Kidokinetics Franchisor Equity Raise

- Fitness

- Kids

$10,000 Min. Investment

Overview

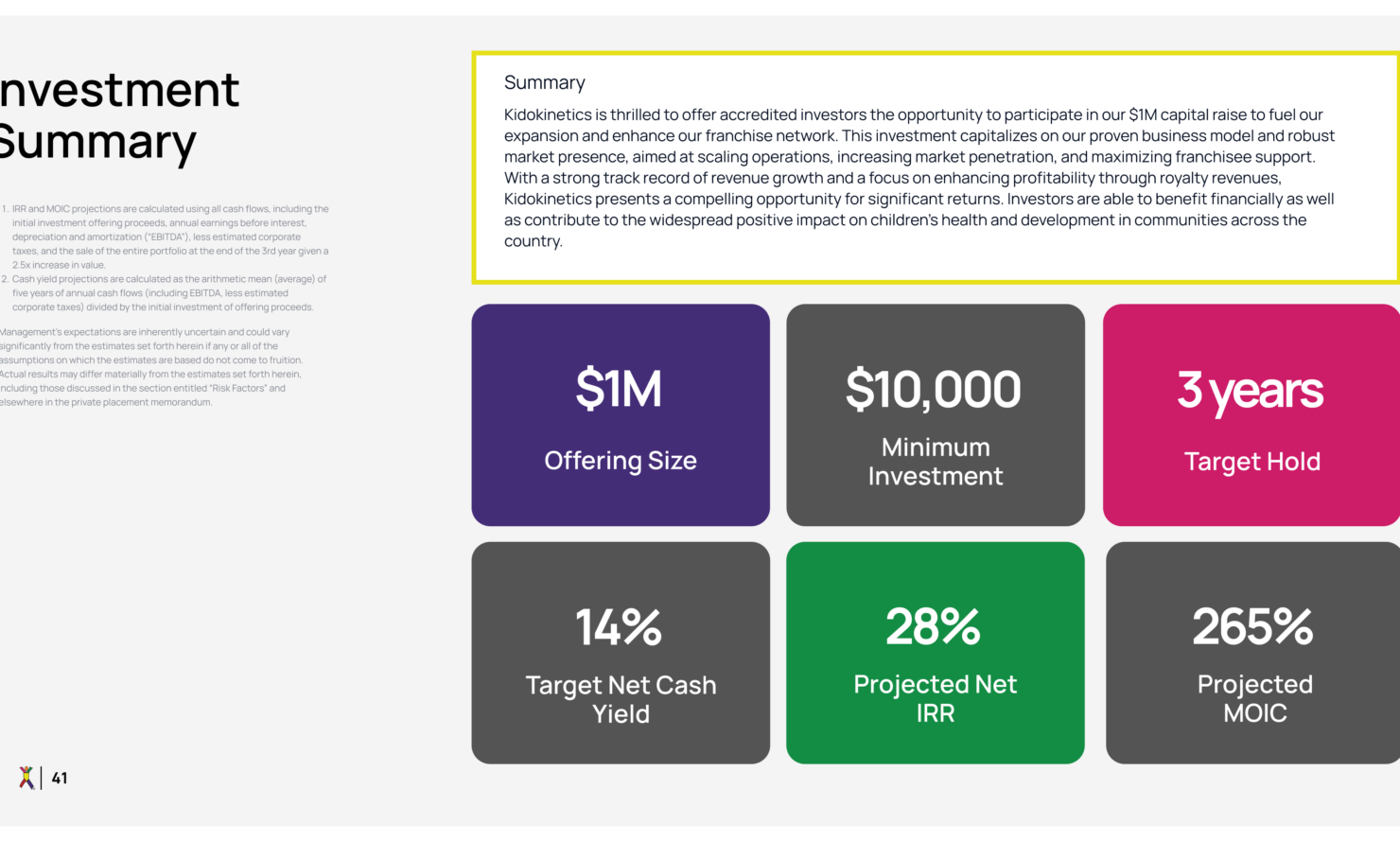

Kidokinetics is thrilled to offer accredited investors the chance to participate in our $1M capital raise, designed to fuel our expansion and enhance our franchise network.

With a strong track record of revenue growth and a strategic focus on boosting profitability through royalty revenue and more efficient franchisee growth, Kidokinetics presents a compelling opportunity for significant returns. Investors in Kidokinetics gain access to a potentially income-generating asset with the potential for equity appreciation, while also contributing to the widespread positive impact on children’s health and development in communities across the country.

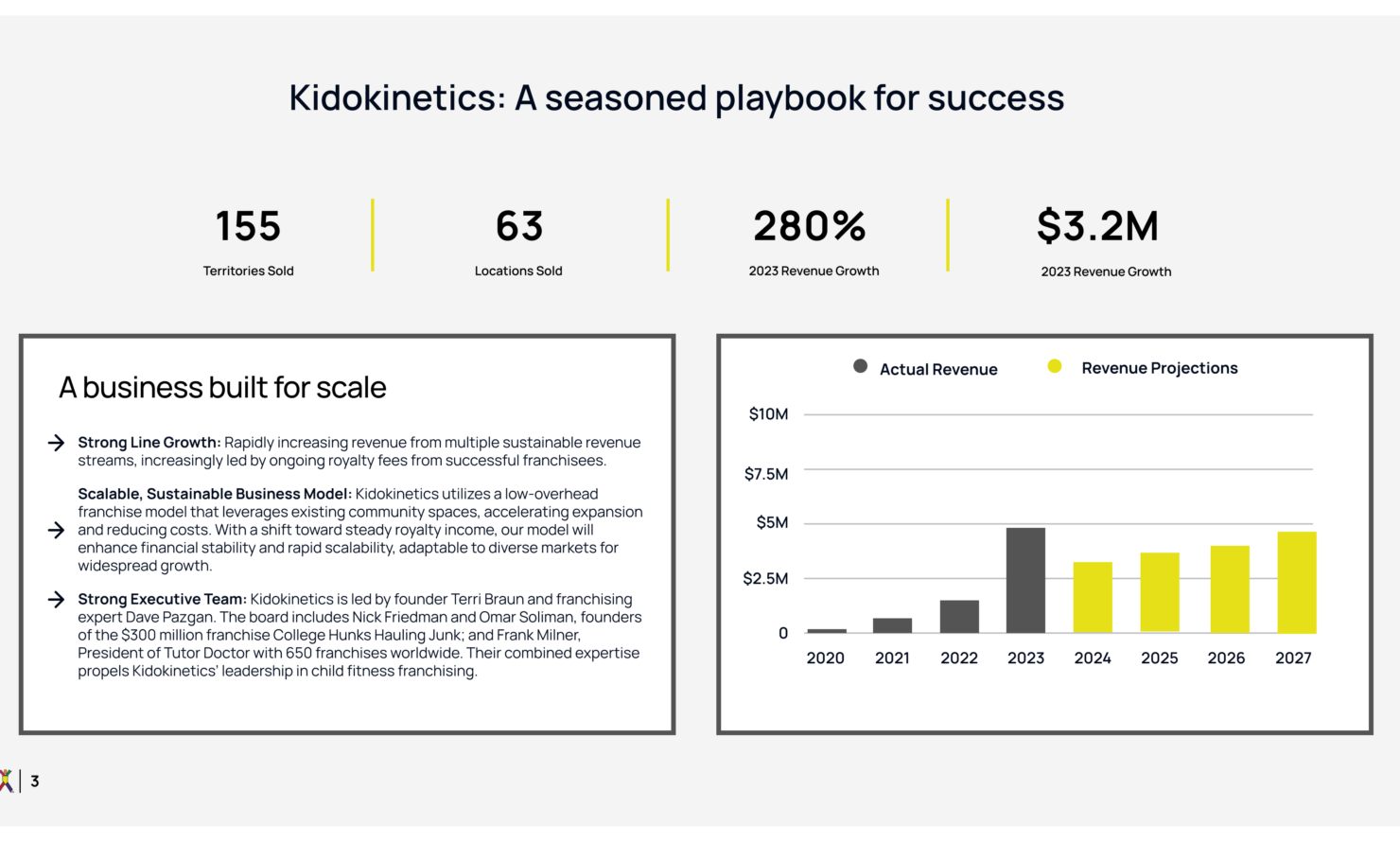

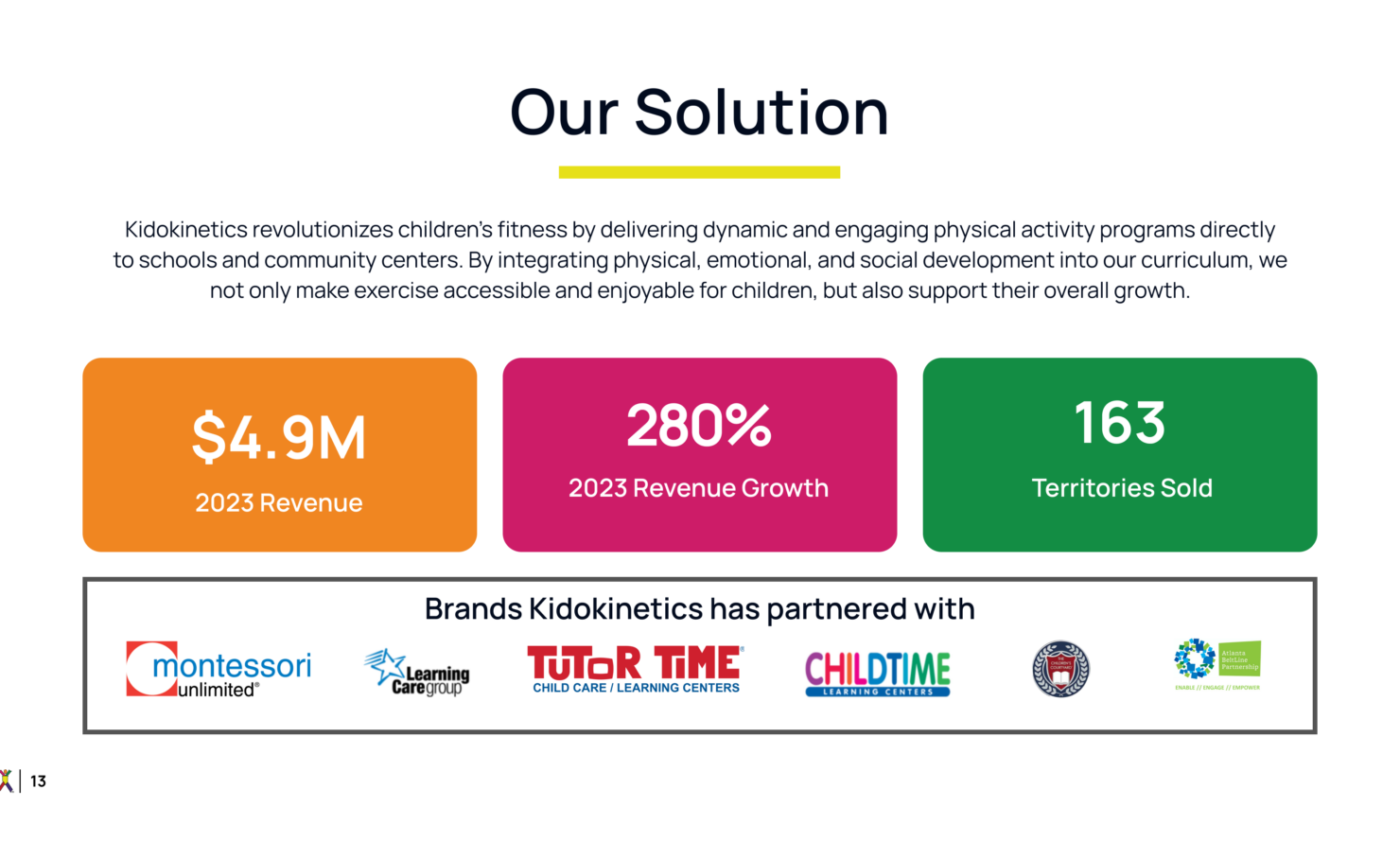

A Business Built for Scale

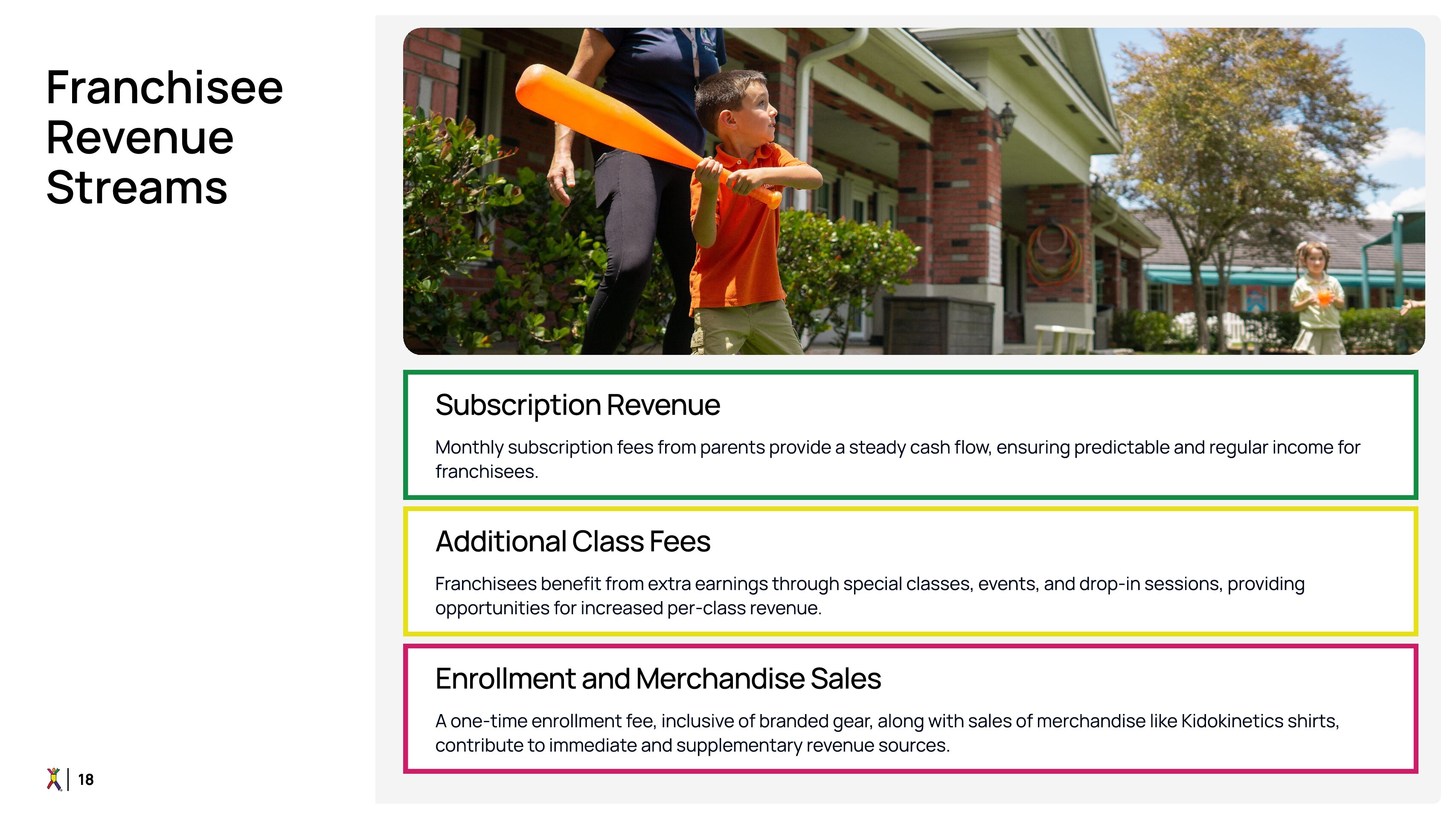

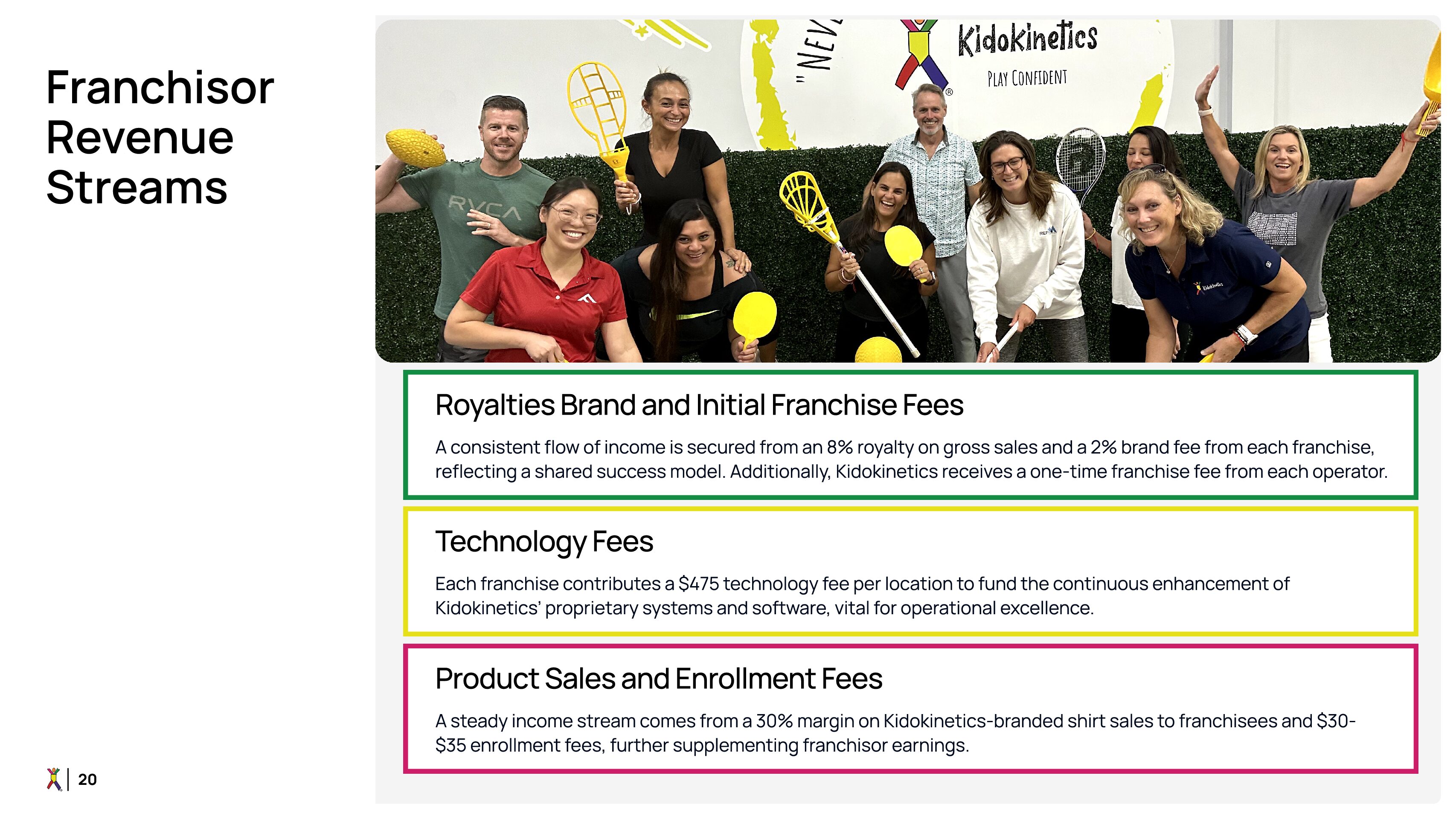

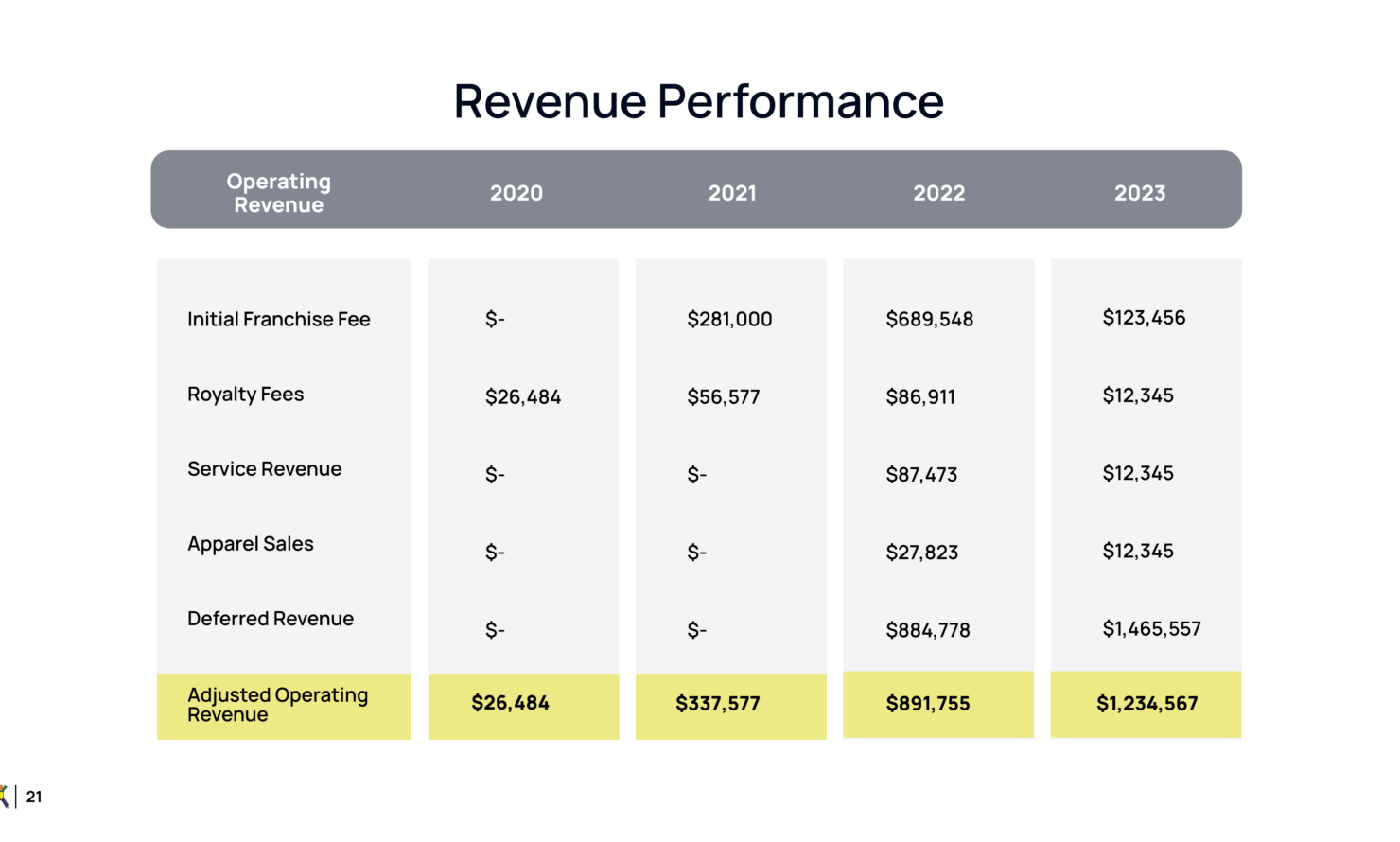

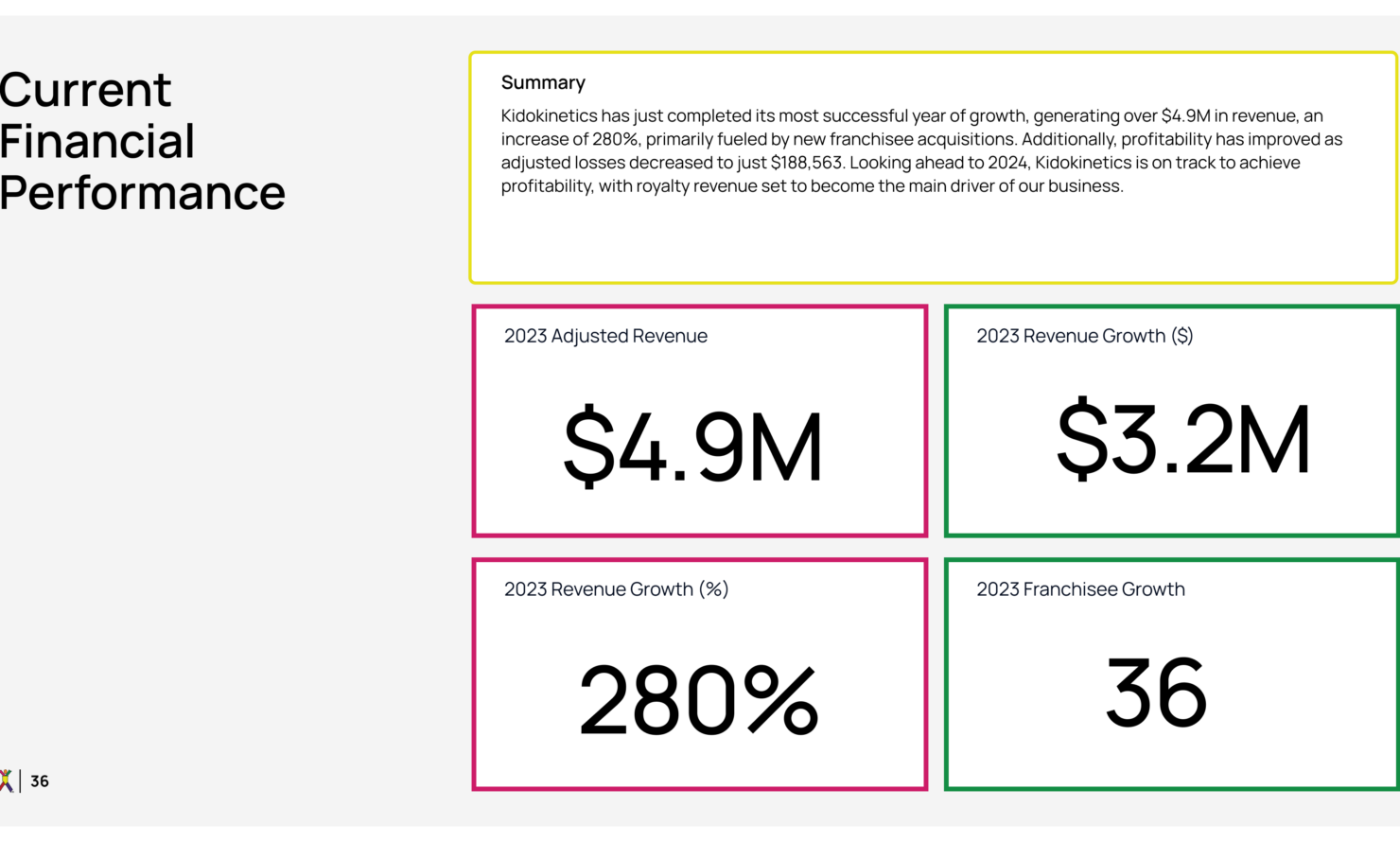

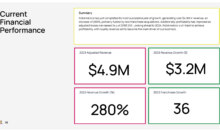

Strong Top Line Growth: Steadily increasing revenue from multiple sustainable revenue streams, increasingly led by ongoing royalty fees from successful franchisees.

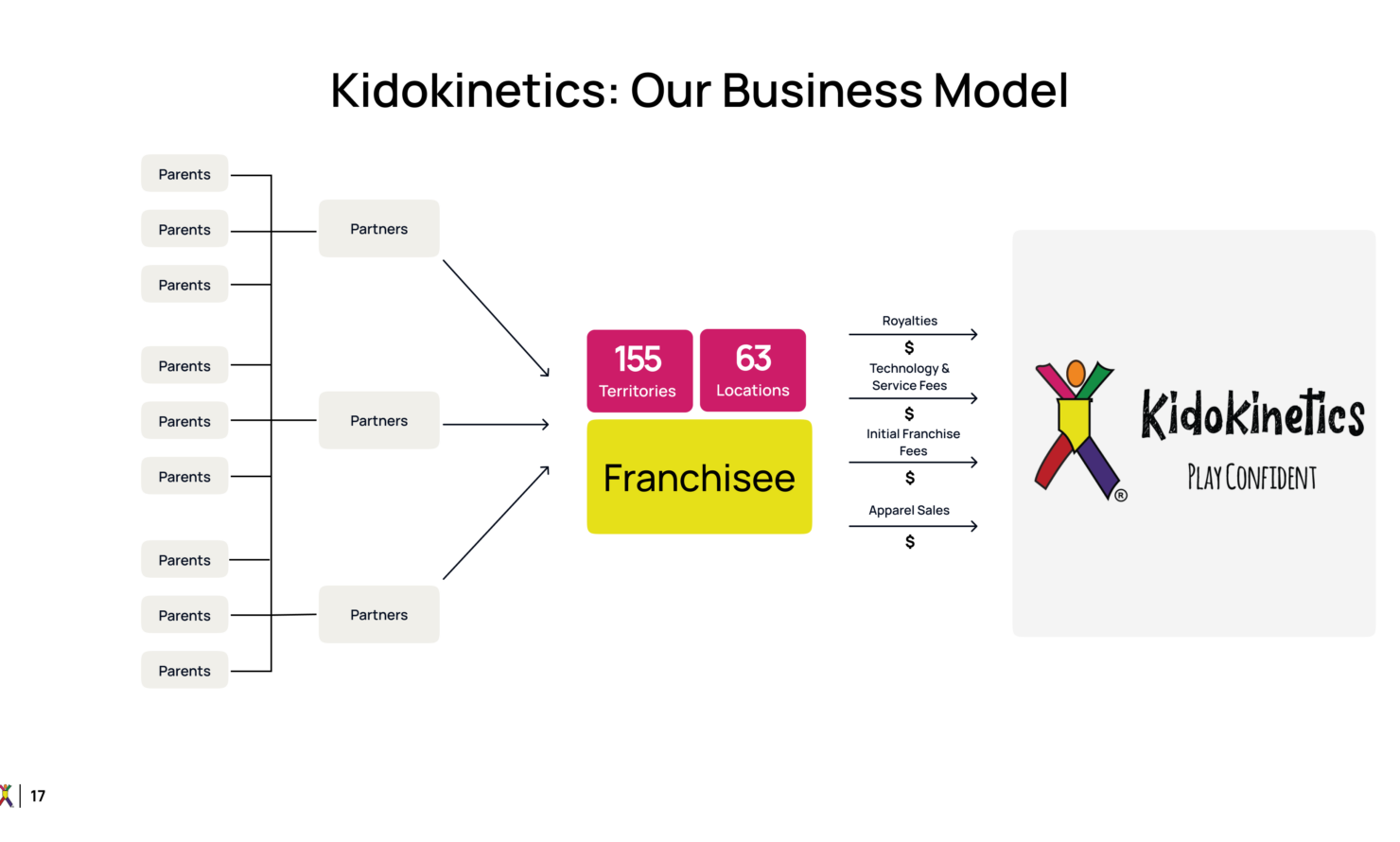

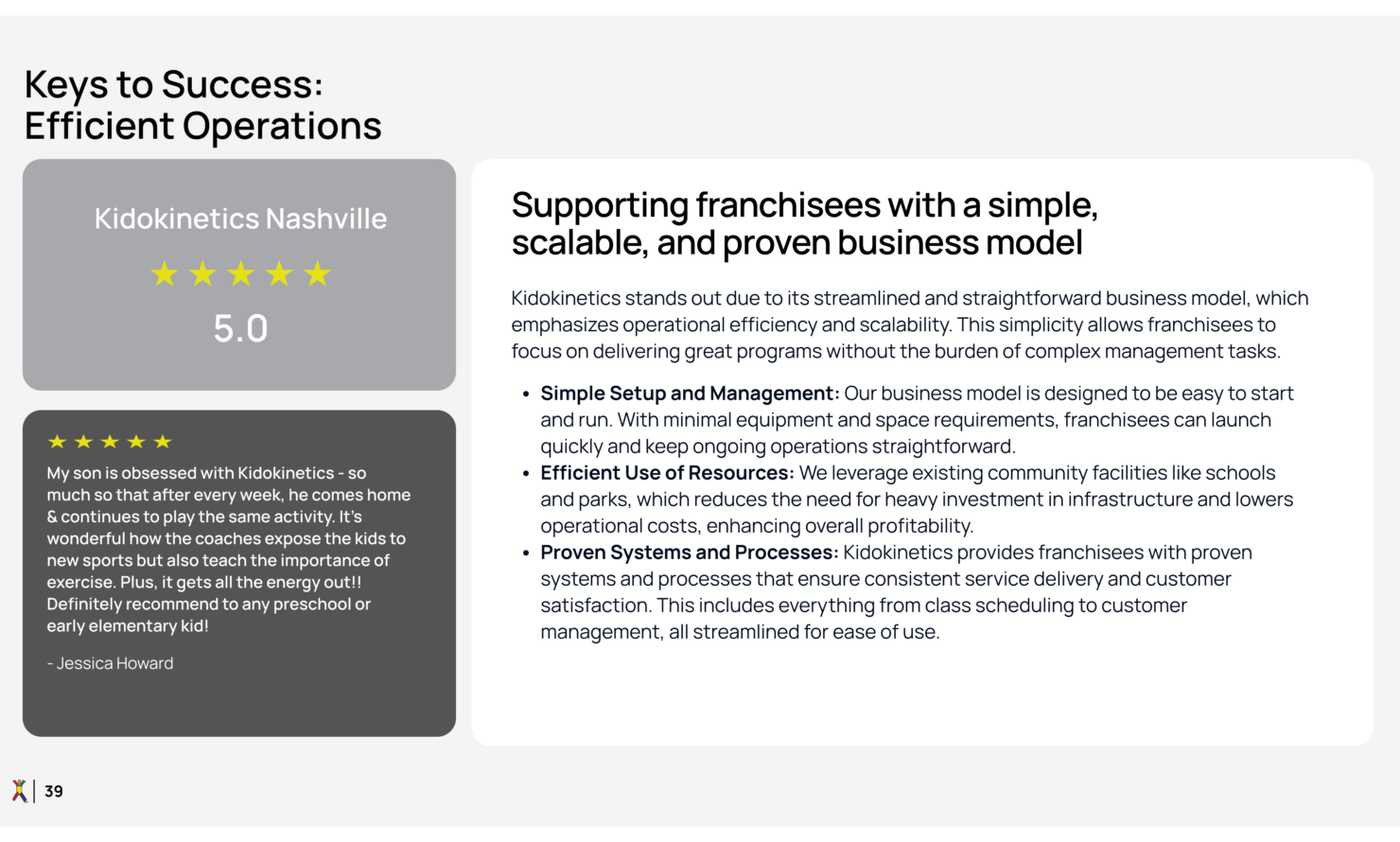

Scalable, Sustainable Business Model: Kidokinetics utilizes a low-overhead franchise model that leverages existing community spaces, accelerating expansion and reducing costs. With a shift toward steady royalty income, our model will enhance financial stability and rapid scalability, adaptable to diverse markets for widespread growth.

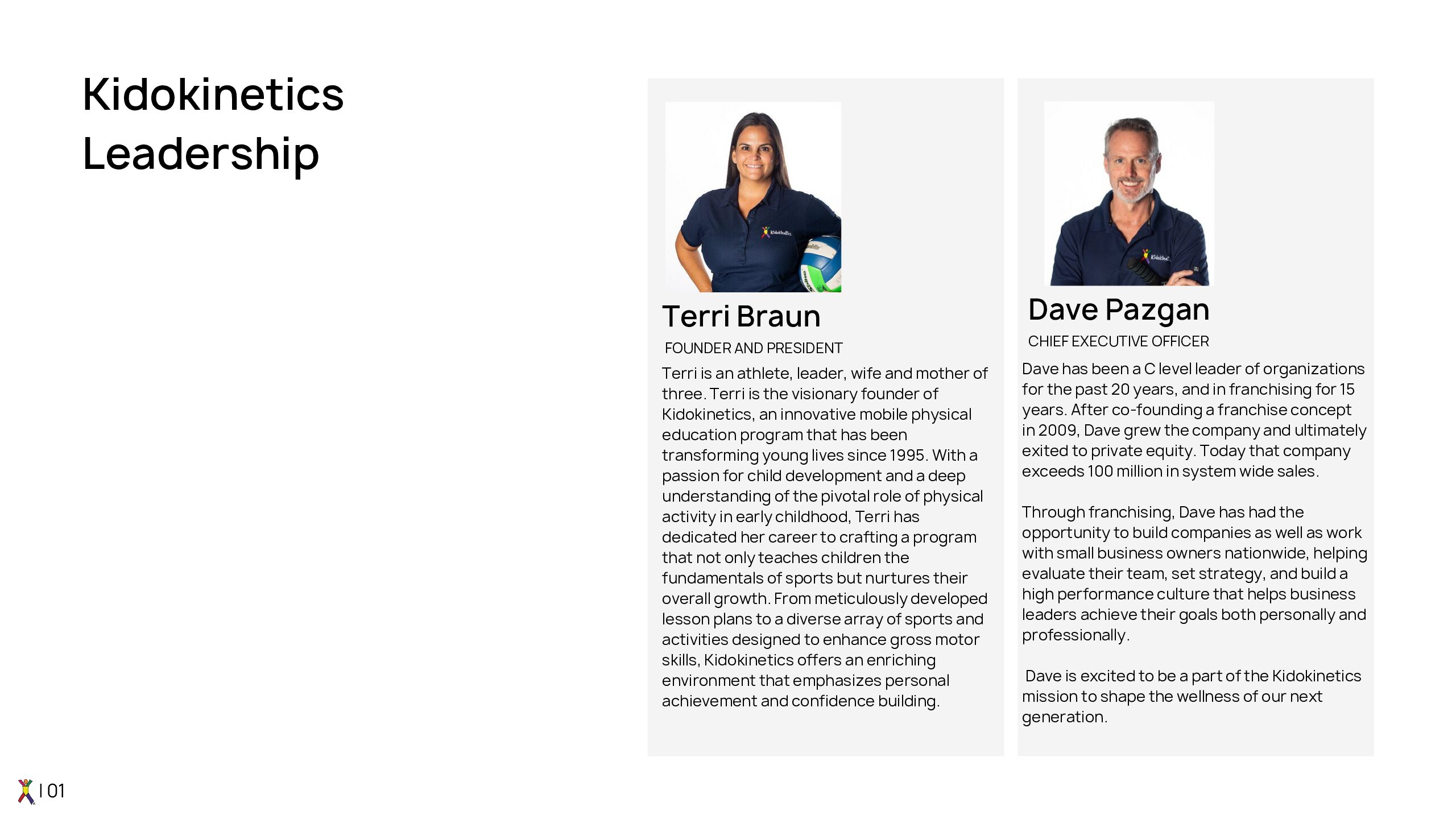

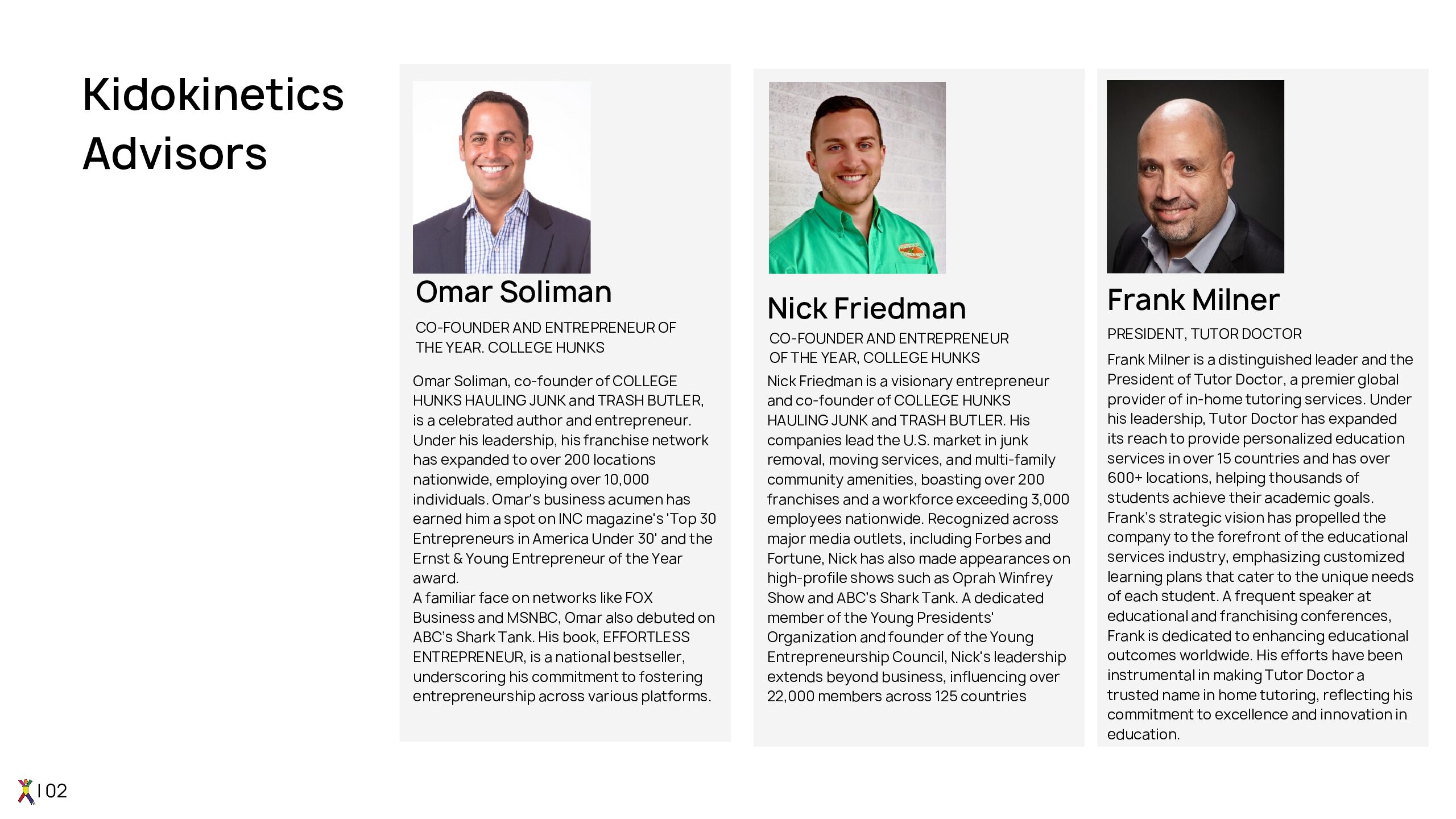

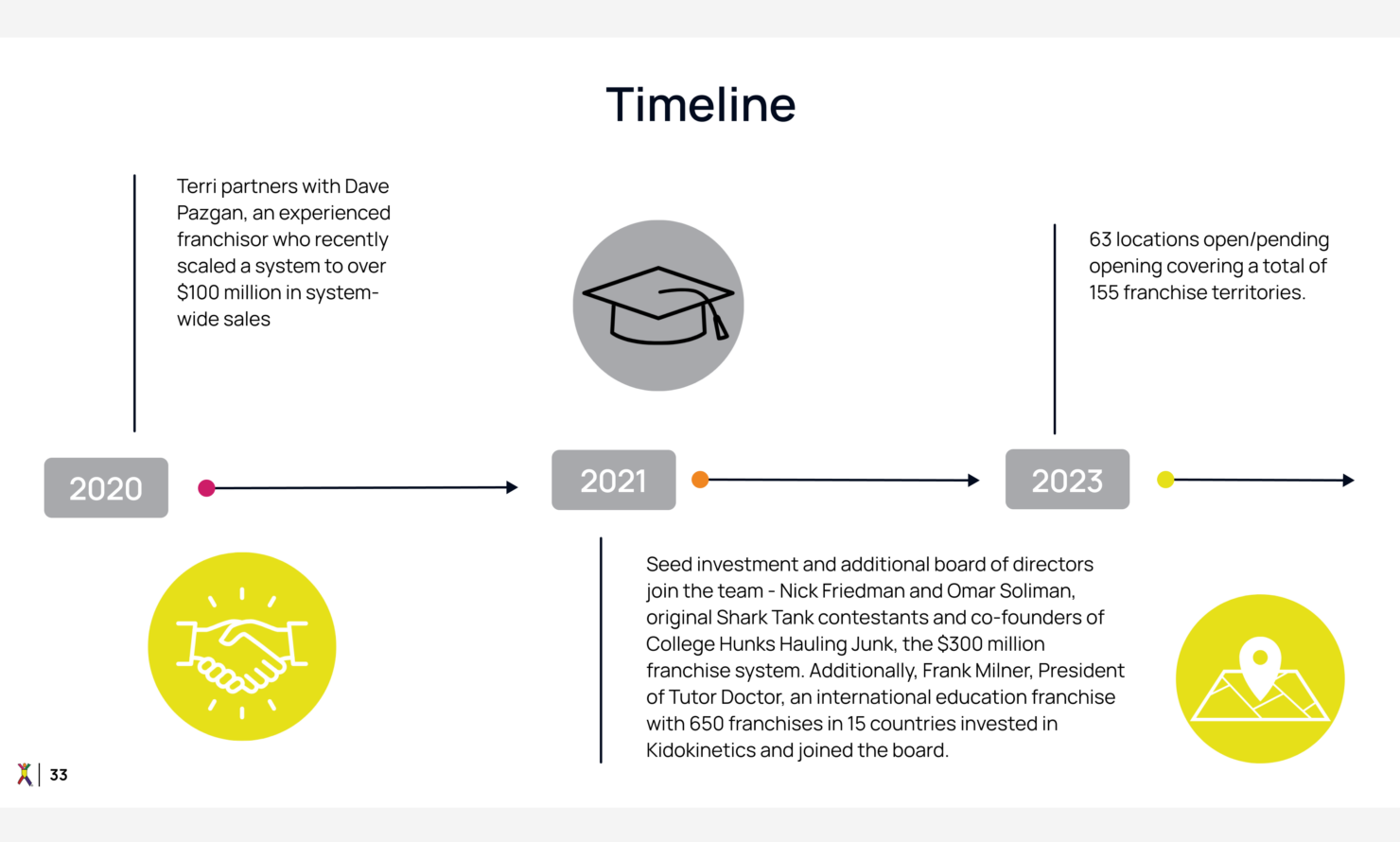

Strong Executive Team: Kidokinetics is led by founder Terri Braun and franchising expert Dave Pazgan. The board includes Nick Friedman and Omar Soliman, founders of the $300 million franchise College Hunks Hauling Junk; and Frank Milner, President of Tutor Doctor with 650 franchises worldwide. Their combined expertise propels Kidokinetics’ leadership in child fitness franchising.

IRA Eligible on AltoIRA

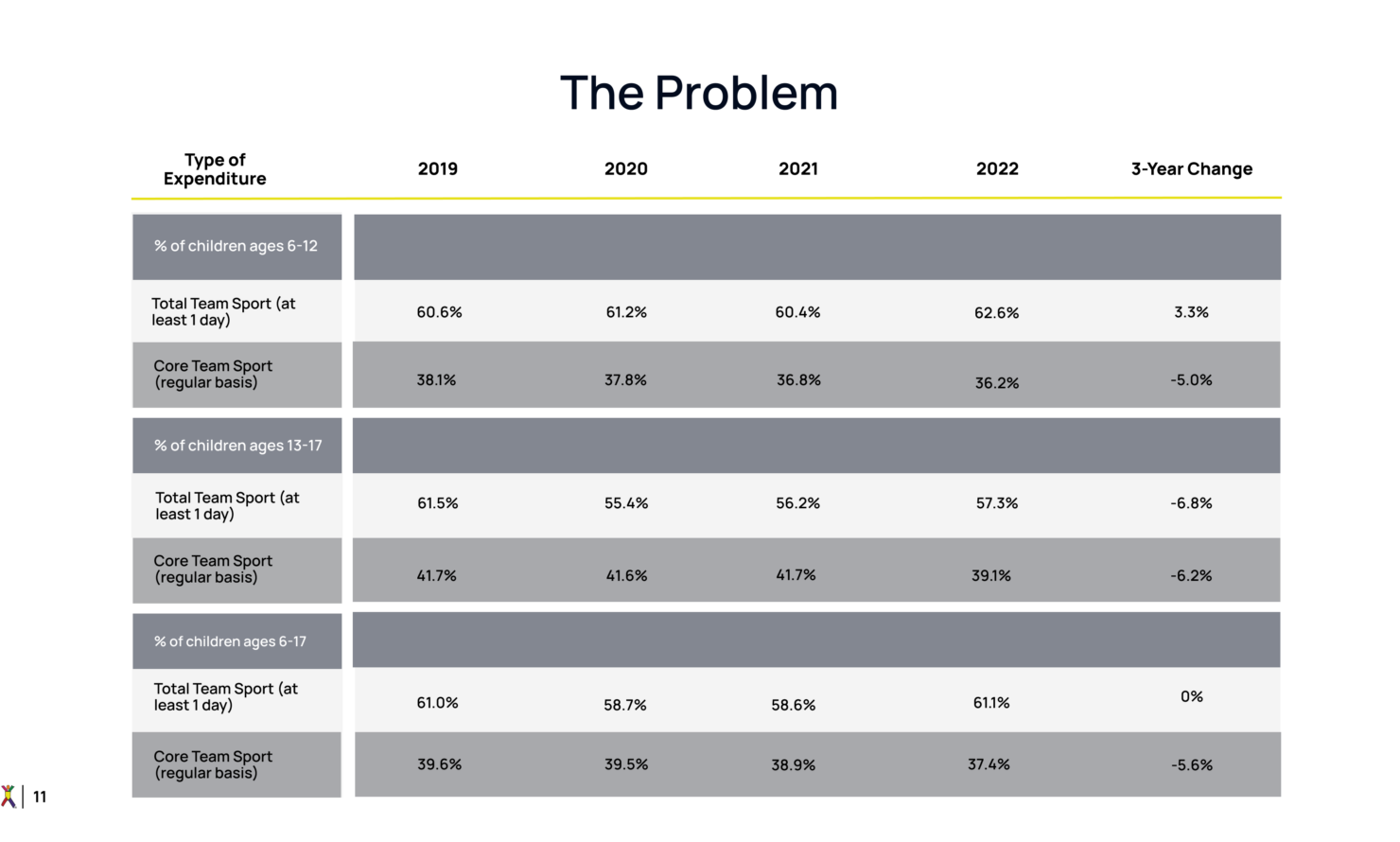

Filling a Gap in the Market

Kidokinetics is revolutionizing physical education by offering privatized, structured sports programs for children, filling the gap left by schools with limited PE resources.

For investors, this means tapping into a growing market of parents (B2C) seeking accessible fitness solutions for their children, as well as schools, daycares, and community centers (B2B) looking to outsource physical education. This dual revenue model enhances scalability and profitability, creating diverse streams of income for investors while addressing an essential need in child development.

Deep Dive

Inside the deal with CEO Dave Pazgan and Founder Terri Braun, including its structure, profitability and expected returns, risks, and other key information.

Documents

Key documents associated with this offering.

Investment Highlights

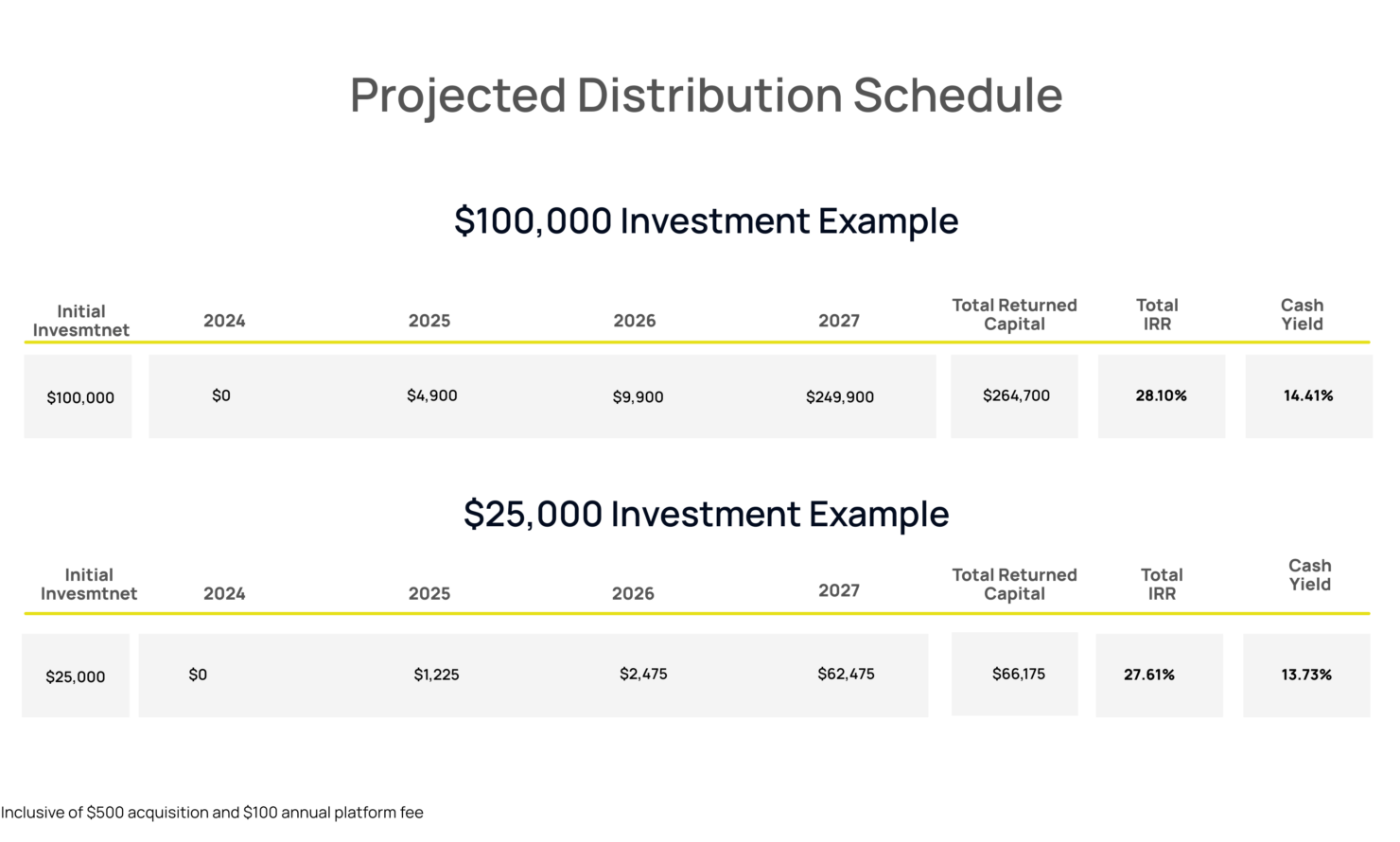

Return on investment

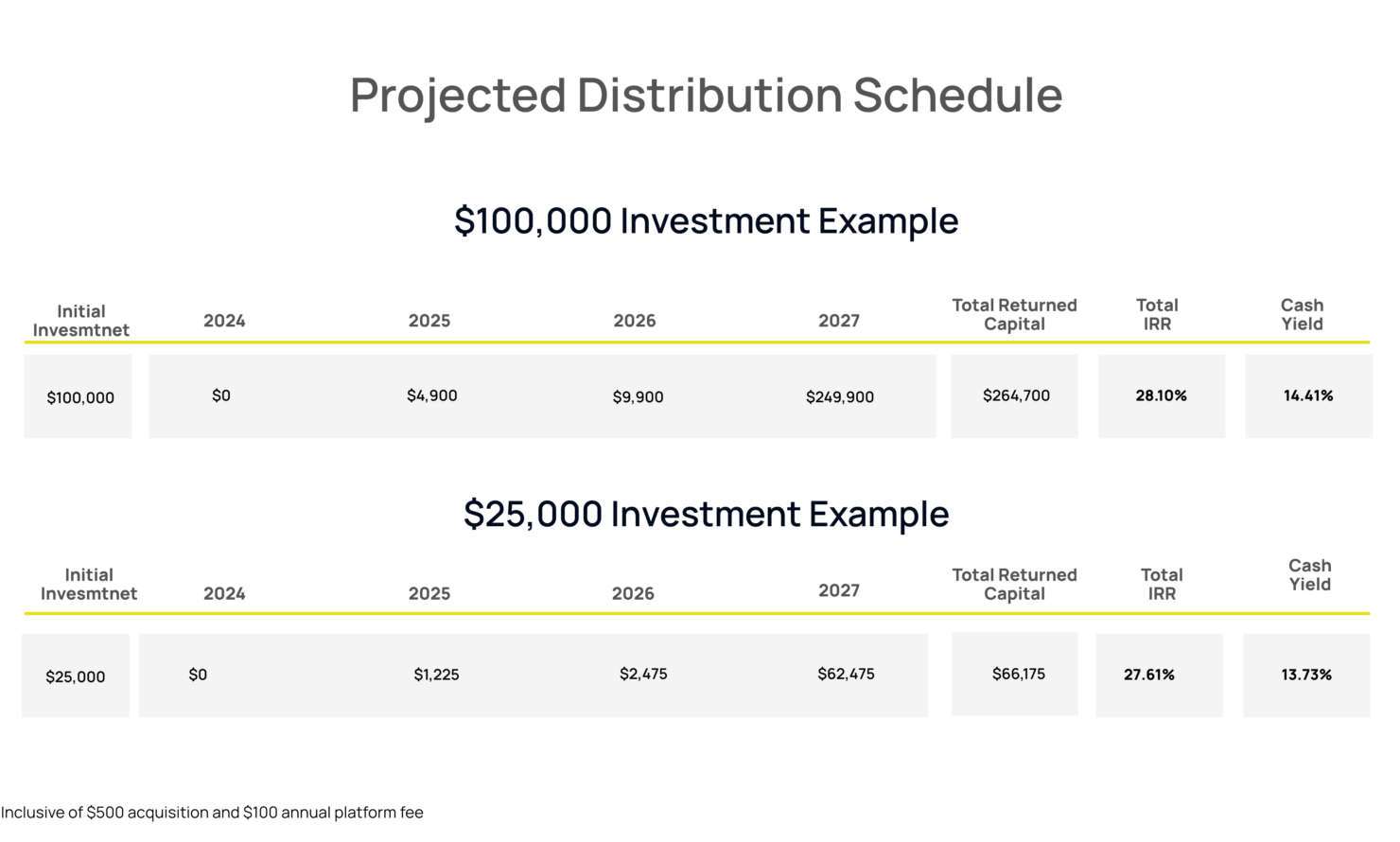

Expected Total Returned Capital: $66,175

Growth

Availability

Leadership

Competition and competitive advantage

Recession and pandemic resistance

This information should be aligned with the key attributes of Kidokinetics to ensure accuracy and consistency.

Steps to Invest through FranShares

- Review the Offering

Start by exploring all the details of the Kidokinetics investment opportunity. Ensure it aligns with your financial objectives by reviewing the projected returns, growth strategy, and business model.

- Register for the Offering

Click the invest now button to sign up for the investment, which is managed through our partner Securitize, a trusted platform specializing in investor onboarding, compliance, and management.

Securitize helps streamline the investment process by handling registration, accreditation, and funding securely and efficiently. You can register as either an individual or an entity.

For assistance during this process, contact: investorsupport@securitize.io.

- Verify Your Identity

Complete the Know Your Customer (KYC) process in your Securitize portal, which includes submitting a government-issued ID and personal information. This is required to comply with regulations and prevent fraud.

- Make a Non-binding Investment Pledge

Indicate the amount you intend to invest. This pledge is non-binding and helps us understand your level of interest without any commitment at this stage.

- Sign the Subscription Agreement

After reviewing your investment pledge, sign the subscription agreement to confirm your investment and finalize the amount.

- Prove Your Accreditation Status

Once you’ve signed the subscription agreement, the next step is to verify your accreditation status.

The easiest way to complete this is through a third-party verification document from your accountant, attorney, or financial advisor. Simply upload the completed document directly via the Securitize platform.

Alternatively, you can provide income documents (showing at least $200k individually or $300k jointly) or evidence of a net worth of $1M.

- Fund Your Investment

Once your accreditation is confirmed, you will receive detailed instructions on how to transfer your funds. Use the provided wire instructions through Securitize to complete your investment.

For questions about the investment process please reach out to support@franshares.com.

FAQ

-

- Watch the investment overview video: This provides a comprehensive look at the Kidokinetics business model and growth strategy.

- Review the Private Placement Memorandum (PPM): Essential for understanding the terms, conditions, and risks associated with the investment.

- Review the subscription documents: Ensure you understand the commitment and process of subscribing to this investment.

- Watch the webinar and ask questions: This is a great opportunity to clarify any doubts and hear answers directly from the Kidokinetics team.

-

Yes, investors can place investment orders for this fund now. Simply create an account through this link (takes less than 10 minutes) and you can place an order today! If you’re having trouble creating an account, please email support@franshares.com for assistance.

-

This offering operates on a rolling close basis, meaning investments will be accepted until the total fundraising target is reached. We recommend investing as soon as possible to ensure your participation, as the offering could close at any time once the target is met.

-

The minimum investment size is $10,000, while the maximum investment size can be up to the remaining available amount in the offering. For specific investment limits, please refer to the details in the Private Placement Memorandum (PPM) or contact the support team.

-

You need to be accredited to invest in this offering because it is conducted under **Regulation D, Rule 506(c)**, which allows companies to raise capital by offering securities to accredited investors without the need for SEC registration. This rule is designed to ensure that investors have the financial sophistication and ability to bear the risks associated with such investments, as these opportunities often carry higher risk and are less regulated than publicly traded securities.

An accredited investor is an individual or entity that meets certain financial criteria set by the SEC. Typically, an individual qualifies if they have a net worth of at least $1 million (excluding their primary residence) or have earned an income of $200,000 (or $300,000 with a spouse) in each of the last two years, with the expectation of maintaining that income level. This qualification ensures that accredited investors can handle the potential risks associated with private offerings.

-

Yes, international investors can invest in Kidokinetics. However, we recommend reaching out to our support team to verify eligibility based on your specific location.

-

To invest in Kidokinetics using AltoIRA, please use the link provided below. For further assistance, you can also visit the offering page or reach out to the support team.

Disclaimers:

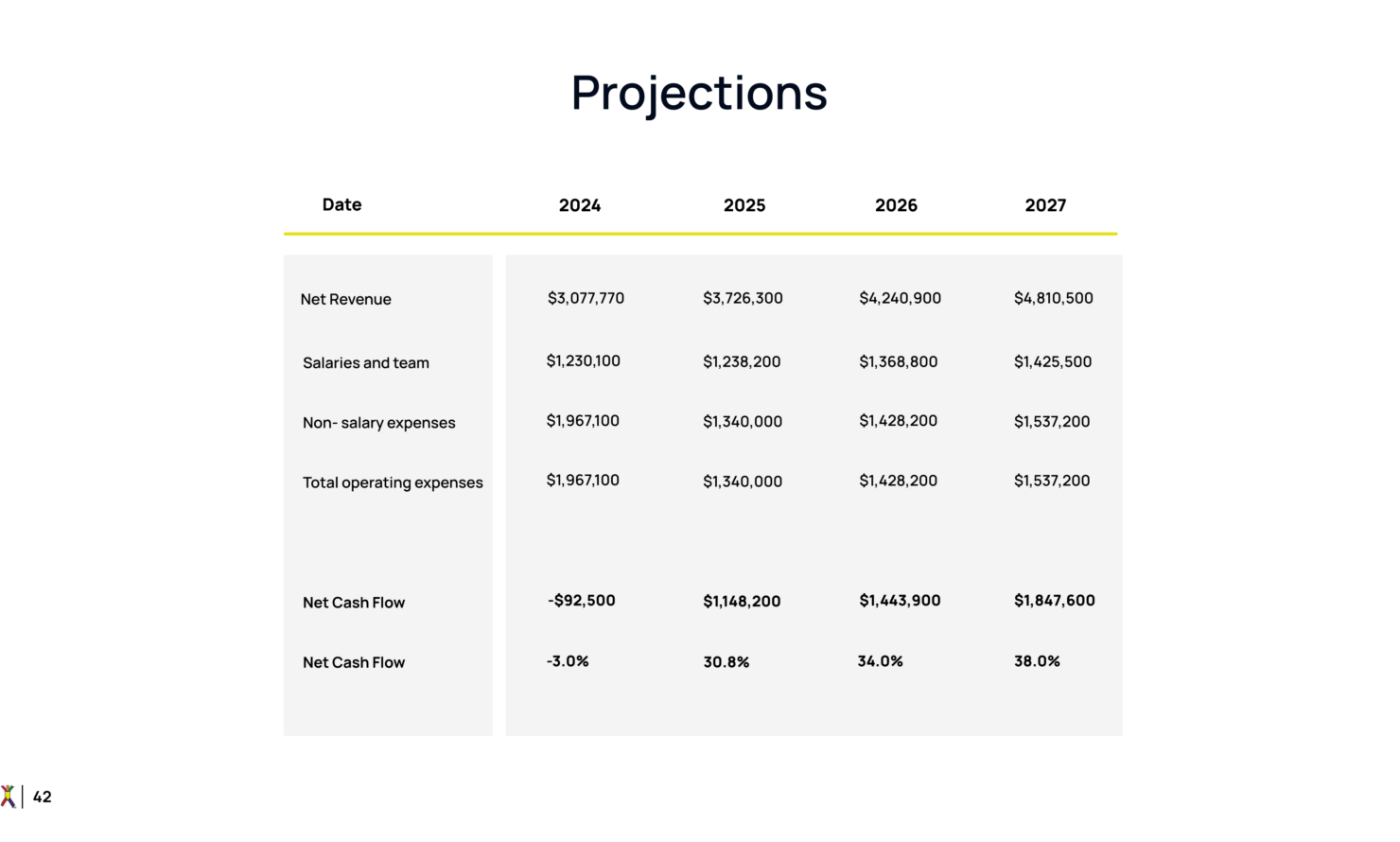

(1) IRR and MOIC projections are calculated using all cash flows, including the initial investment offering proceeds, annual earnings before interest, depreciation and amortization (“EBITDA”), less estimated corporate taxes, and the sale of the entire portfolio at the end of the 3rd year given a 2.5x increase in value.

(2) Cash yield projections are calculated as the arithmetic mean (average) of five years of annual cash flows (including EBITDA, less estimated corporate taxes) divided by the initial investment of offering proceeds.

(3) The preferred return prioritized investors receiving 2.0, or 200%, of their initial investment before profits are distributed to internal stakeholders.

(4) Kidokinetics is targeting a total raise of $600,000 in addition to the $500,000 in investment it has already secured. As part of this capital raise, Dave Pazgan and Terri Braun will be converting $542,000 of deferred compensation owed to them into the same Class B shares.

Management’s expectations are inherently uncertain and could vary significantly from the estimates set forth herein if any or all of the assumptions on which the estimates are based do not come to fruition. Actual results may differ materially from the estimates set forth herein, including those discussed in the section entitled “Risk Factors” and elsewhere in the private placement memorandum.

The information set forth in this document (including any written materials provided herewith) is proprietary and shall be maintained in strict confidence. Each recipient hereof acknowledges and agrees that the contents of this document (i) constitute proprietary and confidential information that FranShares, Inc. (together with its affiliates) derive independent economic value from not being generally known and (ii) are the subject of reasonable efforts to maintain their secrecy.

The recipient further agrees that the contents of this document are a trade secret, the disclosure of which is likely to cause substantial and irreparable competitive harm to the Kidokinetics and/or FranShares. Any reproduction or distribution of this document, in whole or in part, or the disclosure of its contents, without the prior written consent of Kidokinetics and/or FranShares, is prohibited. This document will be returned to FranShares upon request.

This document contains various estimates of financial information and valuation of securities. While all such information is presented based on the exercise of Kidokinetics’ reasonable judgment, there can be no assurance that such information will prove to be accurate or that such valuations reflect the true fair market value of the securities referenced. In addition, certain factual statements made herein are based on information from various sources prepared by other parties. While such sources are believed by Kidokinetics to be reliable, Kidokinetics does not assume any responsibility for the accuracy or completeness of such information. For avoidance of doubt, this information has not been independently verified by FranShares. FranShares does not assume any responsibility for the accuracy or completeness of such information.

FranShares has entered into an agreement with the issuer to provide marketing services in exchange for the following cash fees: a $20,000 one-time listing fee, a $5,000 fee for each additional close following the first close, and a $1,000 monthly platform fee.

Certain statements in this document constitute forward-looking statements. When used herein, the words “project,” “anticipate,” “believe,” “estimate,” “expect,” and similar expressions are generally intended to identify forward-looking statements. Such forward-looking statements, including the intended actions and performance objectives of the relevant party referenced herein, involve known and unknown risks, uncertainties, and other important factors that could cause the actual results, performance, or achievements of such party to differ materially from any future results, performance, or achievements expressed or implied by such forward-looking statements. All forward-looking statements in this document speak only as of the date hereof. FranShares and Kidokinetics expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in its expectation with regard thereto or any change in events, conditions, or circumstances on which any such statement is based. Furthermore, nothing contained herein is, or should be relied upon as, a promise or representation as to the future performance of any fund sponsored by FranShares.