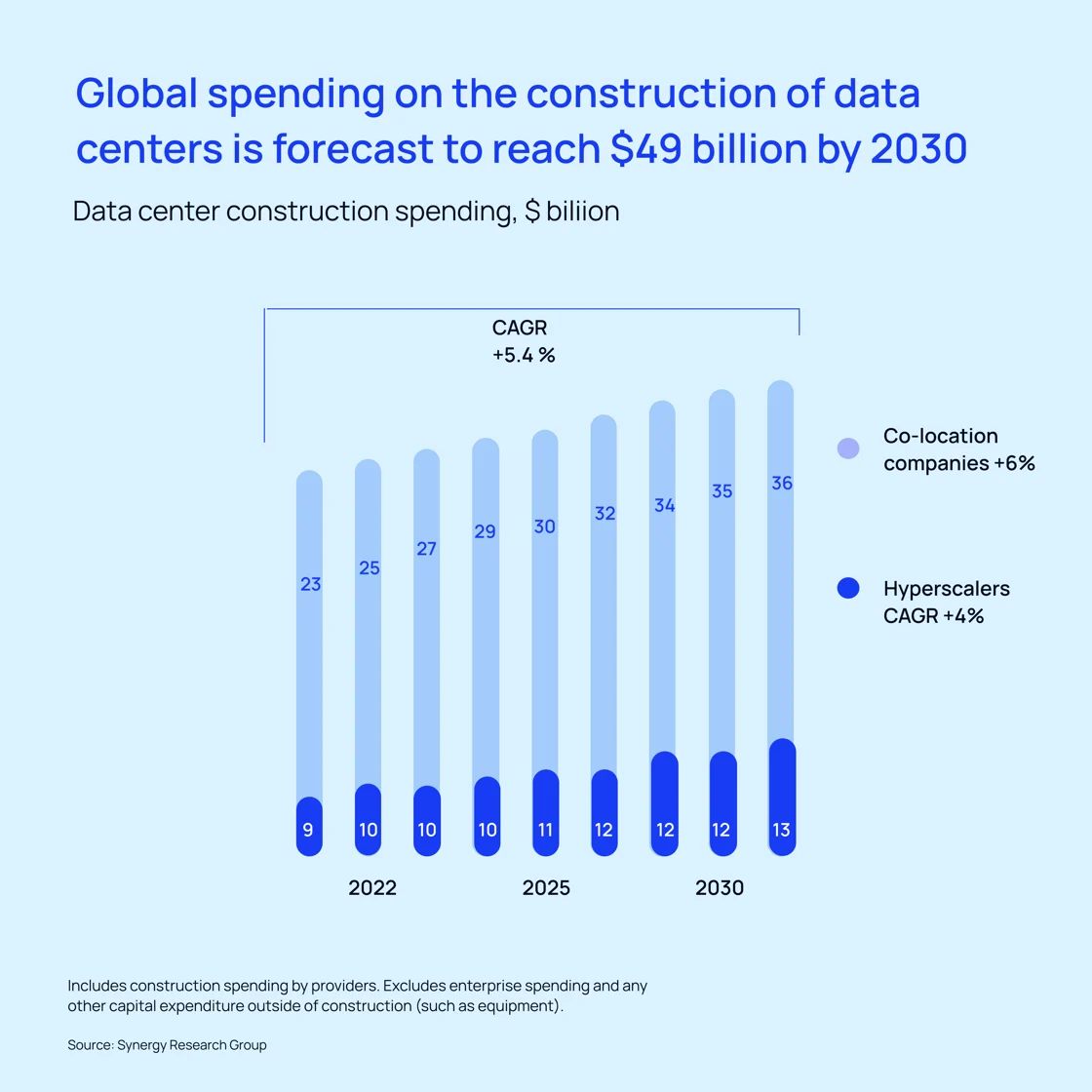

However, according to an analysis by McKinsey, data center power consumption in this country alone is expected to reach 35 gigawatts by 2030, more than double the capacity needed in 2022. It’s additionally anticipated that construction of data centers will eclipse $49B by that 2030 threshold.

Like many emerging markets experiencing explosive growth, data centers have gained the interest of investors. Their attraction lies in their potential for steady, utility-like cash flows and strong risk-adjusted yields. Opportunities abound not only in the operation of the centers themselves, but also in connected technologies, like heat mitigation, server design, green energy, and AI/machine learning.

How to invest in data center technologies

The most accessible data center investment opportunities for private investors are currently REITs and/or ETFs.

- Based in Austin, TX, Digital Realty Trust operates as a real estate investment trust, which engages in the provision of data center, colocation, and interconnection solutions. It serves the following industries: artificial intelligence (AI), networks, cloud, digital media, mobile, financial services, healthcare, and gaming.

- Equinix, a REIT, engages in the provision of collocation space and develops data center solutions. The firm offers secure key management, consulting, network virtualization, customer support, and managed services. It operates through the Americas, Europe, Middle East & Africa and Asia-Pacific. The company was founded by Jay Steven Adelson and Albert M. Avery, IV on June 22, 1998, and is headquartered in Redwood City, CA.

- The Global X Data Center REITs & Digital Infrastructure ETFseeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Data Center REITs & Digital Infrastructure Index. The non-diversified fund invests at least 80% of its total assets, plus borrowings for investments purposes, in the securities of the Solactive Data Center REITs & Digital Infrastructure Index and in ADRs and GDRs based on the securities in the index. The index is designed to provide exposure to companies that have business operations in the fields of data centers, cellular towers, and/or digital infrastructure hardware.

On Our Radar This Week

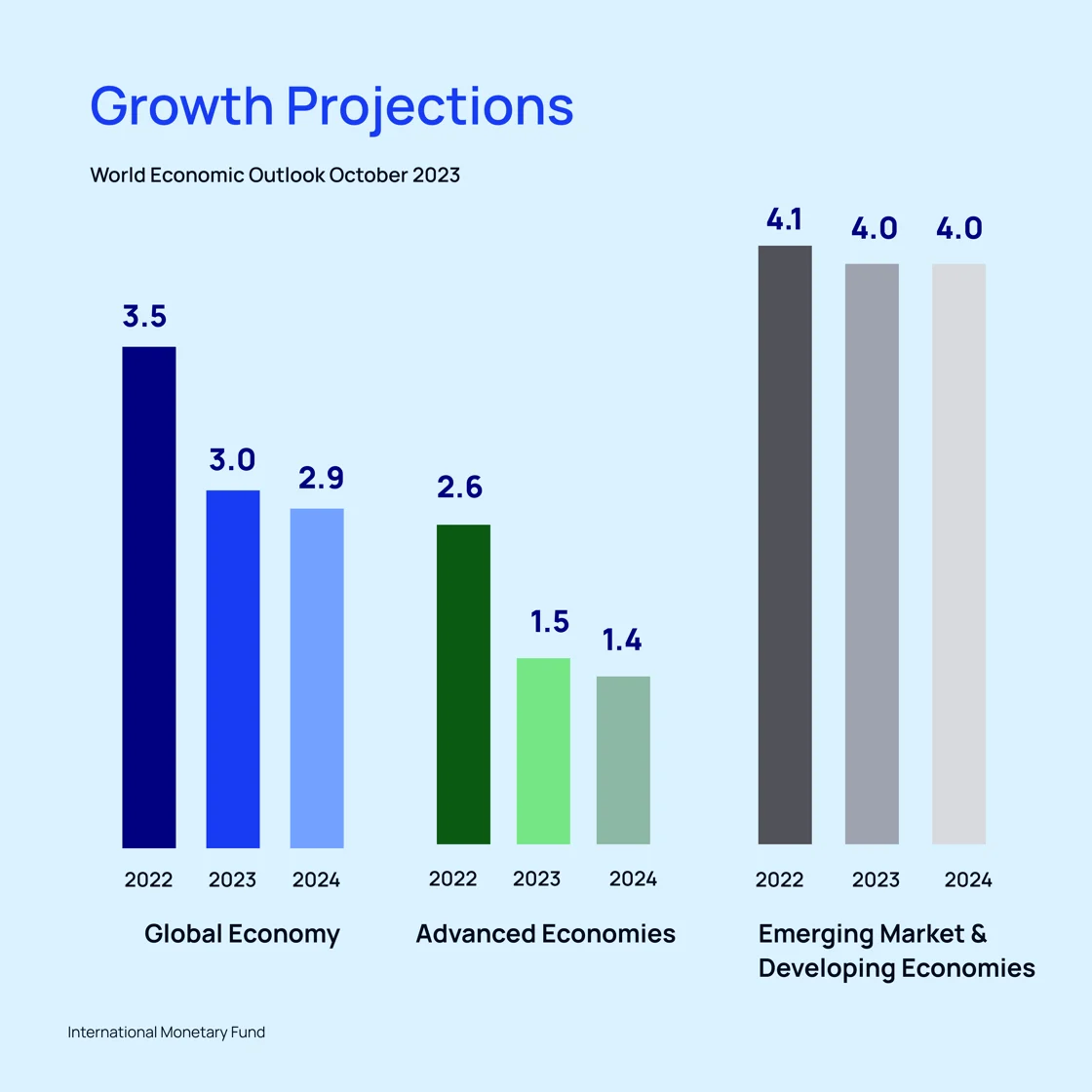

- The latest World Economic Outlook report published by the International Monetary Fund (IMF) presents an optimistic revision for the global economy in 2024, forecasting a growth rate of 3.1%, an increase from the previously projected 2.9% in its October estimates. This positive adjustment is primarily credited to the robustness shown by the U.S. economy and emerging markets, coupled with China’s fiscal stimulus. Notably, inflation is projected to decline more rapidly than initially anticipated, with global rates expected to fall to 5.8% in 2024 and further to 4.4% by 2025. Despite this optimistic outlook, the growth projection still trails the 2000-2019 average of 3.8%, a shortfall attributed to elevated central bank policy rates, the phasing out of fiscal support, and sluggish productivity growth.

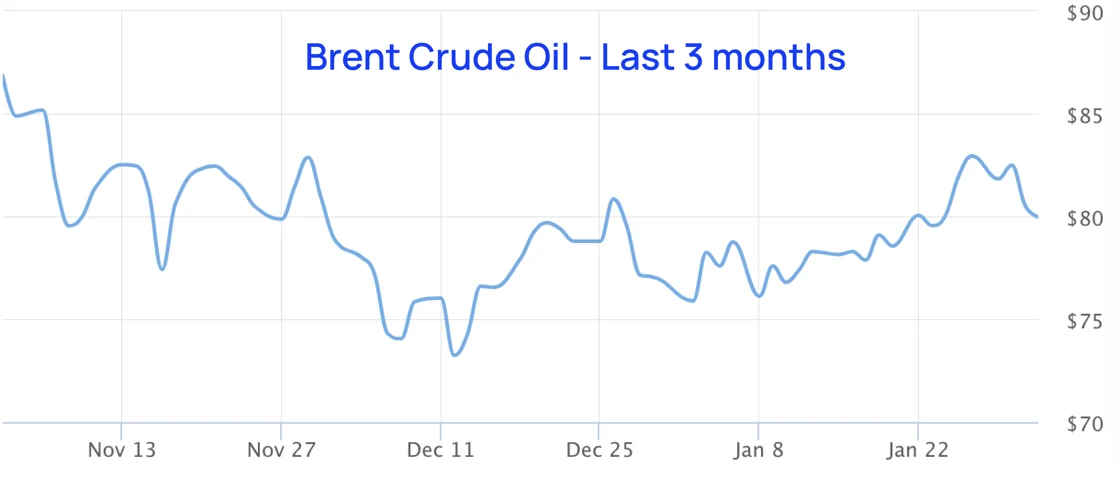

- Oil prices are rising in tandem with tensions in the Middle East after three American service members were killed in a drone attack at a base near the Jordan-Syria border. The U.S. is still considering its response to the incident, the first to kill American troops since the Israel-Hamas war began in October 2023.

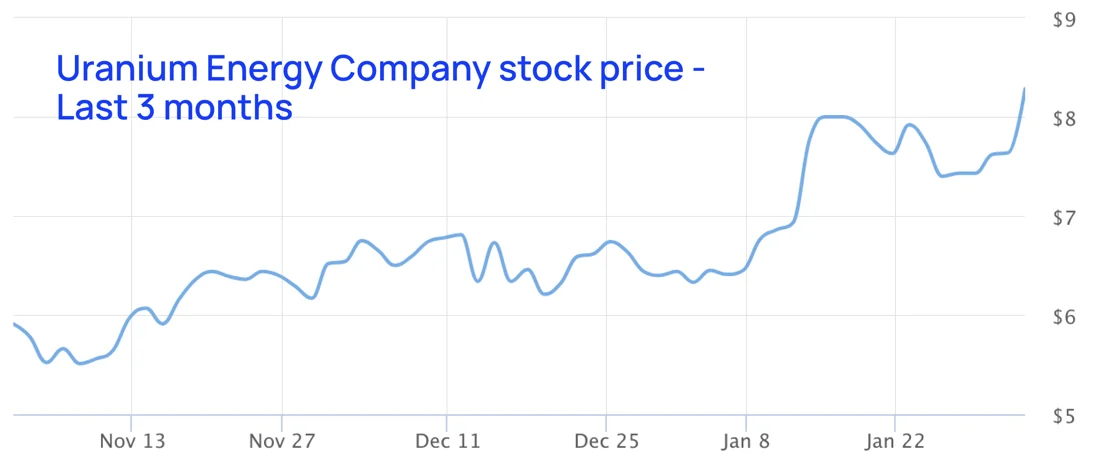

- Thanks to a renewed interest in nuclear power, uranium prices reached their highest levels in almost two decades. Hitting close to $85.75 a pound for the first time since 2007, the spike is attributed in part to fears surrounding oil and gas supplies following Russia’s invasion of Ukraine.

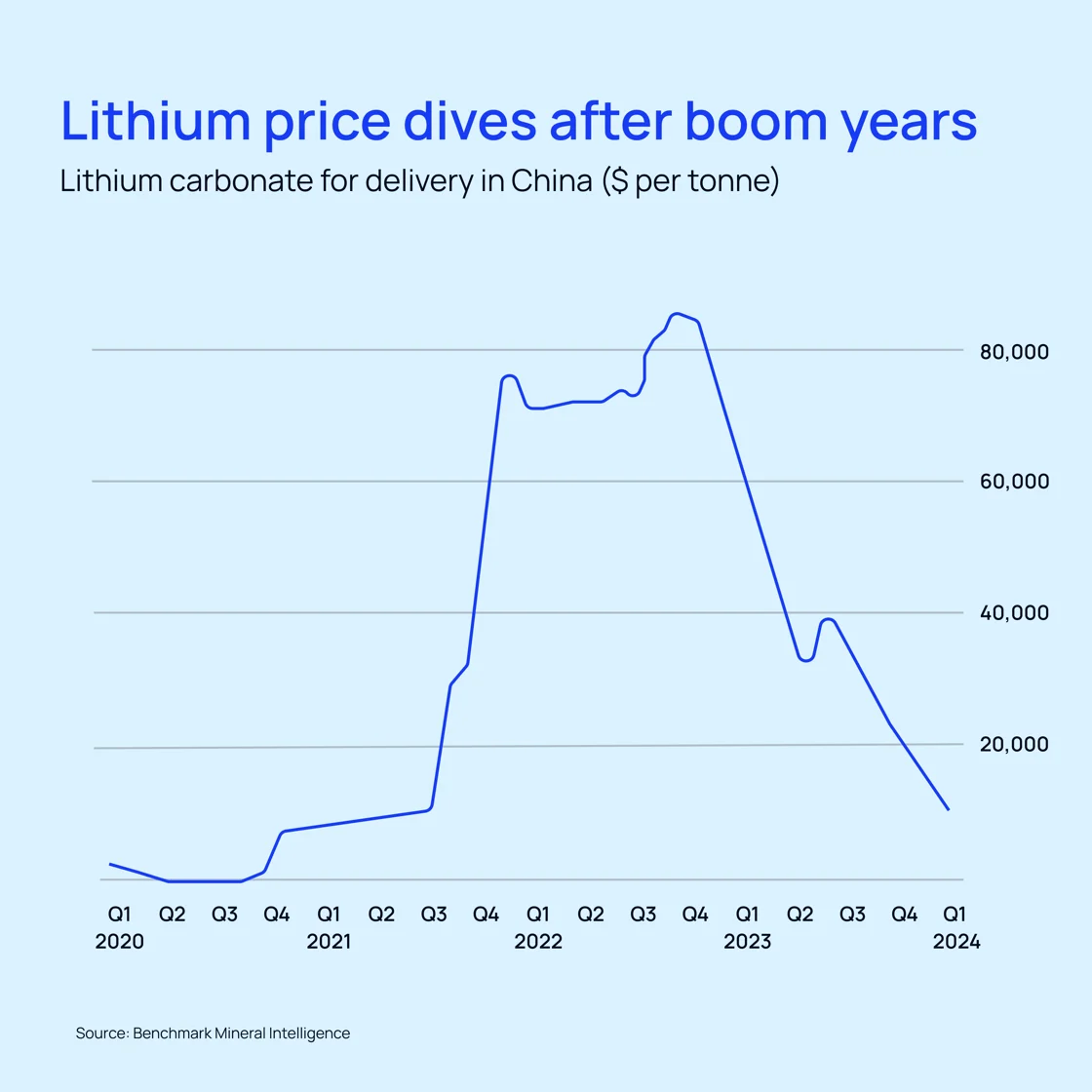

- Lithium prices are on the decline due to lagging EV demand, according to data group Benchmark Mineral Intelligence. Mining companies are cutting costs and scaling back plans to expand lithium production after slowing demand in China continues to crush the price of the metal. The price of lithium has tumbled more than 80% in the past year.

Macro Bites

- According to the International Monetary Fund’s Deputy Managing Director Gita Gopinath, the U.S. economy has already seen about 75% of the impact from monetary policy.

- The World Economic Forum has highlighted artificial intelligence-driven misinformation and disinformation as one of the biggest short-term threats to the global economy.

- The top 20 hedge fund managers made $67B in profits for investors in 2023, as the industry made combined profits of $218B, topping the previous record of $65B set in 2021.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.