Beyond the Arches #24: The cloud of potential recession still hangs overhead, but these silver linings are popular with investors

Featured Story

The stock market soars, but inflation worries still loom

News outlets are telling a tale of two economies this week, as stock markets set new records while consumer concerns and trends tell a more measured story.

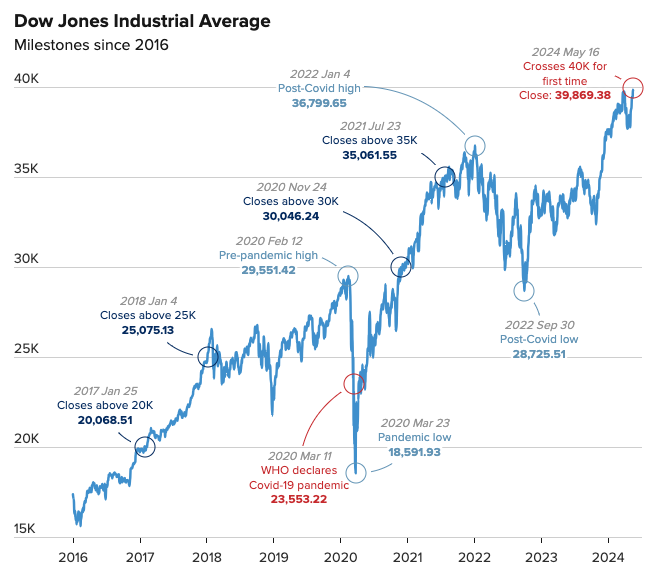

The Dow Jones Industrial Average closed above 40,000 for the first time in its nearly 140-year history last Friday. Stocks floated on renewed hopes that the Fed will follow through on promised rate cuts and free up interest rates. There’s other evidence to support the coming ease, including new reports from the Bureau of Labor Statistics. Other indexes showed similar optimism, with the S&P 500 gaining 0.1 percent. The Nasdaq Composite closed lower by the same.

Yet, despite market buoyancy, other indicators paint a more measured picture of future economic prospects. Wealthy consumers are becoming more careful about how and where they spend their money. Champagne, for example, is in declining demand. Burberry experienced a 40 percent drop in profits worldwide, with sales in the Americas declining 12 percent year over year.

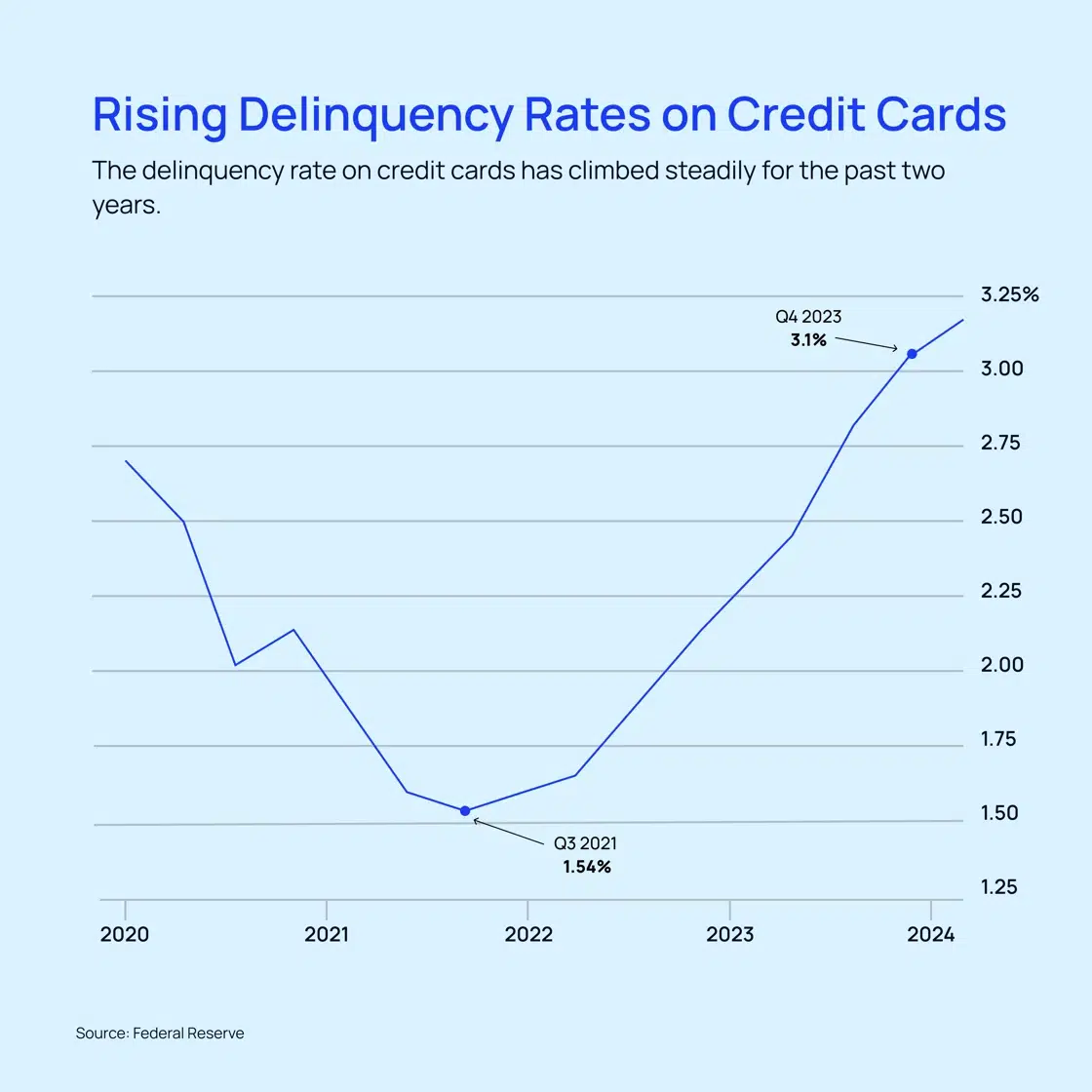

Consumers may be spending, but they’re only paying with cash – and more frequently, not repaying on time. Delinquencies on cards and loans are up. At the same time, some studies point to a significant drop in consumer sentiment, sometimes as high as 13 percent.

In another sign of the times, Target is cutting prices on over 5,000 products, hoping to attract customers whose checkbooks and patience are weary of inflation. Shoppers have endured price increases of 20–30 percent over the last three years.

Where to invest in recession-resistant sectors

Even in volatile times, there are places to look for perennial bright spots in the investment landscape. Traditionally recession-resistant sectors like healthcare, automotive, home services, and others thrive even during a downturn.

Here are three such startups to consider from investment categories to weather the economic tides:

- Incredible Tiny Homes: As housing prices remain high and competition for supply stays tight, aspiring homeowners are looking for alternatives that offer ownership without the burden of a huge mortgage. Incredible Tiny Homes offers high-quality, bespoke homes on a small scale, ensuring style and accessibility for all homeowners. The startup has developed more than 230 community lots and sold thousands of homes in varying models and styles throughout Tennessee, with plans to expand beyond. CEO Randy Jones has attracted capital from hundreds of investors eager to participate in this emerging sector of real estate investing.

- Pirouette: The healthcare sector is a strong and resilient investment as startups continue to push medical technology forward. Pirouette is making it easier to deliver life-saving medicine in a safe and straightforward system. Their Y Combinator-backed auto-injector systems hold 21 patents and over $327K in SBIR grants from the National Institutes of Health (NIH) and the National Institute on Drug Abuse (NIDA). The leadership team features healthcare and engineering experts from MIT and Harvard, including CEO Conor R. Cullinane, Ph.D., CTO Elijah Kapas, and COO Matthew Kane.

- Service My Car: Regardless of the economy, everyone relies on their cars to get them where they need to be. Service My Car makes it easier to take care of your transportation needs with a collect, service, and return maintenance system that takes the time-consuming aspects of repairs off your hands. CEO Ozair Puda, Head of Finance Kashyap Barnawal, and Head of IT Sashit Shrestha lead the Middle East’s first and largest digital car servicing network.

On Our Radar This Week

- On Sunday, fog and poor conditions downed a helicopter carrying Iranian President Ebrahim Raisi and seven other passengers, killing all passengers, shocking the region, and raising concerns about potential political dissent within the country. President Raisi, a supporter and potential successor of Supreme Leader Ayatollah Ali Khamenei, perished in the crash near the Azerbaijan border. The Ayatollah named Vice President Mohammad Mokhber interim President and declared five days of national mourning in the wake of the crash.

- Red Lobster, once a household name and early player in the casual dining sector, filed for bankruptcy after years of turbulent finances and lackluster performance. The affordable restaurant chain boasted 578 restaurants across the U.S. and Canada, bringing in over $2B USD annually in sales. Darden Restaurants sold off Red Lobster to a private equity firm in 2014, and since 2020, the company has largely come under the management of its largest individual stakeholder, Thai Union. Mismanagement, poor reinvestment, and bad marketing decisions stifled Red Lobster’s performance.

- Another 1990s retail icon saw its fortunes fluctuate wildly this week. GameStop, a once and current target of activist investors on Reddit, experienced a 20 percent dip from its previous week’s performance. Investor Keith Gill reignited interest in the meme stock three years ago, causing wild fluctuations in the company’s value. Some analysts say that the game store, facing increasing competition from cloud-based and digital game purchases, could close its doors in as little as five years.

Macro Bites

- Ryanair CEO Expects Softer Pricing Over Summer. Lower ticket prices may be a relief to inflation-weary consumers but also signal a retreat from earlier spending trends in reaction to recession fears.

- Cannabis Rescheduling: When Will It Happen? Expert Lays Out Timeline, Risks And Wild Cards. The drug’s move to Schedule III designation could relax banking laws and alter the Federal approach to law enforcement around its possession and use.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.