Beyond the Arches #27: Voters across the EU and beyond take to the polls. Their top kitchen table issues present investment opportunities across sectors.

Featured Story

After Mexico’s groundbreaking presidential election last week, news watchers may be feeling a bit of whiplash in anticipation of voting results across France, 26 other European Union (EU) countries, and even as far east as India. Despite the election of Mexico’s first female president, Claudia Sheinbaum, the move toward progressive politics seems less likely in France, Germany, and the rest of the EU.

France’s EU Parliamentary elections left the country’s analysts in shock, with exit polls showing that the far-right National Rally (NR) party secured over 30 percent of the vote. The creep of nationalism in France has edged forward in recent years, driven by populist NR party leader Marine Le Pen. The far-right’s foothold into the parliament promoted French president, Emmanuel Macron to announce the dissolution of Parliament and upcoming snap elections mere weeks before Paris hosts the 2024 Olympic Summer Games. The elections, to be held in two rounds on June 30th and July 7th, could help Macron regain the majority – if the popular vote rejects far-right ideology at the ballot box.

The wider EU elections, including those in Germany, saw more centrist sentiment dominate the polls. The center-right European People’s Party showed a strong performance, finishing first and adding seats to the European Parliament. Despite this success, the far-right Alternative for Germany (AfD) soared to second place in polls, although with a considerable lag behind the front-runner.

In a twist beyond Europe’s borders, India’s Hindu-nationalist leader Narendra Modi secured a fifth term. However, the grip of his larger Bharatiya Janata Party (BJP) on power loosened, securing only 240 seats in the country’s 550-seat parliament – after bragging that it would win 400 seats. Despite Modi’s win, the loss means he will need to establish a coalition to achieve any meaningful change in the world’s largest democratic nation. BJP’s losses in parliament curtail its (and Modi’s) ability to deepen their shared vision to change India’s democratic process.

How to invest in “kitchen table” issue startups

When people head to the polls, they have various motivations for how they choose to vote. While social progress is often a motivating factor, voters typically select candidates who offer the most benefit to their personal fortunes and social standing.

These “kitchen table” issues, such as jobs, manufacturing, and resource access, can sway elections away from analyst expectations.

Here are a few companies driving innovation on such fundamental issues:

- Project Buffalo: The motivation for a planned acquisition of an American steel manufacturer by investor Novastone Capital Advisors is to maintain the steel production plant as an American business. The Midwest-based partner for U.S. mining, iron, and steel manufacturing sites is seeking crowdfunded investment in a well-known commodity. The private equity-leveraged buyout transaction, led by Adam Salmen and Novastone, is a rare opportunity for retail investors to participate in a PE deal.

- Athyna: Jobs reports have fluctuated over the past months, with U.S. numbers in May outpacing expectations before falling slightly in later months. Athyna uses AI to drive better recruitment efforts to shorten the talent acquisition cycle and help search for qualified talent far beyond an organization’s own backyard. By leveraging the power of AI and algorithmic matching, the Athyna platform matches qualified talent with specified search parameters. Founder and CEO Bill Kerr is a multiple startup entrepreneur leading other team members, including Head of Product Santiago Nisnik and Head of Growth Simone Kier, to transform the world of recruitment with advanced technology.

- Kara Water: Access to clean water is a fundamental challenge and a concern for millions of people across the globe. Pollution, arid conditions, drought, and changing climate all increase the need for innovation in delivering clean water wherever it is needed. The Kara Water system uses desiccant air-to-water technology along with UV-C sterilization to deliver safe, healthy water that’s low in bacteria and contaminants. One unit is capable of producing up to 2.5 gallons of 9.2+ pH water per day.

On Our Radar This Week

- Israeli Prime Minister Benjamin Netanyahu faces more political headwinds as key members of his party pull away from supporting the war effort in Gaza. Although Netanyahu’s party still retains a slim 64-seat majority in the 120-seat Parliament, the exit of the National Unity party (and its leader, Benny Gantz) makes it more likely the Prime Minister will rely on far-right and ultra-Orthodox partners to secure his position. As the war enters its eighth month, international sentiment toward Israel’s measures and the loss of Palestinian lives further erode Netanyahu’s credibility and control. In the latest example, the Israeli Defense Force secured four hostages from a compound in Gaza – but in the process killed more than 200 people and injured hundreds more.

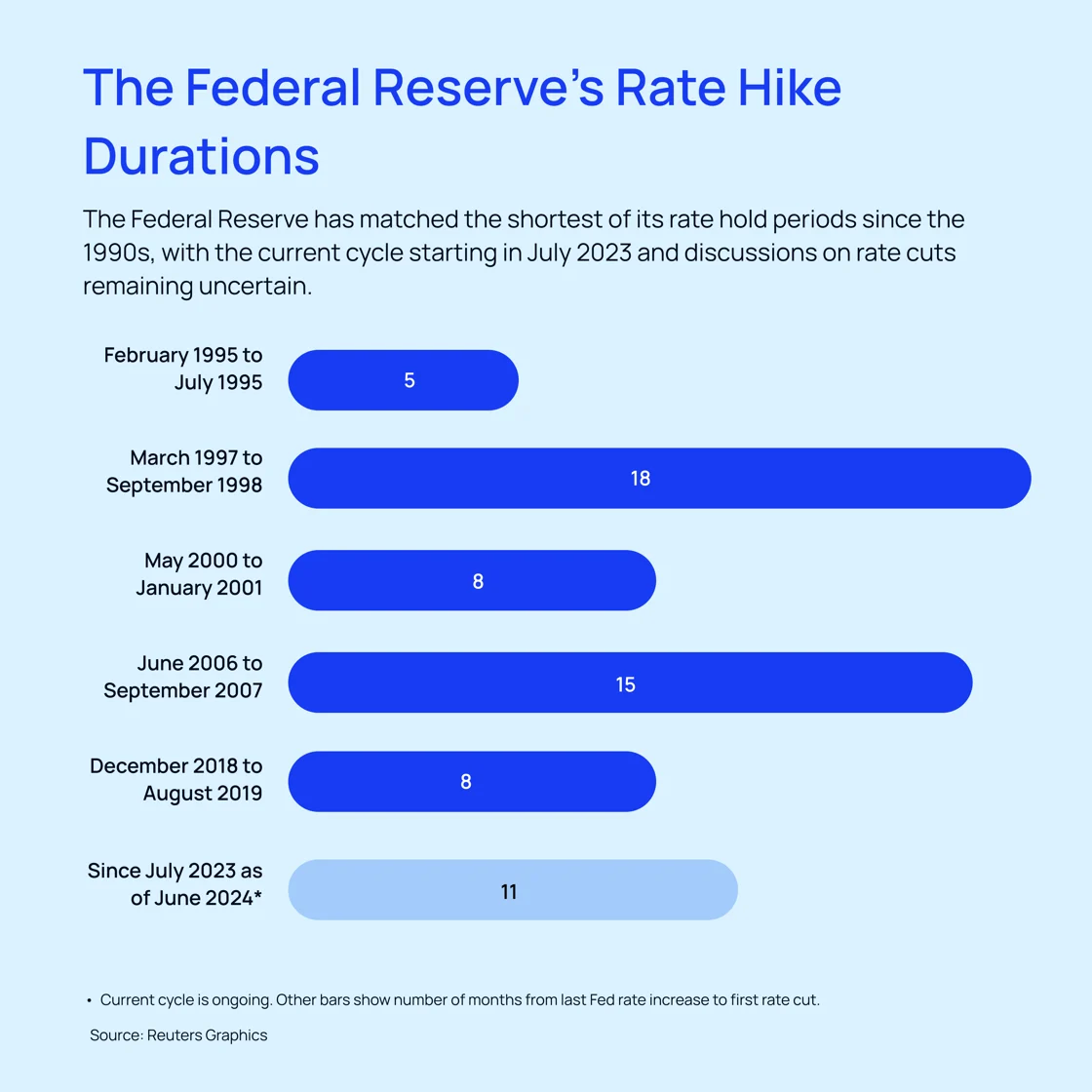

- The Fed’s new economic projections wobble on reports of higher inflation and slowing growth. The latest report from Federal Reserve officials points to fewer interest rate cuts than earlier, more enthusiastic projections suggested. Current expectations are that the Fed will maintain the benchmark interest rate somewhere around the 5.25–5.5 percent mark, the same level since last July. Stalling inflationary indicators make officials reluctant to cut rates unless they see downtrends in inflation, leaving consumers in a state of suspense at a time when interest rates are pushing many out of the housing and automobile markets.

- The Fed decision may also jostle the stock market, according to commentary from JPMorgan Chase and Citigroup analysts. In addition, Consumer Price Index data coming out the same day as the Fed interest decision could add more volatility to the stock outlook in the short term. Some analysts believe the double header of economic metrics could create the largest single-day stock market move since March 2023.

Macro Bites

- Boeing’s first Starliner astronaut mission extended through June 18. The manned visit to the International Space Station was extended to allow a crew spacewalk on June 13th and give engineers time to complete Starliner system checkouts.

- WWDC 2024 debuts AI plans, iOS 18, and more. Promised AI features and other potential surprises await consumers and investors at the yearly Worldwide Developers Conference.

- Activist hedge fund Elliott Management takes $1.9B stake in Southwest Airlines. The takeover by Elliott comes with a push to oust Southwest’s CEO and board chair.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.