Beyond the Arches #16: Gen Z’s turn to AI companions to cope with stress opens new doors for lucrative HealthTech investments

Featured Story

As AI mental health apps boost access to personalized, on-demand support, investor interest in this new market grows

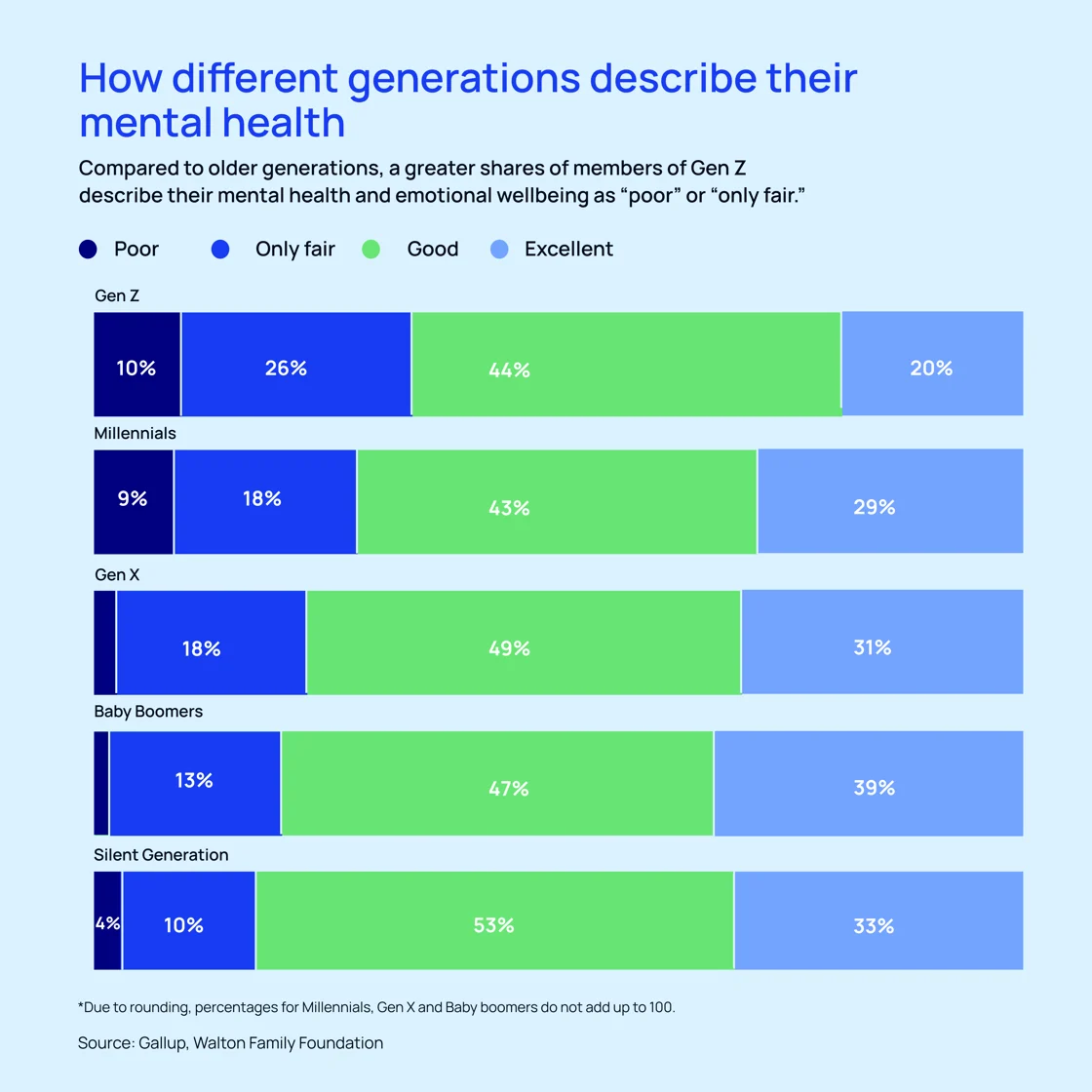

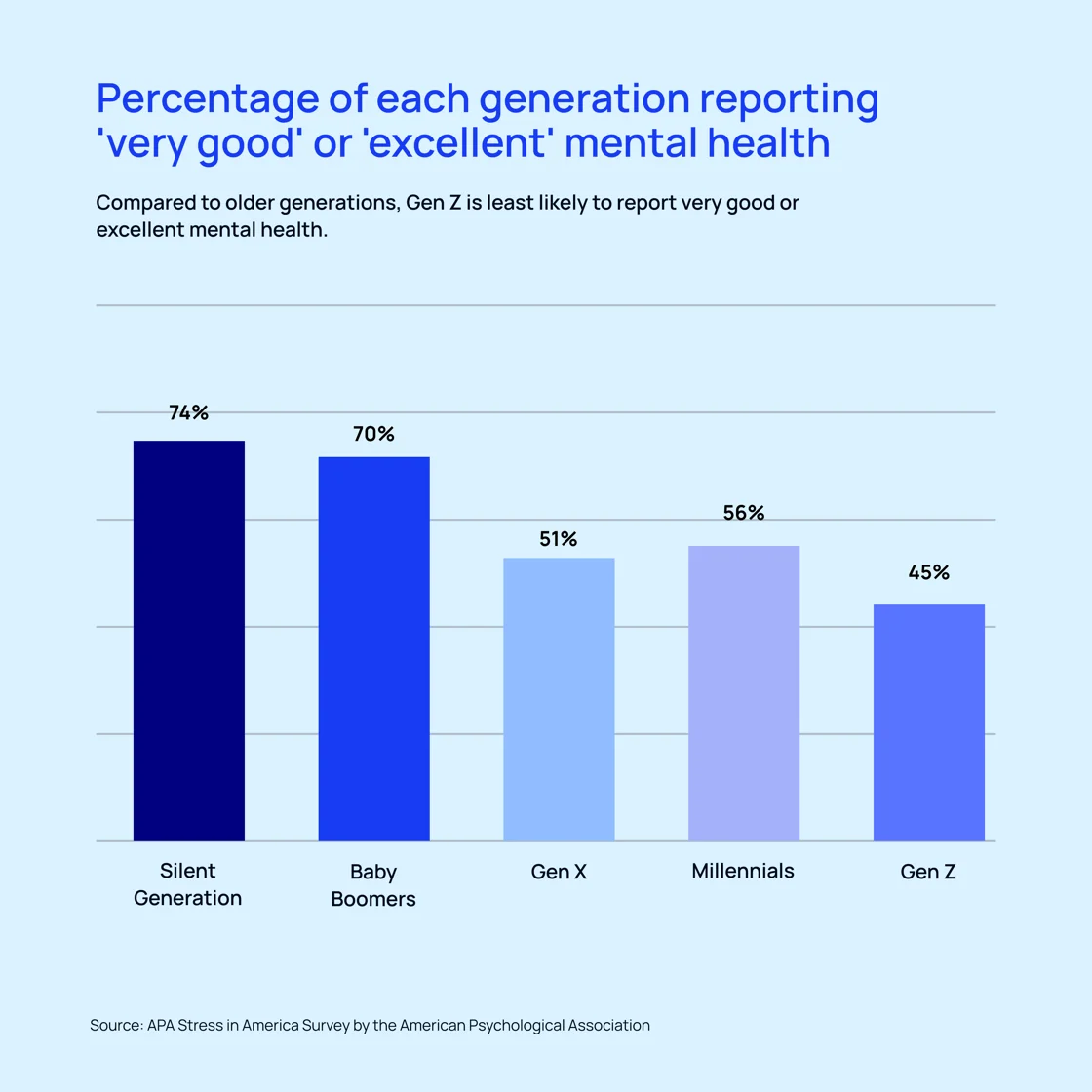

New polling shows that more than half of Gen Z struggles with social and economic stressors. The study of 3000 12 to 26-year-olds revealed that only 41% of this cohort considers themselves “thriving.” Mental health reporting is even more concerning, with one in every 10 Gen Z describing their mental health as “poor.” Only two in 10 consider it “excellent.”

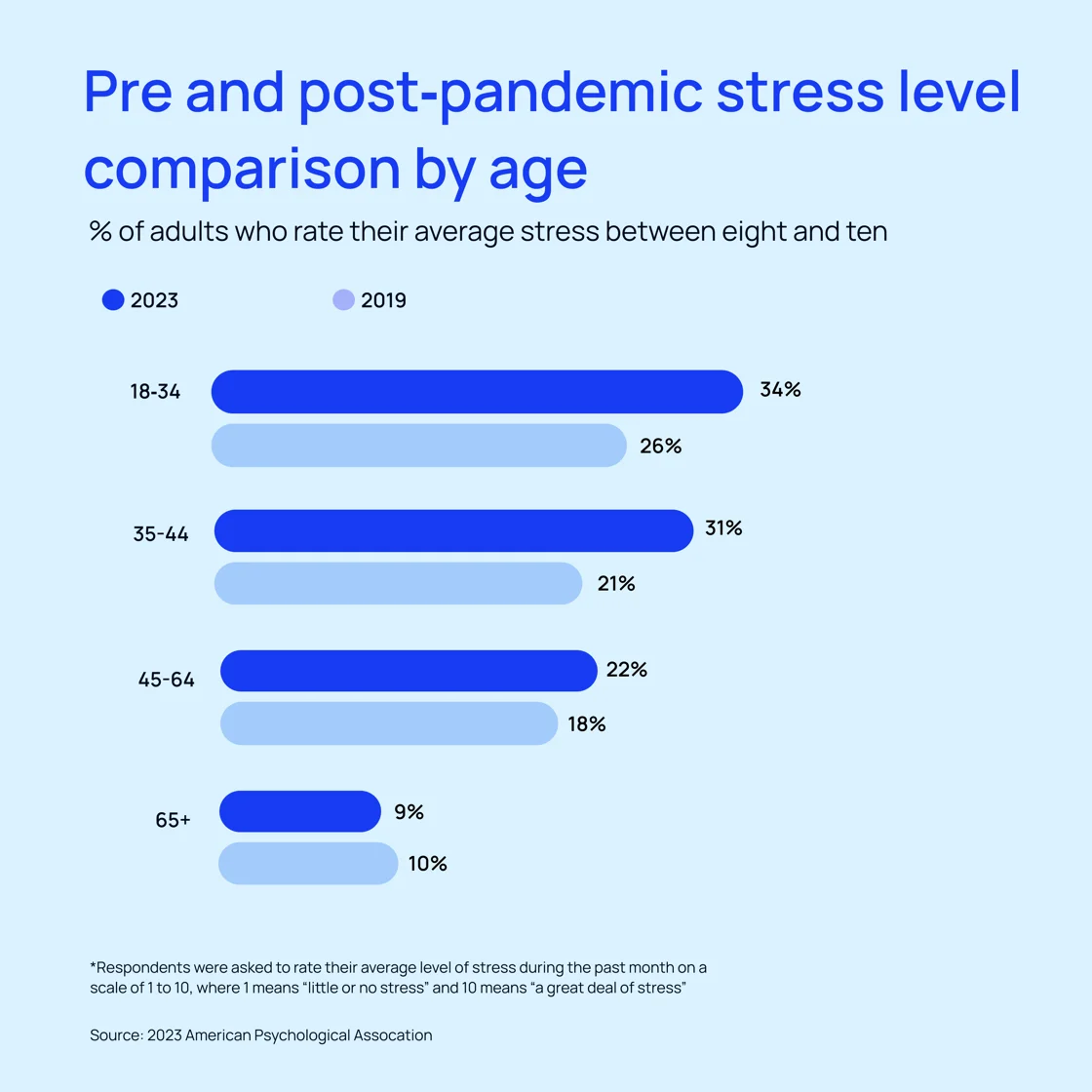

The COVID-19 pandemic added to these burdens, its collective trauma creating long-term stress and the potential to erode mental and physical health further. Here again, Gen Z bears the brunt of its impacts. Adults 18-34 report that, of three categories of health-related stressors—family-related, physical health, or mental health—mental health rated highest at 72%. This is the highest rate among all age cohorts. This age group is more affected by stressors and less likely than other age cohorts to discuss it with friends or family.

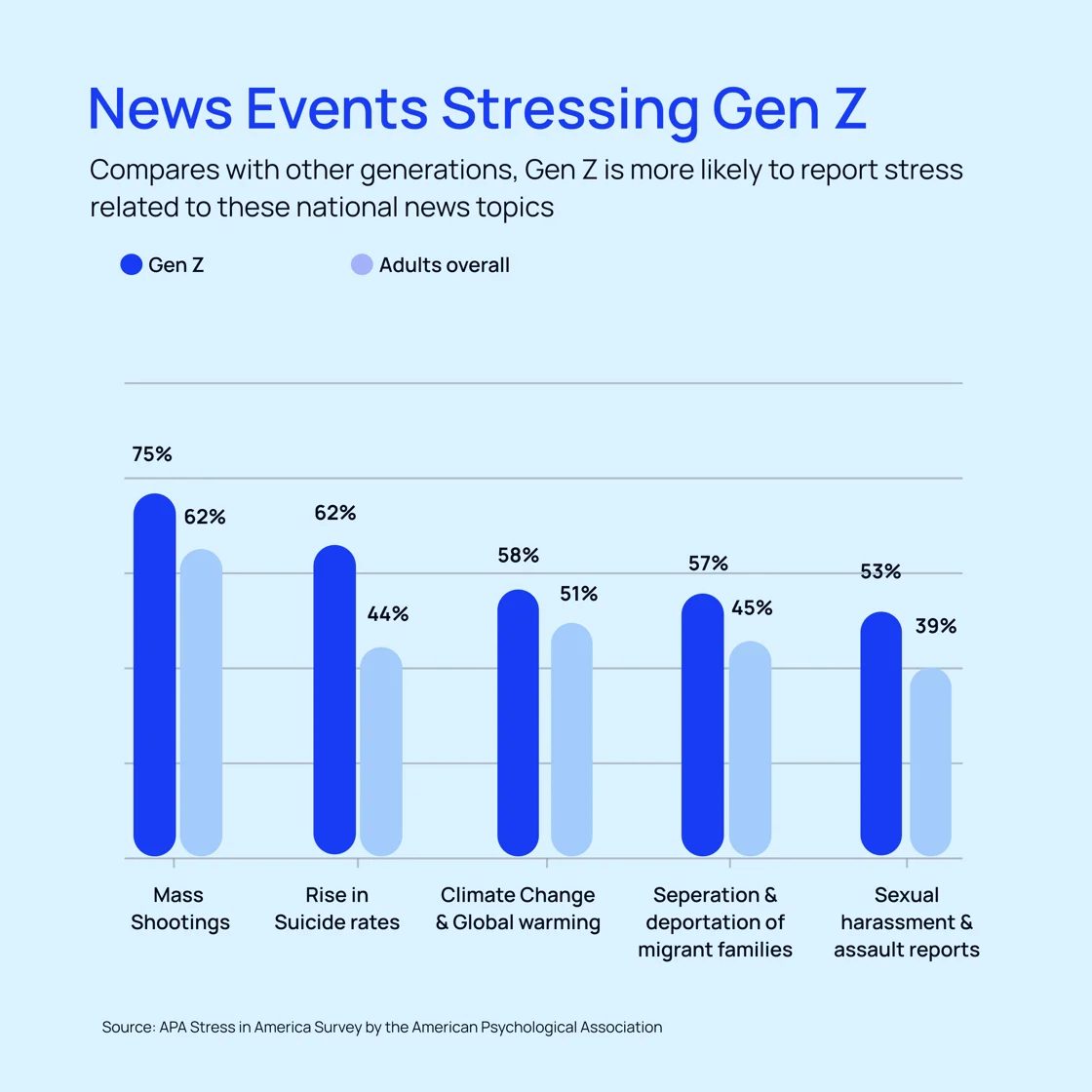

What’s stressing everyone out? Plenty. Gen Z reports that social issues like immigration, sexual assault, climate change, and gun violence top the list. Three in four Gen Z respondents aged 15-17 cited mass shootings as a significant source of stress. Over 90% of Gen Z adults report experiencing physical or emotional symptoms of stress, such as depression, sadness, loss of interest or motivation, and lower energy.

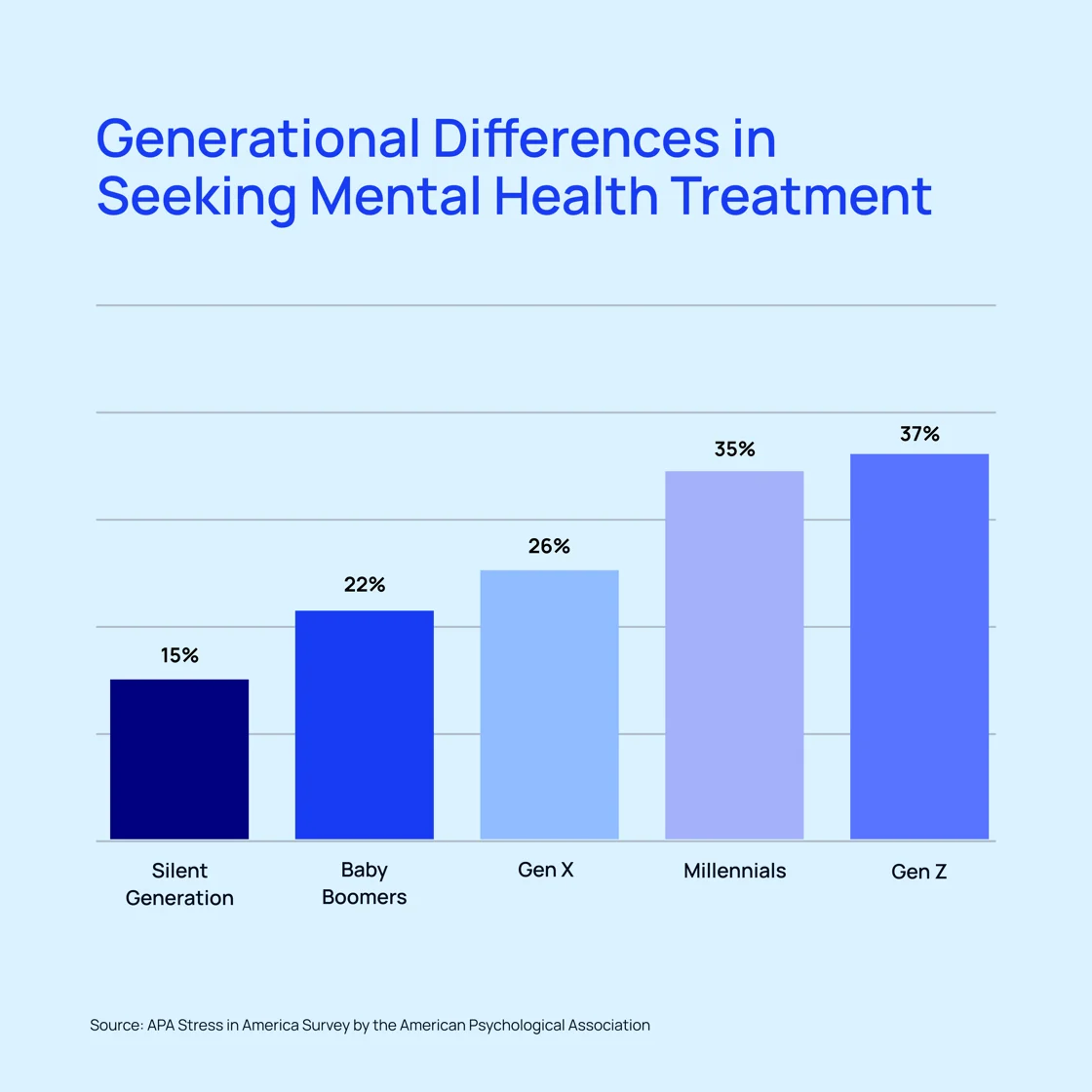

The good news? Gen Z is learning that it’s okay to reach out for help. APA reports that 37% of Gen Z are likely to report they’ve received treatment or therapy from a mental health professional. That’s only true for 26% of Gen X, 22% of baby boomers, and 15% of older adults.

How to invest in a brighter mental health future

AI is popping up in every corner of our lives, but it has created unexpected opportunities in mental health care. AI-powered companions and avatars lend a sympathetic ear to those going through stressful times.

One such AI companion app, Earkick, is an approachable mental health platform co-founded by CEO Herbert Bay and COO Karin A. Stephan. The interactive app can measure mental health within 3 seconds and respond in real time. It boasts metrics like 34% mood improvement and 32% anxiety reduction for users. Earkick also addresses the troublesome gap between when members recognize symptoms and when they receive treatment. It enjoys a 4.8-star rating from over 40,000 members.

Earkick has already attracted $1.5M from top VCs and is raising an oversubscribed round of capital via Wefunder. We expect more investment opportunities in this HealthTech niche as interest and options in AI-based support continue to grow.

On Our Radar This Week

- After years of decline, Chinese stocks experienced the largest one-day gain in the last two years, lifting the yuan and stirring hopes for recovery after three years of disappointing market results. The Shanghai Composite rose 3.2%—its biggest jump since early 2022—and the CSI 300 enjoyed a 3.5% one-day increase. The small cap index saw its biggest increase since 2008. The Chinese market has suffered a combination of flagging economic factors and inertia on the part of policy-makers. Investors’ response to legislative moves to stimulate the sagging markets—including reports that President Xi Jinping will address the challenges with regulators—was cited as the catalyst for the welcomed upturn.

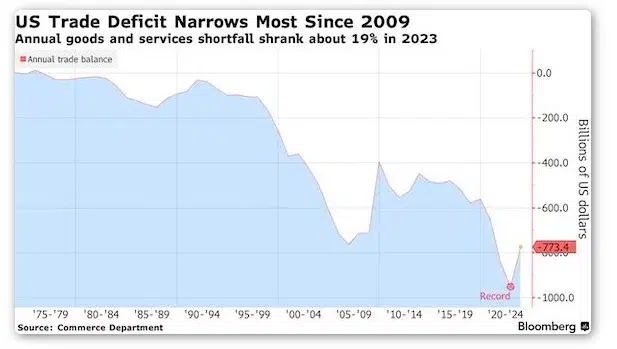

- Despite a slight increase in December, the annual trade deficit gap fell to its lowest level in three years this week. This new low comes on the heels of record deficit numbers in 2021 and 2022. Lower oil costs and decreasing demand for consumer electronics like computers and cell phones helped solidify the decrease. Americans once focused on home-based purchases are now setting their sights on the horizon (literally), investing in the return to travel and increased interest in recreation post-pandemic. The 1.2% boost to U.S. exports in December also influence the currently sunny economic outlook.

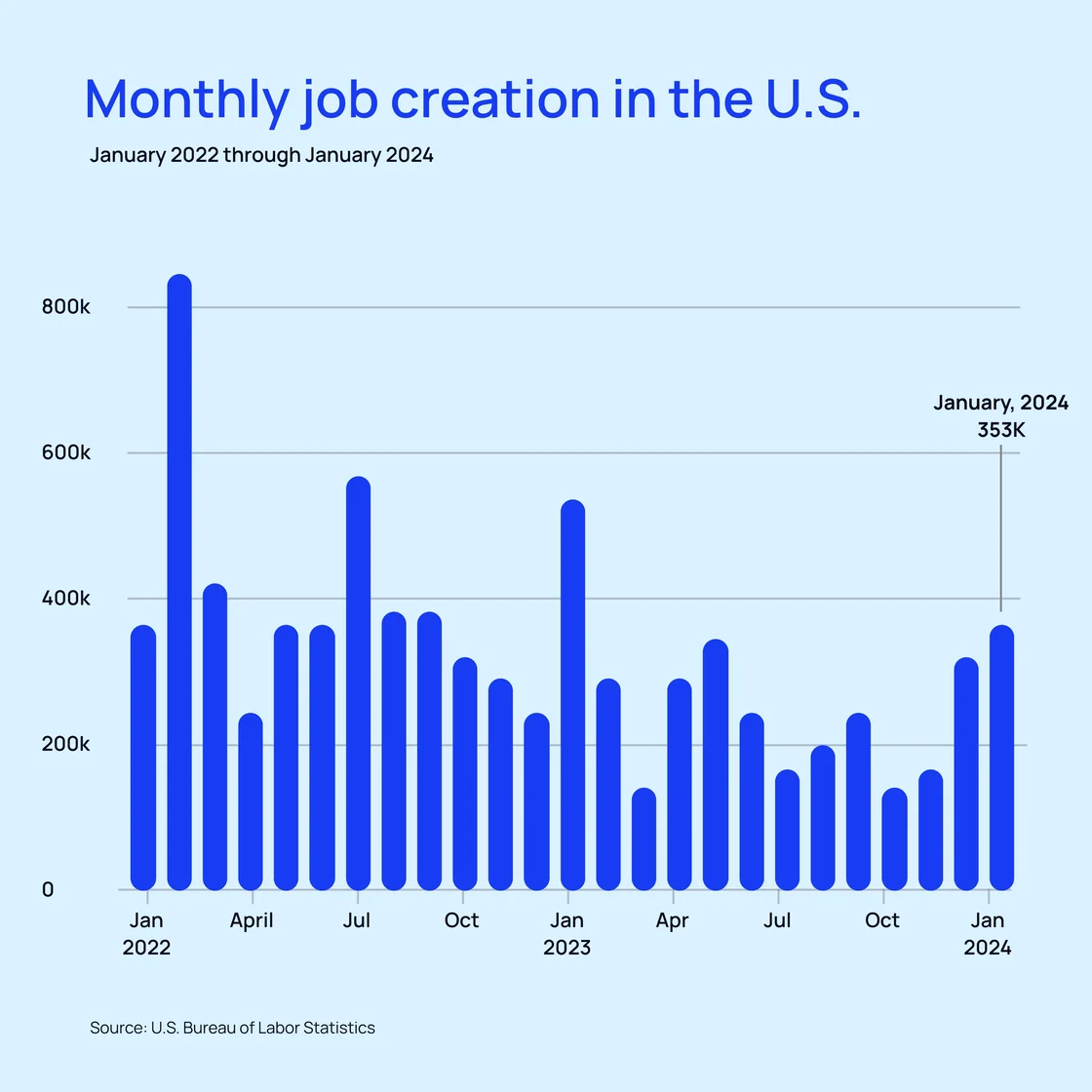

- Americans have more good economic news to celebrate, thanks to a January job market boom. The US added over 350,000 jobs last month, surpassing the expected 185,000 increase Dow Jones predicted. Professional and business services led the way, with healthcare and retail positions further bolstering the figures. Wage growth also held promising numbers, with hourly earnings averages increasing 0.6%. The YoY wage basis beat its 4.1% forecast, reaching 4.5%. December job gains also turned out to be better than initially reported, with the U.S. adding 117,000 more jobs than the original 333,000 estimate.

Macro Bites

- China tightens trading restrictions on domestic institutional investors and offshore units to curb stock market decline, imposing caps on some brokerages’ cross-border total return swaps with clients.

- The U.S. and China meet to discuss economic issues including the global macroeconomic outlook, investment screening, debt coordination, and climate change impacts.

- The Fed assures investors that the hot labor market won’t interfere with planned interest rate cuts, pointing to the expected moderation in wage growth and cooling jobs numbers.

- WeWork founder Adam Neuman is attempting to buy back the company out of bankruptcy.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.