Beyond the Arches #17: What’s the future of realty commissions? Learn about the NAR settlement and how to invest in real estate tech

Featured Story

NAR lawsuit settlement and commission impacts

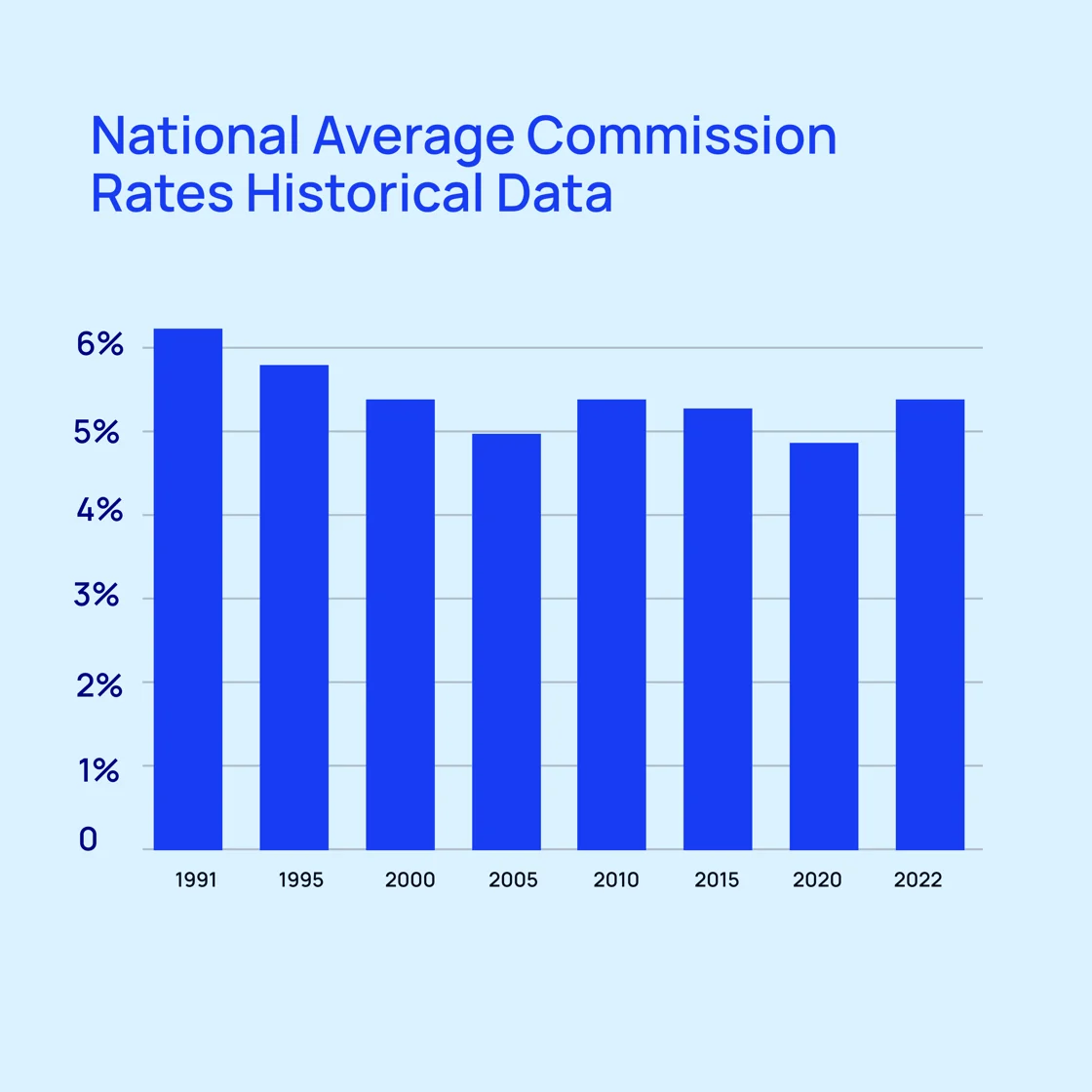

Everyone who buys or sells a home knows that Realtor commission is a factor in your total price. For decades, rules set by the National Association of Realtors (NAR) have set the customary commission at 6 percent of the selling price.

Complainants brought a series of lawsuits alleging that the NAR’s commission and broker payment policies violate antitrust laws. With the settlement of these suits and NARs agreement to pay over $418 in damages, the new question is: What comes next for home sales and and agents’ fees? Some speculate the changes to the commission structure could result in significant savings for home buyers and sellers.

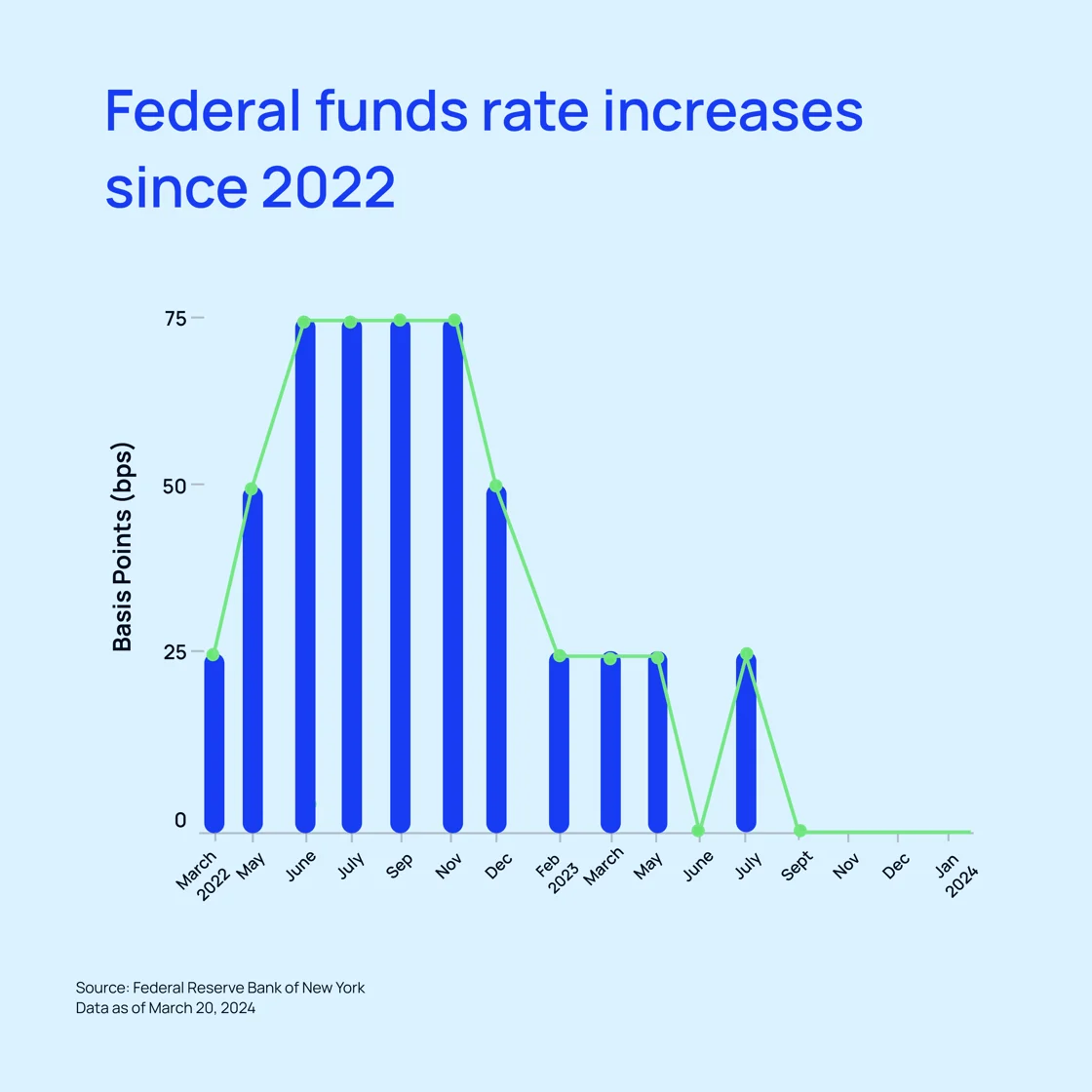

In other news affecting the housing market, the Federal Reserve this week maintained its current rates, but indicated plans to proceed with three scheduled rate cuts in the next three quarters of the year. The decision came after the Fed’s two-day policy meeting to discuss the central bank’s rate-setting. With the federal funds rate at its highest point in over 23 years, homebuyers, auto consumers, credit card holders, and investors will closely watch the rate situation and its impact on consumer and commercial lending.

How to invest in real estate technologies

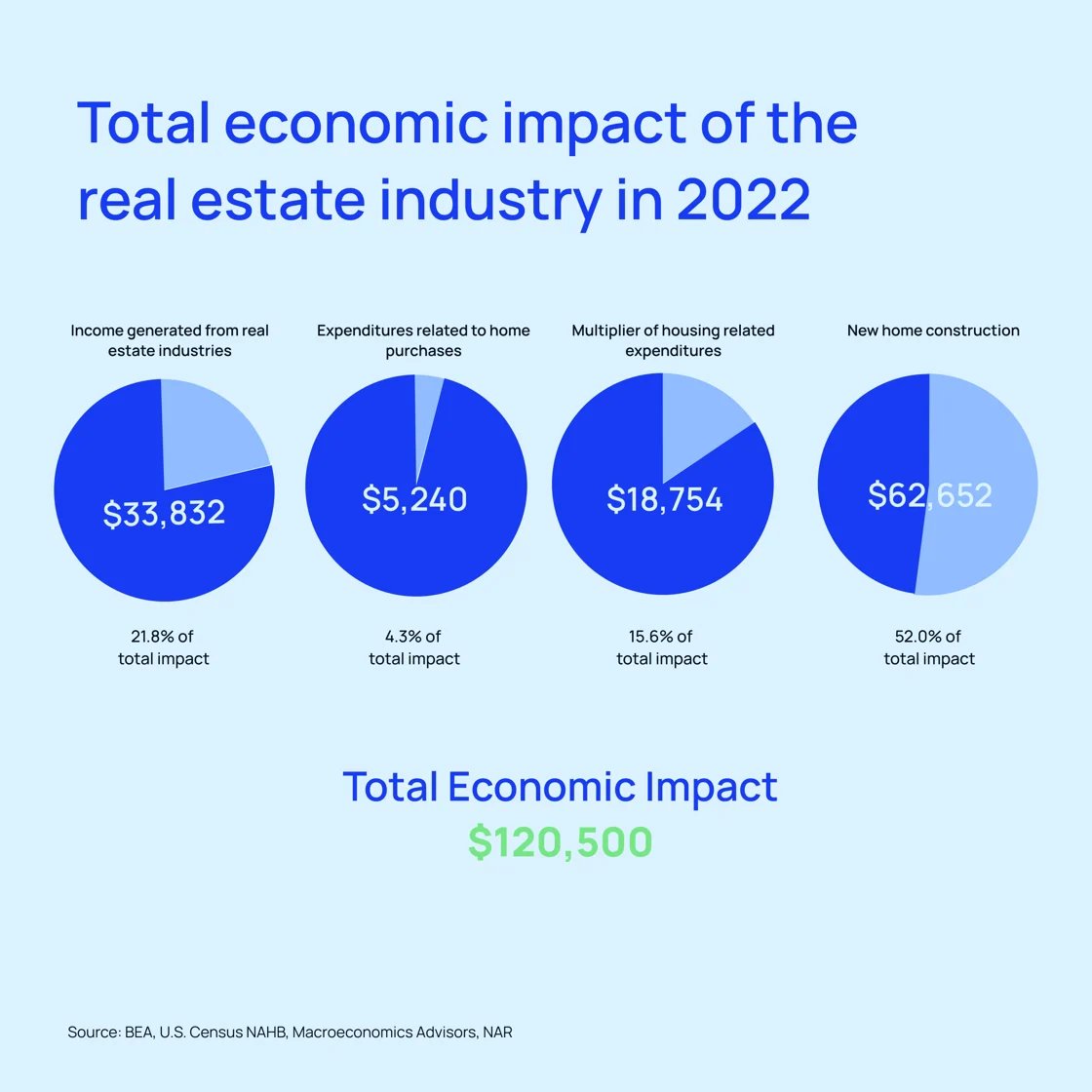

Changes to the structure and business model of the real estate industry will spur innovation and opportunity within this important investment sector. Even before these changes take shape, there are plenty of opportunities for investors interested in real estate and loan servicing technology:

- There’s stiff competition for homes in most residential markets. With low supply, buying without a sales contingency (the need to sell your house to fund the new property) can give buyers an edge. Knock offers buyers innovative bridge loan solutions to fund their new purchase without relying on immediate funds from selling their current home. The Atlanta, GA-based startup features Sean Black, CEO and founding member of Trulia, Jamie Glenn, fellow Trulia founder and COO, And former Zillow Product Design Lead Allie McKinley.

- AI-powered discovery is a popular and versatile use of new technology. With LookyLOO, consumers in the real estate relocation market can use AI insights to find the perfect neighborhood to call home. The platform offers a one-stop shop for buyers and renters looking to pull up stakes and find a perfect property in a new locale. LookyLOO’s team includes multi-exit founder and CEO Edmond Dilworth, award-winning Chief Creative Officer Mike Fung, and Chief Marketing Officer Michele Hobbs. Michele’s work with Fortune-500 brands includes Cisco, eBay, Lowe’s, Merck, and Microsoft.

- With many finance industry businesses moving into the cloud, it’s no surprise that mortgage services use technology to produce better outcomes for lenders and customers. Sway Compass, chosen as Forbes 100 fastest-growing startups for Mexico, is a cloud financial infrastructure startup whose innovative API helps mortgage originators and homebuilders make the best decisions for ranking and approving potential borrowers. Sway Compass’s team features CEO Joel Antonio Cruz Garzia, Chief Research Officer Litzia Marivi Contia, and financial solutions designer and Chief Compliance Officer Diana Isabel Cruz Garcia.

On Our Radar This Week

- Bitcoin has had a tumultuous week. The price of a coin dipped to around the $60,000 mark before regaining its over-$65,000 price on positive news from the Fed. Although cryptocurrency is decentralized, its price still responds to economic and traditional market conditions. Other prominent coins, including Ethereum, DogeCoin, and Solana, experienced similar fluctuations. Cryptolinked stocks like Coinbase and MicroStrategy fared better. Crypto investors are now closely watching the imminent halving of Bitcoin mining rewards (the money earned using your PC’s processing power to help build the blockchain decentralized ledger).

- The S&P 500 closed at a historic high 5,200 mark for the first time in response to the news that Fed rates would continue to support expected corporate profits. The rates, back on track for the first time since early 2020, remain at current levels on indications that consumer prices are coming down. Calmer prices prompted the Fed to ease off of further rate increases.

- UK inflation rates are cooling. The inflation rate fell to its lowest level since September 2021 and is trending toward meeting Bank of England targets in the next few months. Global unrest, food and energy supply chain disruptions due to the Ukraine invasion, and energy concerns have stoked inflation, particularly in the energy and food sectors. This new low is a welcome reprieve from rates reaching 6.7% just six months earlier.

Macro Bites

- Tencent posted disappointing earnings for the fourth quarter of 2023 due to a softening domestic games market. Despite this notable stumble, optimism for Chinese economic performance remains high.

- Japan’s central bank ended its 17-year run of negative rates with the first increase since 2007. The move is meant to support Japan’s moderate post-pandemic recovery.

- Google will pay over €250 in fines to French regulators over breach of contract connected to payments to media companies for reproducing their content.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.