Beyond the Arches #21: Travel is back in business (and leisure). Investors are ready to go on the journey.

Featured Story

Tech titan stocks stumble, with potential for wider ramifications

Some big news: The Magnificent Seven tech stocks lost nearly a trillion dollars last week, and even the most tech-forward investors are keeping a wary eye on their next move. While a few of the Seven regained some footing, such as Tesla’s newly minted autonomous driving agreement with China, the cohort has an outsized impact on the wider markets. Together, these seven stocks account for nearly 30 percent of value in the S&P 500. In the coming days, earnings reports might offer some brighter news that incentivizes investors to catch the dip in the short term, although a portion of the recovery will hinge on Fed rates. Consistently higher rates without the promised relief of planned cuts might tamp down the tech sector’s traditionally robust performance. Without caution, a more pronounced sell-off could be on the horizon.

Business travel approaches cruising altitude

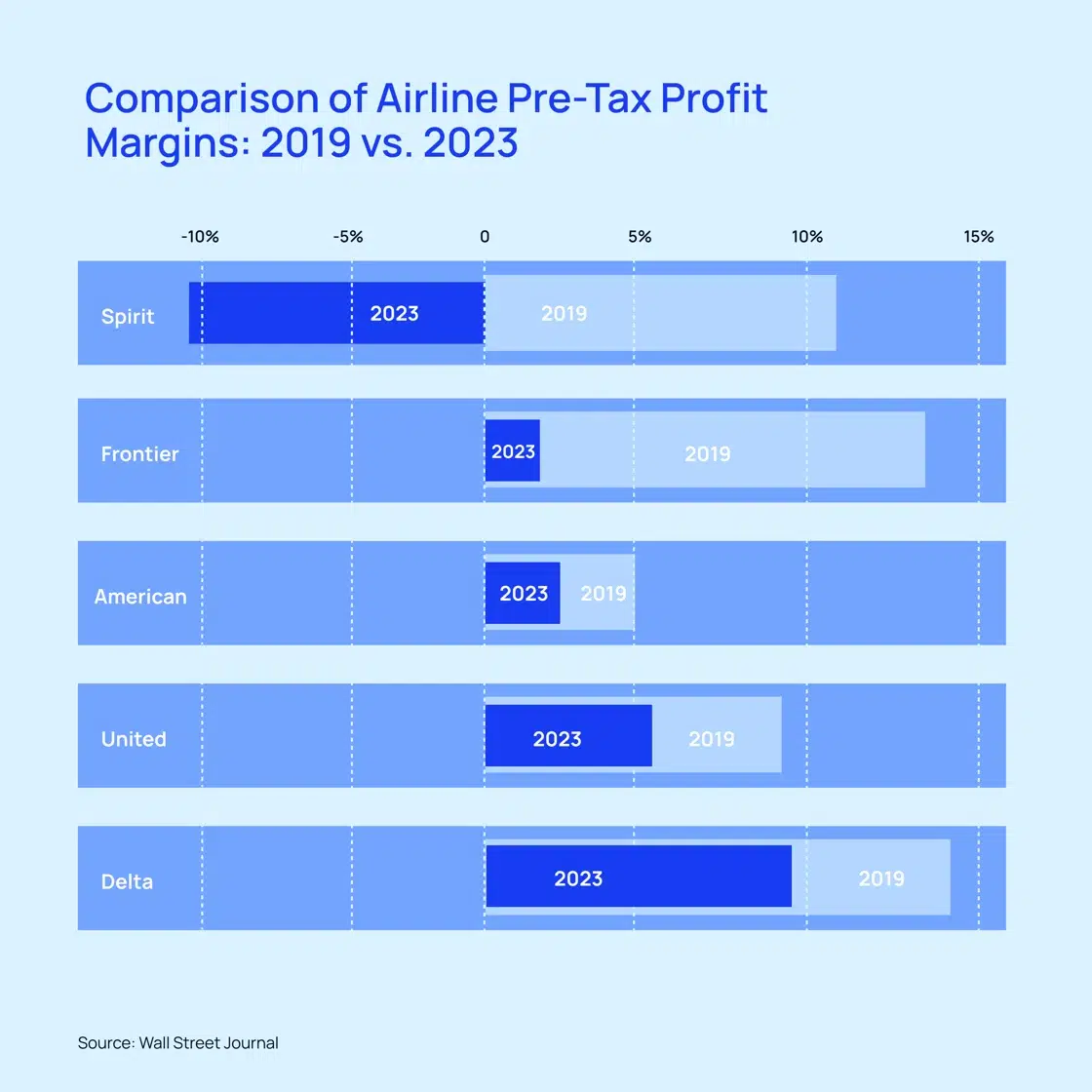

Employees are back on the proverbial road again, driving business travel closer to pre-pandemic levels despite the availability of remote work tools. With large corporations luring (at times compelling) remote employees back to the office, staffers are also starting to emerge from the era of Zoom-centric meetings and conferences. The Wall Street Journal reports boosts in airline travel, hotels, and ancillary services approaching or matching pre-pandemic travel numbers. Employees are back on the proverbial road again, driving business travel closer to pre-pandemic levels despite the availability of remote work tools. With large corporations luring (at times compelling) remote employees back to the office, staffers are also starting to emerge from the era of Zoom-centric meetings and conferences. The Wall Street Journal reports boosts in airline travel, hotels, and ancillary services approaching or matching pre-pandemic travel numbers.

A hot sports summer is coming to Europe

The Olympic and Paralympic Summer Games are headed to Paris, and the European Football Championships will soon arrive at sites across Germany and the UK. There’s plenty for sports fans to get pumped about — and they are.

A flurry of global sporting events is fueling travel excitement for 2024. Recent search data show a 30 percent increase in interest for categories like outdoor amenities, family-friendly accommodations, or close-by access to sports stadiums and other venues. French cities including Lilli, Versailles, and Lyo,n are getting an extra boost thanks to their proximity to the Summer Games. In Germany, cities like Dortmund, Munich, and Stuttgart capture the attention of fans looking to catch some football in one of 10 host locations throughout the country. Another highlight in the travel buzz for sports fans: Airbnb reports a spike in fun “Play” category lodging that makes the destination just as exciting as the sports matches.

How to invest in the travel (and hospitality) sector

Technology keeps the world moving, whether on land, in the air, or at sea. Innovative companies are building the travel platforms and experiences of tomorrow, catering to eager tourists and on-the-move business travelers getting back on the road after the pandemic. Here are two companies making travel more social and more streamlined:

- Jurny: This hospitality platform uses AI to bring data insights and innovation to the $4B travel industry. The platform offers hospitality partners like Airbnb, Vrbo, Expedia, and thousands of independent property investors AI-enhanced property management solutions on a global scale. The company already has a booked ARR of $2.2M, serving over 3,000 units. The leadership team, including CEO Luca Zambello and board members John Waller and Erik Rannala, has attracted investment from top VCs, including Mucker Capital, Okapi VC, Singularity Capital, SaaS Ventures, and more than 1,000 individual investments.

- Floqsta: Social media is one of the biggest sources of influence for adventurous travelers looking to experience new sights and cities. Floqsta connects adventurers with like-minded fellow travelers through AI insights. The platform helps a 200M-strong market of young travelers to find travel companions for their next destination, addressing the problem of trip cancellation for millions of solo travelers who are eager to connect with groups of kindred spirits for the journey. CEO and Co-founder Dasha Kuksenko, Co-founder and Head of Technology Michael Huynh, and Chief Data Scientist/Head of AI Alan Walker lead the startup backed by investors such as former Travelocity CEO/President Hugh W. Jones and former CEO of IndiGo Airlines Aditya Ghosh.

On Our Radar This Week

Global deals and global tensions top the stories captivating news-watchers and investors:

- The Israel-Gaza War: The world continues to wait for news concerning theGaza hostage and cease-fire negotiations, hoping for a resolution to seven months of turmoil that has claimed more than 30,000 lives and displaced hundreds of thousands. Heightened tensions persist throughout the region despite some indications of progress. Analysts and the global investor community continue to monitor for potential swings in domestic and international markets.

- Musk’s EV deal with China: Tesla CEO Elon Musk made fast work of negotiations to bring autonomous driving to China, completing a round of meetings in just 24 hours that secured launch agreements with the Chinese government. The deal represents a significant step forward in bringing advanced driver assistance, called Full Self-Driving (FSD), to the region.

- After meetings with top officials in Beijing, China’s government has tentatively given FSD a green light in Tesla’s second-biggest market. Chinese technology company Baidu will form the foundation of Tesla’s mapping and navigation for the region. Musk is eager to promote the controversial software feature globally as the company faces lower sales growth this year. News of the deal boosted Tesla stock 10 percent earlier in the week.

Macro Bites

- Wall Street Has Spent Billions Buying Homes. A Crackdown Is Looming. The house-warming might be over for corporate investors and hedge funds snapping up single family homes to rent. Lawmakers are considering legislation to prevent the practice and compel institutional buyers to divest hundreds of thousands of properties.

- Oil Falls on U.S. Inflation Concerns: Oil trading slid lower this week after inflation data points toward a longer-than-expected stall in proposed Fed interest rate cuts.

- Ukraine Aid Lifts Defense Industry as Debate Over Profits Reignites: With Congress finalizing aid for the war in Ukraine after contentious negotiations, the defense industry now stands to reap the benefits of restocking the U.S. weaponry and defense supplies.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.