Investing in the biggest franchises: Yum Brands, RBI, Inspire Brands

Investing in franchise businesses can offer exposure to some of the most recognizable brands in the world. In this article, we introduce three franchise behemoths – Yum! Brands, Restaurant Brands International (RBI), and Inspire Brands – whose portfolios include household names like Pizza Hut, Burger King, Dunkin’, and more. We’ll explore each parent company’s brand lineup, financial scale, typical franchise startup costs, and how they leverage economies of scale across their networks. Finally, we’ll discuss how FranShares provides everyday investors with institutional-quality access to this asset class, without requiring millions in startup capital or any operational experience.

Yum! Brands: A Global Fast-Food Empire

Yum! Brands, Inc. (NYSE: YUM) is one of the world’s largest restaurant companies, with over 61,000 restaurants worldwide as of 2025. Its portfolio spans four major fast-food brands: KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill. These brands collectively generated more than $65 billion in system-wide sales in 2024, underscoring Yum’s immense global reach. In fact, Yum’s scale is so vast that it opens a new KFC, Taco Bell, Pizza Hut or Habit Burger restaurant approximately every two hours – a testament to its aggressive expansion and franchising capacity.

Each Yum subsidiary is a giant in its category. For example, KFC operates nearly 32,000 restaurants in over 150 countries, making it the world’s largest chicken restaurant chain. Pizza Hut counts over 20,000 locations globally, and Taco Bell leads the Mexican-inspired QSR segment with 8,500+ restaurants (primarily in the U.S.). The Habit Burger Grill, a 2020 acquisition, is smaller (roughly 380 units) but gives Yum a foothold in the fast-casual burger space. This diversified portfolio helped Yum achieve $7.55 billion in revenue in 2024, a 6.7% increase from 2023, driven by steady same-store sales growth and rapid international development.

Investing in a Yum Brands franchise requires substantial capital, though exact costs vary by concept and location. Here are typical initial investment ranges for Yum’s major brands:

- KFC: Total initial investment around $1.4 – $2.8 million, including a $45,000 franchise fee. Operators must have a net worth of $1.5 million and $750k in liquid assets.

- Taco Bell: Initial investment roughly $576,000 up to $3.37 million, with a franchise fee between $25,000 and $45,000. Taco Bell often requires $750k liquid capital and $1.5M net worth, similar to KFC.

- Pizza Hut: Estimated startup costs range from about $782,000 to $2.05 million for a new traditional Pizza Hut, with an initial franchise fee of $25,000. Smaller delivery/carry-out formats can be on the lower end of the range.

- The Habit Burger Grill: Habit’s franchising costs range between $1,658,000 and $2,849,000 for a full-sized restaurant (plus a $35k franchise fee). Habit had ~$700 million system sales recently, showing solid unit economics.

Yum! Brands leverages its massive scale to create cost efficiencies and shared innovations across its restaurants. The company’s purchasing power is virtually unmatched – for instance, Yum buys 1.7 billion kilograms of poultry and spends $1.4 billion on dairy products annually. By negotiating global supply contracts, Yum helps franchisees secure food and packaging at prices smaller chains could never attain. Yum also deploys cutting-edge technology system-wide at bargain prices thanks to its scale; the company has over 2,000 in-house digital and tech employees developing unified platforms for online ordering, delivery integration, loyalty programs, and point-of-sale systems.

As CEO David Gibbs noted, “No one can do what we do, gathering committed, capable and capitalized partners across the globe to share a vision”. In short, Yum’s franchisees benefit from an unmatched support infrastructure – from real estate and construction guidance to training through the Yum Center for Franchise Excellence.

Restaurant Brands International (RBI): Burger King, Tim Hortons, Popeyes, and More

Restaurant Brands International (RBI) is a Toronto-based multinational formed in 2014 via the merger of Burger King and Tim Hortons. Today, RBI’s portfolio includes four iconic quick-service brands: Burger King (the world’s second-largest burger chain), Tim Hortons (Canada’s dominant coffee/donut brand), Popeyes Louisiana Kitchen (a fast-growing fried chicken chain), and Firehouse Subs (a U.S.-based sandwich franchise) Together, RBI’s brands encompass about 30,000 restaurants in 100+ countries, making RBI the world’s fifth-largest fast-food operator by unit count (after Subway, McDonald’s, Starbucks, and Yum!). In 2024 RBI generated $8.4 billion in revenues (largely from franchise royalties and property revenues), with system-wide sales far higher given its extensive franchise base.

Each RBI brand is a sizable business in its own right. Burger King leads in scale with roughly 19,000 locations globally, serving flame-grilled burgers in nearly every major market. Tim Hortons has around 5,500 restaurants (mostly in Canada), where it commands ~60% of the coffee market and has steadily expanded abroad in recent years (including into China and the U.S.). Popeyes operates over 4,000 units worldwide, famed for its fried chicken and a viral 2019 chicken sandwich that turbocharged sales. The newest addition, Firehouse Subs, has about 1,200 restaurants and was bought in 2021, bringing a growth-oriented sandwich concept into RBI’s fold.

RBI’s financial performance has been marked by steady same-store sales growth and international expansion. For example, in Q2 2025, RBI saw 2.4% systemwide same-store sales gains driven largely by strong demand in international markets. RBI’s multi-brand portfolio provides diversified cash flows (coffee/breakfast, burgers, chicken, etc.) and the ability to invest in whichever concept has the strongest momentum.

For investors considering an RBI-brand franchise, here are approximate initial investment requirements per brand:

- Burger King: Total investment typically ranges from $316,000 up to $2.66 million for a new restaurant, plus a $50,000 franchise fee. BK franchisees are generally expected to have $500k liquid capital and $1M+ net worth.

- Tim Hortons: Estimated initial investment about $680,000 to $1.9 million, with a franchise fee of $25k–$50k. RBI often requires Tim’s franchisees to possess ~$500k in liquidity.

- Popeyes: Initial investment roughly $500,000 on the low end to around $3.9 million for a freestanding location in a prime market. The franchise fee is $50,000, and like BK, Popeyes prefers owners with $1M+ net worth given the high development costs.

- Firehouse Subs: A smaller footprint brand, Firehouse has a lower startup cost of about $380,000 to $800,000 for a typical unit (inline strip mall location), with a $20,000 franchise fee. Adding a drive-thru or end-cap unit can raise costs to ~$1 million. Financial requirements are more modest (often ~$300k net worth).

RBI was expressly built to capitalize on shared scale across its brands. When Burger King merged with Tim Hortons in 2014, a key goal was to allow Tim Hortons to leverage Burger King’s resources for international growth while achieving “financial efficiencies for both companies”. In practice, RBI has centralized many functions – supply chain, procurement, technology platforms, franchising systems, and administrative services – to serve all four brands. For example, RBI’s chains jointly use a global supply chain management platform to manage suppliers, quality, and food safety across Burger King, Tim’s and Popeyes.

This unified approach improves negotiating power with vendors (lowering food and packaging costs) and streamlines compliance and quality control. Similarly, RBI’s corporate teams in marketing and technology have rolled out initiatives that often span multiple brands – for instance, the company has invested in mobile ordering apps and loyalty programs for each chain, leveraging lessons learned across the portfolio. While each RBI brand maintains a distinct identity and menu, they clearly benefit from the collective scale, market insight, and capital of the parent company. This scale was crucial during challenges like the COVID-19 pandemic, during which RBI’s central tech systems enabled rapid deployment of delivery, drive-thru optimizations, and digital coupons across all brands, helping franchisees weather the storm. In summary, RBI’s “secret sauce” is running a lean holding company that amplifies its brands’ strengths by sharing best practices and back-end resources – a strategy that has made it a dominant franchisor worldwide.

Inspire Brands: A Diversified Franchise Powerhouse

Inspire Brands is a multi-brand restaurant company formed in 2018, and in a few short years it has assembled one of the largest franchise portfolios in the industry. Backed by private equity firm Roark Capital, Inspire owns Arby’s, Buffalo Wild Wings, Sonic Drive-In, Jimmy John’s, Dunkin’, and Baskin-Robbins, among other concepts. This collection spans over 33,000 restaurants across nearly 60 countries and all 50 U.S. states – making Inspire the second-largest restaurant company in the U.S. by locations, behind only Yum! Brands. In 2020, Inspire’s blockbuster $11.3 billion acquisition of Dunkin’ Brands (Dunkin’ and Baskin-Robbins) roughly doubled its system size, pushing its global system-wide sales above $32.6 billion annually. Though privately held (not publicly traded), Inspire has reported robust growth: for example, Arby’s and Sonic have achieved record sales in recent years, and Dunkin’ continues to expand both domestically and abroad under Inspire’s ownership.

Brand portfolios and strengths: Inspire’s portfolio is deliberately diversified across food categories and service formats:

- Arby’s – Fast-food sandwich chain known for roast beef; ~3,500 units. (Arby’s was the foundation of Inspire, and it continues to grow with new menu innovations like brisket and nationwide expansion.)

- Buffalo Wild Wings (BWW) – Casual dining/sports bar with 1,200+ units specializing in wings and beer.

- Sonic Drive-In – Unique drive-in fast-food concept (roller-skating carhops) with ~3,500 locations, strong in America’s South and Midwest.

- Jimmy John’s – Freaky-fast gourmet sandwich shops (~2,800 units) known for delivery; acquired by Inspire in 2019.

- Dunkin’ – One of the world’s largest coffee and baked goods chains, with ~12,900 locations globally (including ~9,400 in the U.S.) at the time Inspire acquired it. Dunkin’ brings a massive morning daypart business to Inspire’s mix.

- Baskin-Robbins – Iconic ice cream parlor brand (often co-branded with Dunkin’), ~7,000 shops worldwide.

Each of these brands is a leader in its niche, and together they give Inspire broad market coverage (from morning coffee to late-night wings). Inspire’s strategy is to “invigorate great brands and supercharge their long-term growth”, often by sharing capabilities across the portfolio. Despite challenges in casual dining, for instance, Buffalo Wild Wings has been revitalized under Inspire with a new prototype store and menu innovation, while Dunkin’ has thrived with new beverage offerings and speedy drive-thru designs from Inspire’s playbook.

Because Inspire encompasses both quick-service and casual dining brands, the franchise investment requirements vary widely. Some examples:

- Dunkin’: A traditional Dunkin’ shop entails about $437,500 to $1.79 million in initial investment, with a $40k–$90k franchise fee. Dunkin’ franchisees need $250k+ net worth and $125k+ liquid capital.

- Buffalo Wild Wings: Being a full-service sports bar, BWW has higher costs – often $2 million or more all-in, including kitchen/bar build-out and large floor space. (Franchisees usually must have $1M+ net worth.)

- Baskin-Robbins: As a primarily dessert shop, Baskin is relatively low cost – roughly $300k to $500k investment for a shop, with a $25k franchise fee – and is often a secondary franchise for multi-unit operators (sometimes co-branded with Dunkin’).

True to its name, Inspire Brands has built an integrated platform of shared services and technology-enabled capabilities that all its concepts can leverage. The company describes itself as “tightly integrated around extensible, tech-enabled platforms, enabling each brand to benefit from the collective scale of the enterprise.” In practice, this means Inspire runs Centers of Excellence in areas like supply chain, R&D, marketing, IT, real estate, and HR that serve every brand in the portfolio. By sharing data and analytics, Inspire can cross-pollinate insights: a successful promotion or operational innovation at one brand can be rolled out to others. For instance, Dunkin’s years of experience with non-traditional locations (airports, universities) are now guiding Inspire’s push to open more Arby’s, Sonic, and BWW units in similar venues.

Likewise, Inspire’s leadership structure was reorganized to emphasize scale and shared expertise, with a central team overseeing brand segments and company-wide growth initiatives. The result is a “franchise ecosystem” where each brand retains its unique identity and franchisee community, but all gain competitive advantages from being part of a larger collective. This strategy has paid off: Inspire’s brands have reported cost savings, faster innovation, and stronger franchisee support than they could achieve alone. For investors, Inspire showcases how private equity can bring operational synergies and growth acceleration to established franchise chains through scale and integration.

Emulating Big-Brand Efficiencies: Triton Pacific & Tasty Restaurant Group

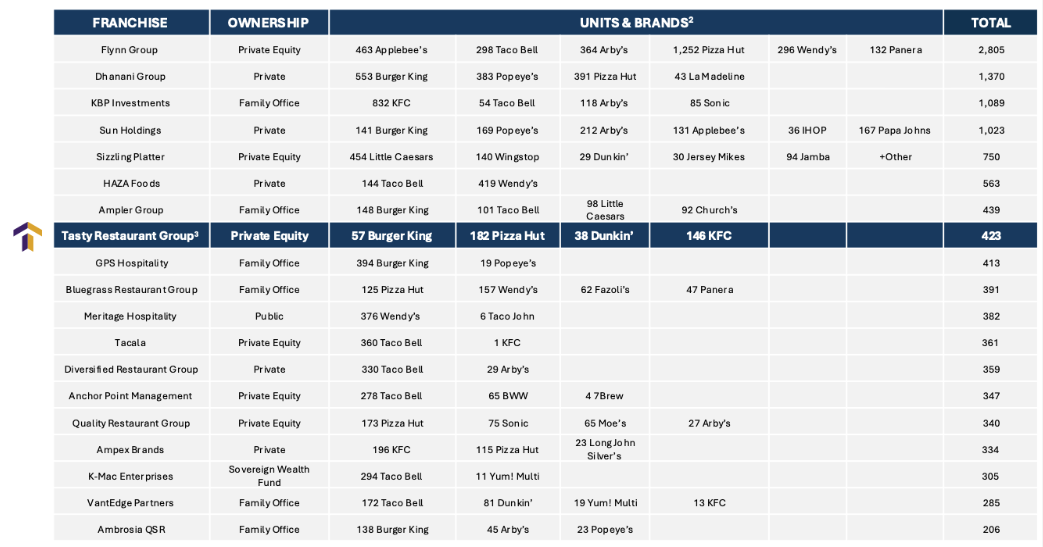

The FranShares–Triton Pacific partnership aims to give investors the benefits of these large-scale franchise efficiencies by teaming up with an experienced operator: Tasty Restaurant Group (TRG). Tasty Restaurant Group is a top 10 multi-brand quick-service operator that oversees franchise restaurant investments on behalf of Triton Pacific’s funds. Headquartered in Dallas, TRG was formed by Triton Pacific in 2016 to be an “industry-leading restaurant management company,” bringing deep expertise in running, scaling, and existing chain restaurants. TRG’s leadership team averages 20+ years in the restaurant industry, and collectively they have managed approximately 50,000 franchise and franchisor locations across 27 brands.

Sources: 1. http://www.bloximages.newyork1.vip.townnews.com, Franchise Times’ Restaurant 200, Aug 2024, Tasty Restaurant Group Q2 2025 | 2. Units and Brands represent companies acquired by Franchisee companies shown on left column, and may not be representative of Tasty Brands II, LP acquisitions. As of June 30, 2025. TRG oversees operations for Pizza Hut, Burger King, Dunkin’ / Baskin-Robbins and KFC / Taco Bell brand locations listed (Dunkin’ and KFC locations are under Tasty Brands II portfolio). 3. Tasty Brands II, LP (“Tasty”) has established Tasty D’Lites, LLC as a portfolio company to operate as a Dunkin’ Brands franchisee – including both Dunkin’ and Baskin-Robbins concepts. The current portfolio represents 38 Dunkin’ & Baskin-Robbins stores. Tasty Brands II, LP (“Tasty”) has established Tasty Chick’n, LLC as a portfolio company to operate as a Chickn’ Brands franchisee – including both KFC’ and Taco Bell concepts. The current portfolio represents 146 KFC/Taco Bell stores. 5. Store count as of 6/30/25, but adjusted to reflect expected closures, divestitures, and development currently in process.

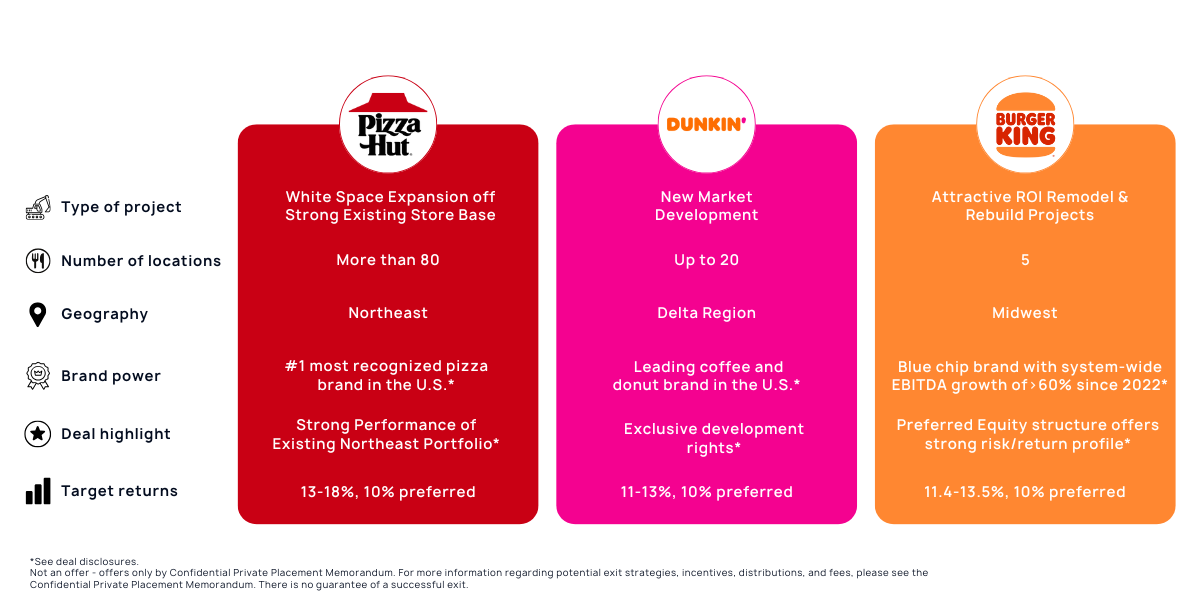

On the financial and strategic side, Triton Pacific Capital Group acts as the sponsor and asset manager bringing this all together for investors. Triton Pacific is a private equity firm with over 20 years of experience and a track record of 30+ private equity transactions, investing ~$500 million of equity into companies (aggregate enterprise value ~$1.3 billion). Notably, Triton Pacific has focused on franchised restaurants through its prior funds: Tasty Brands, LP I and II. These funds invested in portfolios of Burger King, Pizza Hut, Dunkin’, and KFC restaurants, among other assets. In doing so, Triton Pacific has honed a specialized strategy in the QSR space, and built a team that knows how to identify opportunities, perform due diligence, and execute growth plans for franchise businesses. FranShares’ role is to make this institutional-grade investment accessible: the minimum investment is $10,000 – far lower than the millions it would normally take to buy into a large franchise operation outright. Through FranShares’ online platform, investors can subscribe to these offerings, track performance, and receive updates on the portfolio’s progress, benefiting from Triton Pacific’s professional management without having to commit seven-figure sums or run a restaurant themselves.

Triton Pacific and Tasty Restaurant Group are essentially emulating the playbook of Yum, RBI, and Inspire at the franchisee level. By backing locations run by Tasty Restaurant Group, investors’ capital is placed into a scalable franchise platform that has the ability to rapidly acquire or build new units, and operates with a high level of operational efficiency and oversight. Triton Pacific and TRG together bring “institutional quality” portfolio management to this venture – from rigorous site selection and deal flow (leveraging their relationships with franchise brokers, lenders, and franchisors), to installing metrics-driven management systems and value-enhancement programs at the store level.

Unlocking Franchise Investments for Accredited Investors

The world’s largest franchise companies – Yum! Brands, RBI, and Inspire – have shown how scale, diversification, and professional management can drive impressive growth and efficiencies in the restaurant industry. Now, thanks to the FranShares–Triton Pacific partnership, accredited investors have a chance to leverage those same economic dynamics by investing in locations of Pizza Hut, Dunkin’ and Burger King. By investing alongside Triton Pacific and Tasty Restaurant Group, you’re effectively partnering with an experienced franchise operator that mirrors the practices of Yum and Inspire, but with the nimbleness of a targeted private equity strategy. It’s a unique opportunity to diversify your portfolio with franchise locations – with experts handling the day-to-day and a proven playbook aimed at maximizing returns.

Explore More Profitable Franchise Opportunities

If you’re considering expanding your business horizons, read on to learn about the most profitable franchise opportunities in each industry. Whether you’re a budding entrepreneur or a seasoned veteran in the franchise world, our curated selection will guide you toward making an informed decision.