Beyond the Arches #19: AI is power-hungry. Sustainable energy holds the key to keeping it fed — and presents new investment opportunities.

Featured Story

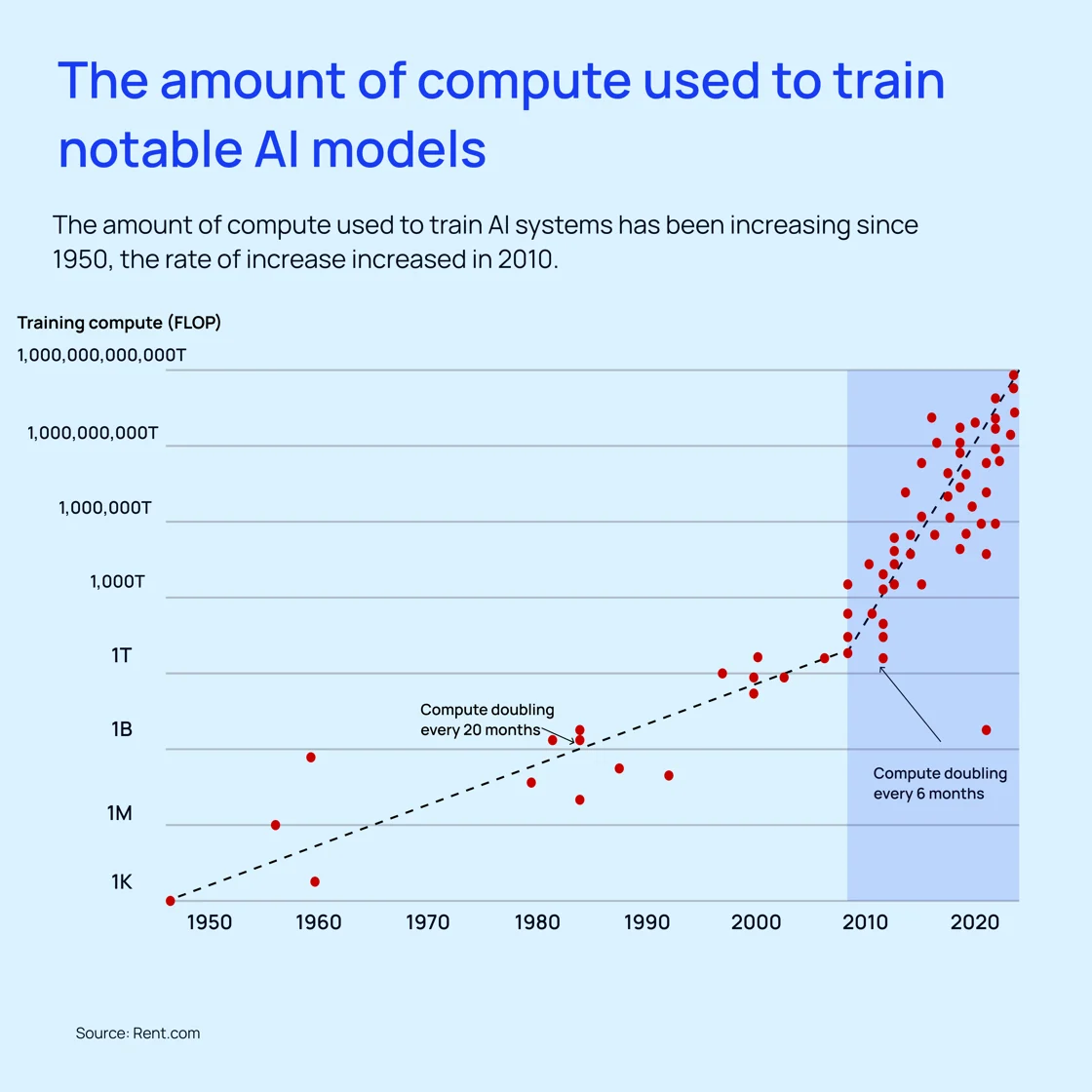

AI’s “insatiable” power needs come into the spotlight

AI is consuming electricity at a startling pace. As reported in the Wall Street Journal, the power needed to fuel AI neural nets like ChatGPT could consume 20% to 25% of US power needs by 2030. This stark assessment is from Rene Haas, CEO of Arm Holdings PLC, a chip design company and subsidiary of major tech investor SoftBank Group. It comes on the heels of an International Energy Agency report quantifying the cost of interacting with generative AI. That report highlighted how a single ChatGPT search query consumes nearly ten times the power of an average Google search. With the obvious climate implications of increasing AI use, the search for sustainable power comes to the forefront.

Oil slips after riding a 5-month high

Oil fell to $85 a barrel this week after a months-long stretch of record prices, which was largely due to geopolitical tensions in the Middle East and fluctuations in indexes such as the Relative Strength Index. Traders are watching closely the situation in Gaza as Israel works toward a cease-fire. Iran’s involvement in the conflict further complicates the situation, as supply chain disruptions through the Strait of Hormuz can potentially impact the transport of oil and other commodities.

Despite the dip, analysts predict prices will rally later in the year, with price estimates of $80 to $100 a barrel. OPEC production cuts and continued consumption contribute to the possibility of higher prices through 2024.

Surprise jobs growth exceeds March expectations

Job creation exceeded expectations last month as the U.S. added 303,000 new nonfarm jobs. Dow Jones had originally estimated an increase of 200,000 jobs for the month. Unemployment dipped to 3.8%, in line with expectations. Wages also edged up .3% for the month, 4.1% YoY.

The biggest gains were in Health Care, which added 72,000 jobs. Government roles rose by 71,000 jobs, Hospitality gained 49,000 jobs, and construction gained 39,000 jobs. The gains in March, combined with strong numbers in February, are good signs for the larger economic outlook.

How to invest in power sustainability

Progress takes power. Increased industrial and AI power demands bring the need for sustainable and renewable power sources to the forefront. For investors interested in tech and AI innovation, investments in the energy to power these cutting-edge applications may also be of interest. Here are two companies shaping the sustainable energy future in innovative ways:

- Paladin Power, Inc.: Energy storage makes power consumption more efficient and reliable. Paladin Power is focused on developing new battery technologies to give consumers more control over their energy management. Battery storage helps customers buy public grid power at lower prices and consume stored energy during peak hours. It also helps them maintain power during disruptions. CEO Ted Thomas, who has 13 years of experience in energy storage and stackable battery design, leads Paladin alongside CFO Michael Bennett and CSO Derek Cahill.

- Multiturbine: Renewable generation has experienced a boom in innovation. Wind innovator Multiturbine contributes to the $100B wind energy space with cheaper, cleaner solutions to harnessing wind power. The company’s modular turbine generation design, along with integration of AI efficiency tools, creates a predictive environment for collecting and optimizing power. The product’s scalability makes it a key player in the evolving landscape of renewable energy generation. Cofounder and CEO Matthew Michel leads the Multiturbine team with Adviser and Cofounder Usman A. Fateh.

On Our Radar This Week

- The Dow closed 9 points under on Tuesday, rallying slightly from a 100-point dip, as investors brace themselves for expected inflation data. The market is in a holding pattern awaiting results from the March Consumer Price Index (CPI), which is expected to show little progress against inflation rates that have dogged the economy for the last several years.

- The S&P 500 experienced more of a rebound, closing at 5,200. Companies like Tesla and NVIDIA experienced gains after investor uncertainty of the last week. Investors are watching the CPI for indicators of how consumer spending will impact Fed cuts through 2024.

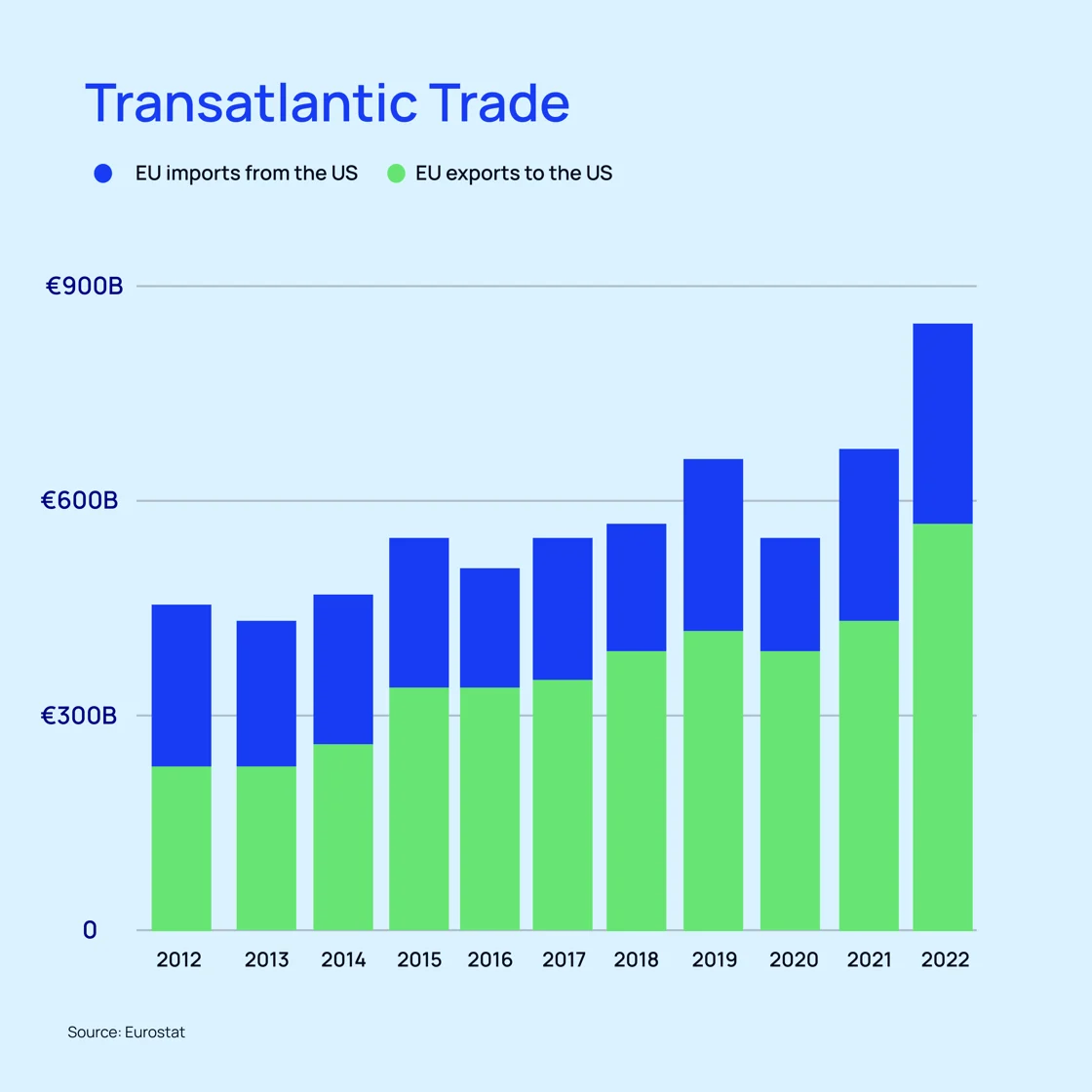

- Mineral production, a key part of renewables generation and storage, is in focus for the US and EU as they move toward an agreement on supply chain resiliency. The two powers will miss the early April target date originally set but are working on an “agreement in principle,” though there is still more work to be done.

Macro Bites

- Investor pessimism costs Intel as other chipmakers outpace them: Intel investors delivered a blow to the company’s standing, wiping out $27B in value over concerns that the company’s turnaround plan is off track.

- RSV shot shows promise in combatting adult illness: Data from Pfizer show that its innovative RSV vaccine may protect millions of high-risk adults from the virus. Regulatory agencies will now review the vaccine for expanded approval.

- What to expect from the Bitcoin halving: Investors weigh economic conditions and past performance as the halving event nears, which is expected to occur between April 18 and April 21st (the last Bitcoin halving event occurred in May 2020).

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.