Diversifying Your Portfolio in 2025: How Franchise Investing Can Hedge Against Market Volatility and Recession Fears

In recent weeks, investors have faced a whirlwind of market volatility. U.S. and global stock markets have been rocked by renewed trade tensions and tariff shocks, reviving memories of Trump-era trade wars. Amid this turbulence, many are looking beyond the traditional stock-and-bond portfolio for stability. In this newsletter, we’ll examine the current market climate and then explore how alternative investments – especially franchise businesses – can help diversify and hedge against uncertainty. We’ll also discuss BlackRock CEO Larry Fink’s call to rethink the classic 60/40 portfolio and how franchise opportunities fit into that vision. Finally, we invite you to an exclusive webinar on leveraging franchise investments as part of your strategy.

Market Turbulence in Early 2025

In early April 2025, global markets experienced significant volatility due to President Donald Trump’s announcement of comprehensive tariffs aimed at reducing the U.S. trade deficit and revitalizing domestic manufacturing. On April 2, dubbed “Liberation Day,” the administration imposed a 10% baseline tariff on all imports, with additional country-specific tariffs targeting nations with which the U.S. had substantial trade deficits.

However, by April 9, facing both domestic and international pushback, the administration decided to pause the implementation of these higher tariffs for 90 days, excluding China. This pause was intended to allow for negotiations and mitigate potential economic disruptions . Despite this temporary halt, the tariffs already in place continued to influence market dynamics, contributing to investor uncertainty and market fluctuations.

As a result, U.S. markets remained on edge, with major indices experiencing fluctuations as investors navigated the complexities of the evolving trade policies. This environment underscored the challenges in achieving economic stability amidst shifting trade strategies and heightened geopolitical tensions.

Rethinking the 60/40 Portfolio – Enter Alternatives

In times of extreme market volatility, the old playbook of 60% stocks and 40% bonds is being questioned. Even Larry Fink, CEO of BlackRock, has suggested it’s time to “forget 60/40.” In his 2025 annual letter, Fink proposes a new allocation: 50% stocks, 30% bonds, and 20% in private assets. This 50/30/20 model would devote a full 20% to alternatives like real estate, infrastructure, and other private markets – investments outside the public stock and bond exchanges The rationale is that these private assets can offer uncorrelated returns, inflation protection, and steadier income, providing better diversification and potentially higher returns in the long run. “Diversification has been called the ‘only free lunch’,” Fink wrote, harkening back to the origins of modern portfolio theory and urging investors to broaden their scope.

Of course, shifting 20% of a portfolio into illiquid assets is not without challenges. Experts caution that private investments often come with liquidity risks and higher fees, and typically require a long-term commitment. It’s also true that this approach isn’t one-size-fits-all – not every investor can tolerate having a fifth of their assets locked up in ventures that can’t be sold at the click of a button. That said, large institutions like endowments and pension funds began increasing allocations to private markets years ago, recognizing the potential benefits. Now, high-net-worth individuals are following suit, especially in an era when public markets are whipsawing daily.

So where could that 20% go? Real estate and infrastructure are two pillars Fink highlights, but another compelling avenue is investing in franchise businesses. Franchise ownership falls into the category of “private equity” in a sense – it’s an ownership stake in a real, cash-flowing business rather than a publicly traded security. For an investor seeking diversification, franchises can offer the twin appeals of tangible asset investment and potential steady income streams, often with lower correlation to stock market movements. In fact, franchise opportunities can combine some advantages of real estate (as many involve property or leases) with the operational cash flow of a business – making them a unique hybrid in an alternative asset allocation. Let’s explore how franchises have performed historically, particularly in rough economic waters.

Franchise Investments – A Resilient Hedge Against Volatility

Franchises have a track record of resilience during recessions. The franchise business model, by its nature, often focuses on essential products and services – the kinds of things people continue to spend on even when budgets tighten. Looking back at past downturns provides striking evidence. During the Great Recession of 2007–09, when U.S. GDP contracted sharply, many franchise sectors not only survived but thrived:

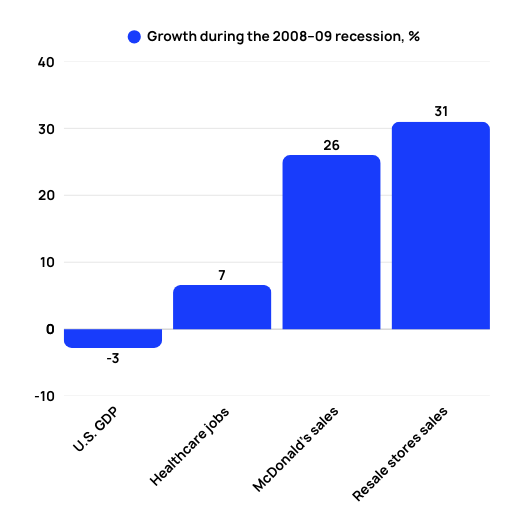

Chart: Several franchise-related sectors showed growth during the 2008–09 recession even as the overall economy contracted.

Why do franchises often weather recessions so well? A big reason is the nature of their industries. Many franchises are in businesses that people turn to more during downturns. For instance, budget dining like quick-service restaurants tends to pick up as consumers trade down from pricey restaurants to affordable comfort food. In 2008–09, McDonald’s famously saw sales growth accelerate while many sit-down restaurants struggled – it even opened 600 new stores in 2008 and kept up same-store sales growth into 2009. Fast-food franchises proved their “recession-resistant business model” by posting double-digit profit growth when the economy was at its worst. Similarly, resale retail franchises (think thrift or consignment stores) thrive when consumers seek bargains. During the 2008 downturn, 65% of U.S. resale shops reported higher sales – averaging ~31% gains – as thrifty shoppers flocked to secondhand goods. That’s a remarkable surge that outpaced even many “good times” retail growth rates.

Then there are the franchises that provide essential services, which are needed in any economy. These include sectors like auto repair, home maintenance, healthcare, and senior care. If your water heater breaks or the car needs new brakes, you’ll get it fixed whether or not the GDP is growing. As one industry expert put it, certain home services (plumbing, HVAC, etc.) are things “people will always need, no matter what the state of the economy”. Auto maintenance is another steady performer – in downturns, people hold onto their cars longer and spend more on repairs, benefiting auto-service franchises. Senior home care is perhaps the quintessential recession-resistant franchise sector: the demand is driven by demographic inevitabilities (aging baby boomers), not discretionary spending. Notably, even in the depth of the 2008 recession, the overall healthcare industry kept adding jobs (up 6.6% in 2008), reflecting how needed services like elder care continued unabated. It’s no surprise that health and senior care businesses are consistently ranked among the “top recession-resistant franchises.” In fact, more senior care brands began franchising immediately after the 2008 recession, responding to the rising demand and relative stability of that industry.

Beyond their inherent recession resistance, franchises also benefit from a unique dynamic in tough times: a surge of new entrepreneurs. Economic downturns often cause layoffs or early retirements for corporate workers – many of whom then consider buying a franchise as a path to control their destiny. Historically, franchising has “done very well under most economic conditions”, and in a slump, “lack of employment opportunities or fear of job loss drives many people to explore franchise ownership,” explains Franchise Business Review CEO Eric Stites. In other words, when jobs are scarce, owning a franchise becomes an attractive option, which can actually boost the franchise sector’s growth coming out of a recession. For example, following the 2008–09 recession, franchise businesses saw a strong decade of growth. And even during the recent pandemic downturn, essential franchises found ways to adapt and often came back strong once lockdowns eased.

Today in 2025, we’re seeing this continued confidence in franchising. The number of franchise establishments in the U.S. is projected to grow by over 15,000 units in 2024, reaching a record 830,000+ locations. New franchise concepts are emerging in everything from home services to budget-friendly fitness, and established franchise brands are still expanding. This growth underscores an important point for investors: franchises can serve as a valuable diversification tool, providing cash flow and defensive characteristics when public markets are shaky. They allow you to tap into consumer demand that never truly goes away – or that even shifts in your favor – during economic downturns.

Embracing Diversification – Your Opportunity

In light of the volatile stock market and the insights above, now is an opportune time to consider alternative investments like franchises as part of your portfolio mix. This is not about abandoning stocks and bonds, but about complementing them. A franchise investment (or several across different industries) can act as a “third leg” of your portfolio stool – one that doesn’t wobble in tandem with Wall Street. It’s a tangible asset backed by real business activity, often with built-in support systems from the franchisor to help navigate economic ups and downs. Owning franchises can also provide personal involvement and oversight that you just can’t have with an index fund – an appealing prospect if you like to be hands-on or diversify your skills.

Of course, due diligence is key. Not every franchise will flourish in a recession, and not every franchisor is created equal. FranShares helps you to focus on proven, recession-resistant sectors (like those discussed: essential services, budget dining, senior care, etc.) and scrutinize the franchise’s track record during past slowdowns. With careful selection, franchise investments can be a strategic hedge that generates steady income even when your stock portfolio is whipsawing with the headlines.

In summary, the current market turmoil is a wake-up call to broaden your investment horizons. Diversification isn’t just about mixing stocks and bonds – it’s about investing in different kinds of assets, including private businesses, that can thrive when markets falter. As Larry Fink’s 50/30/20 model suggests, allocating a portion of your wealth to alternatives like franchises could enhance your portfolio’s resilience. By doing so, you not only aim to protect your net worth from the next bout of market volatility, but you also position yourself to capitalize on stable growth in cornerstone sectors of the economy.