Beyond the Arches #14: Some investors are planning to ride the rideshare wave to alpha…here’s how!

Featured Story

Rideshare is still king as the robotaxi revolution remains distant

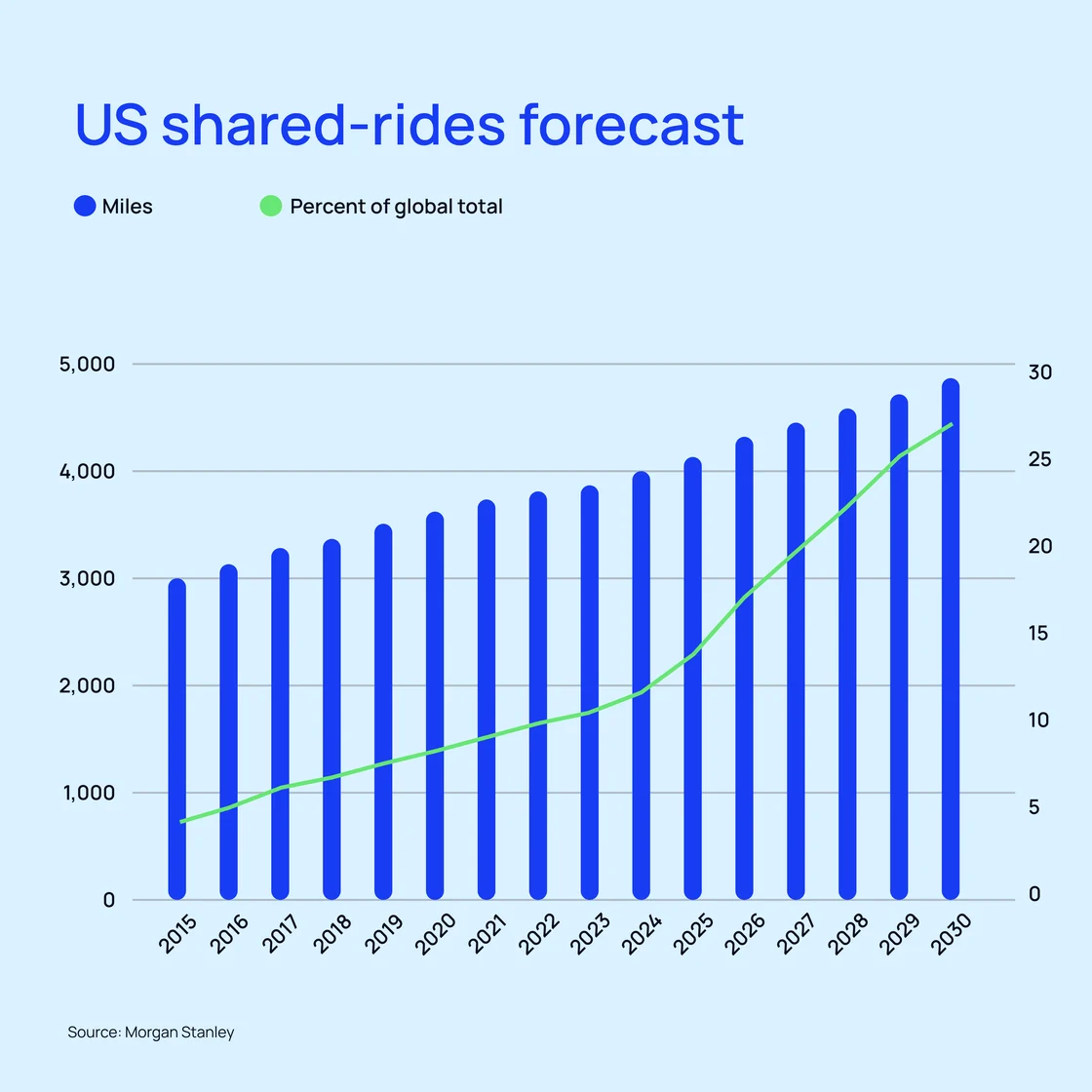

Ridesharing has become a necessity for commuters and travelers alike, especially those in densely settled urban areas. The demand for these services is only expected to grow as city populations continue to climb; according to projections by Morgan Stanley, for instance, ridesharing in the United States will make up over 25 percent of the global total by 2030.

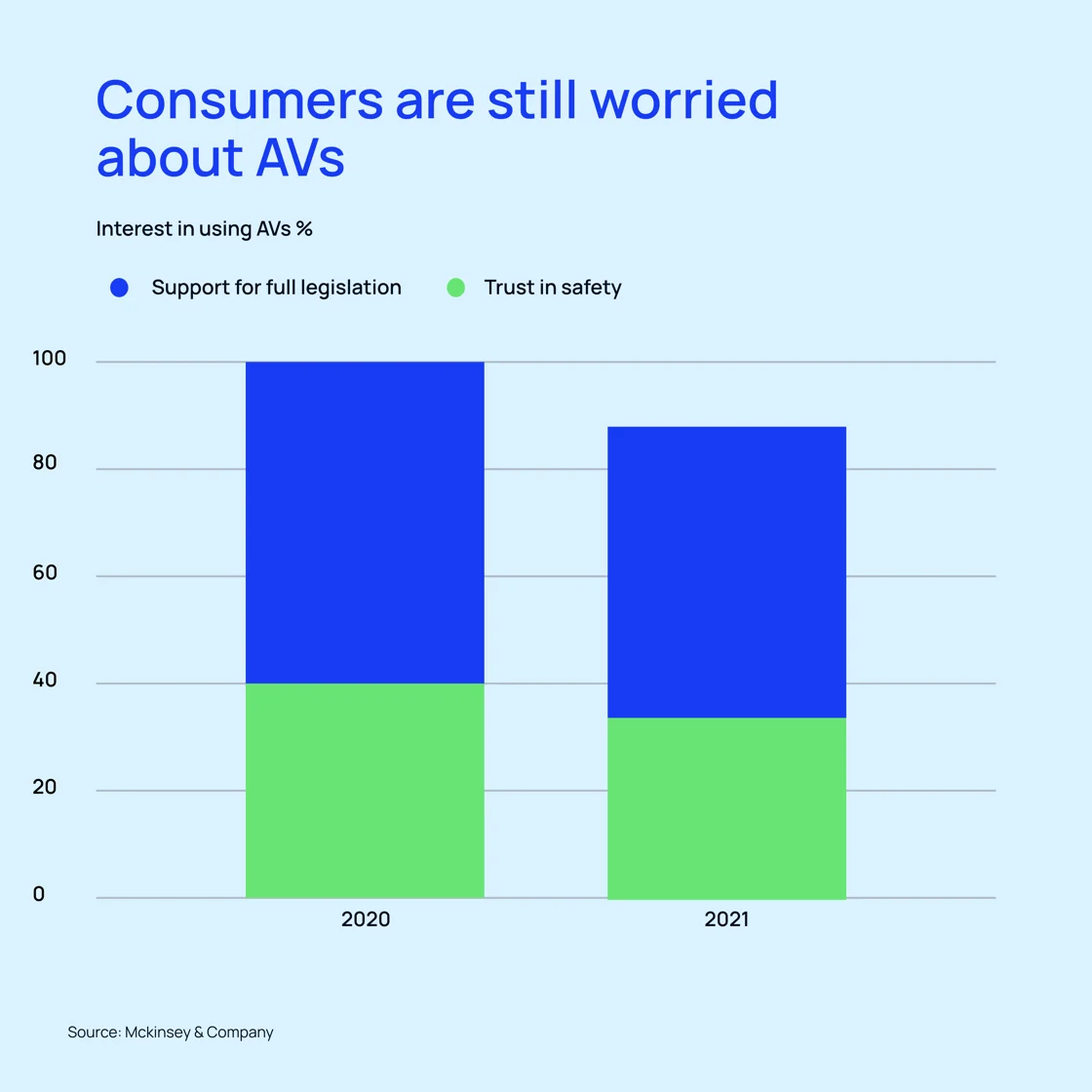

Robotaxis are relative newcomers to the ridesharing scene and are anticipated to receive regulatory approval sooner rather than later. Yet these vehicles aren’t without their challenges. While their autonomous drivetrain and traffic mitigation features lend themselves to lower fares in the long term, consumers are still concerned about their safety capabilities.

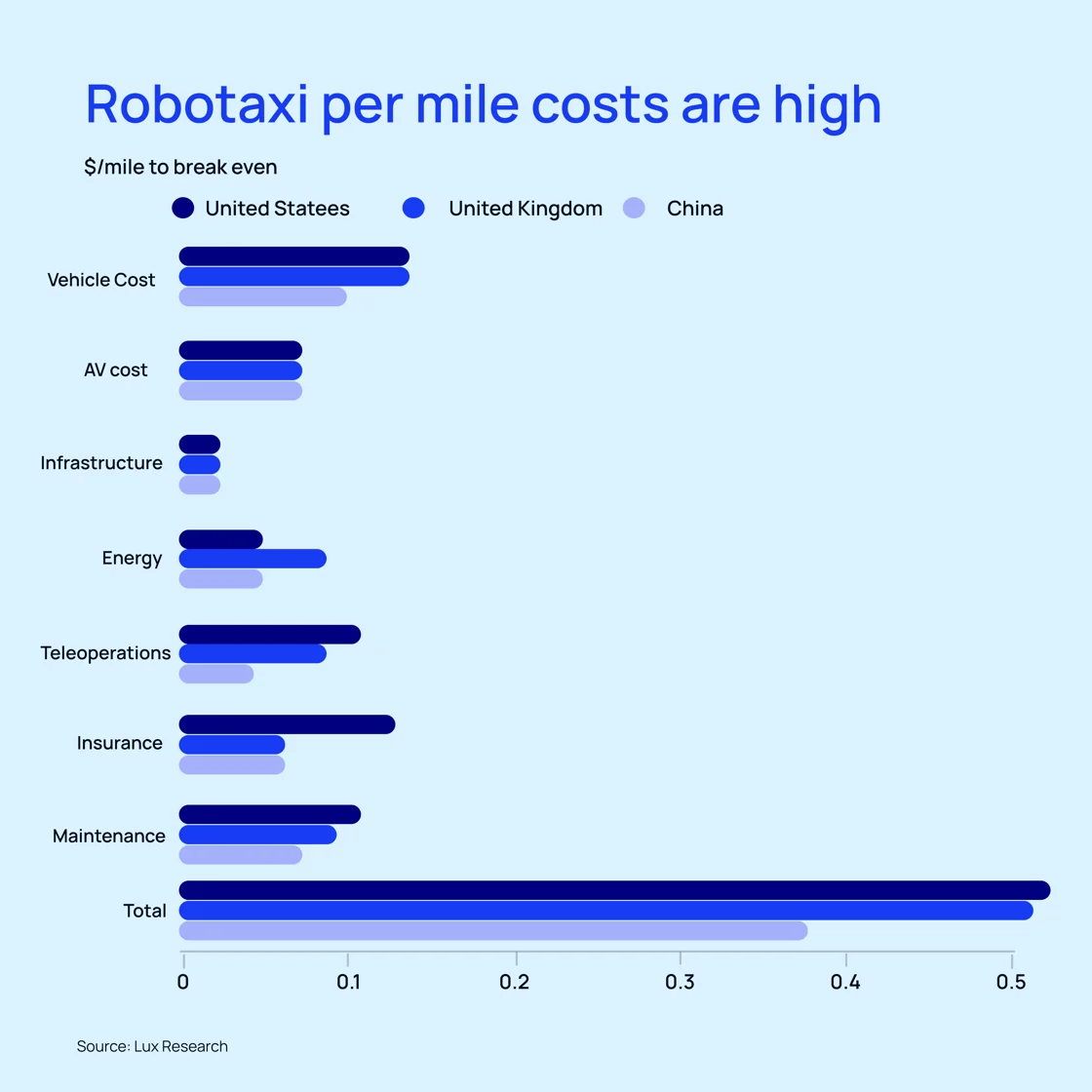

Unfortunately, we haven’t seen much of those cost-saving benefits – at least, not yet. The fare for a robotaxi service in the Bay Area is still comparable to a standard Uber. There are many reasons why costs for robotaxis remain high, including the R&D investment needed to get these enterprises off the ground, as well as cleaning and maintenance costs, and the need for remote supervision technology to monitor the safety of passengers.

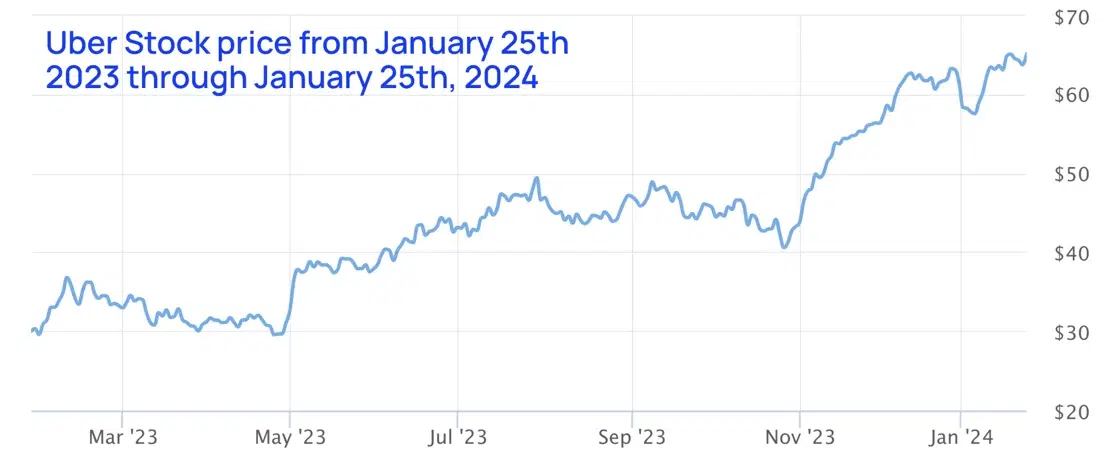

Rethinking the use of Lidar (light detection and ranging) versus cameras is one way to potentially bring down the cost per mile, as well as leveraging advertising opportunities within the vehicles themselves. In the meantime, “traditional” ridesharing services like Uber are still enjoying increased demand, which means investing opportunities for smart investors.

Direct investment opportunities

With the rideshare market expanding, you may want to explore investment opportunities. Here are two direct-investment options to leverage right now:

- Freebird Rides

Freebird is a mobility marketplace that allows users to redeem promotions, get cash back, and earn rewards when traveling near local businesses by booking their Uber and Lyft rides through the Freebird app. On the vendor side, the company allows businesses to directly target and convert revenue-generating customers by offering cash-back or other rewards, with directly measurable return on investment (ROI) in a pay-for transaction. Freebird Rides is planning a national rollout this spring and is currently raising capital via WeFunder. - On Touch Go

A self-service ad platform for rideshares, On Touch Go allows companies to reach millions of captive viewers in 60,000+ rideshare vehicles nationwide. The campaign setup process takes mere minutes and allows for hyperlocal targeting. Rideshare drivers who implement the platform in their vehicles can earn additional monthly income. On Touch Go is currently raising capital via WeFunder.

STR Investment Opportunities

Short-term rentals (STRs) are a flexible and often lucrative way to add real estate to your investment portfolio. Check out these opportunities, courtesy of our friends at The Offer Sheet.

A cozy updated Ohio abode

12625 Millview Ln, Chardon, OH 44024 | $399,900

Nestled on a private 5.6-acre lot, this remodeled three-bedroom, three-bathroom A-frame home offers scenic views and combines rustic charm with modern updates. The main floor features open-concept living and dining areas flooded with natural light and complete with a cozy wood-burning fireplace adorned in natural river rock. The kitchen, updated with pine countertops and a central island, includes appliances that are all less than four years old, blending style with functionality. Two bedrooms and a full bath are also featured on the main level. Walk out to the wrap-around deck, which is great for your enjoyment as well as for entertaining, and the hot tub invites you to enjoy the space year-round.

- Average daily rate: $326

- Expected occupancy rate: 63%

- Monthly expected income: $6,247

- Monthly expected expenses: $4,107

- Monthly expected cash flow: $2,140

- Expected cash on cash return: 22.7%

Come for a rest at a New England Eagles Nest

59 Cedarwood Road, Stockbridge, VT 05772 | $549,000

Eagles Nest is a superb example of the Robert Carl Williams prairie-style contemporary. As you enter this captivating two-bedroom, two-bathroom mountain home, the striking slate tile draws you to the main living area with its welcoming open floor plan, vaulted ceilings, massive fieldstone fireplace, and scores of windows offering breathtaking views. The updated kitchen features stainless appliances, attractive pendant lighting, and a convenient breakfast bar, while sliders in the living and dining areas extend the living space outdoors. Tastefully appointed and decorated, this spectacular home is offered fully furnished and move-in-ready. It is centrally located in the heart of the Green Mountains, close to several world-class ski resorts, making it a perfect vacation getaway, primary residence, or short-term rental property.

- Average daily rate: $334

- Expected occupancy rate: 66%

- Monthly expected income: $6,705

- Monthly expected expenses: $4,680

- Monthly expected cash flow: $2,025

- Expected cash on cash return: 16.2%

Turnkey luxury in northeast Pennsylvania

1142 Oakland Pl, Pocono Pines, PA 18350 | $1.5M

This beautiful new craftsman home is full of one-of-a-kind details. The six-bedroom, four-bathroom home features European windows and doors, custom solid eight-foot oak doors, custom chandelier, modern banister, wood and stone countertops, induction oven, radiant flooring, all custom-made outdoor furniture, and much more. This could make a great family home or short-term rental/investment property.

- Average daily rate: $611

- Expected occupancy rate: 64%

- Monthly expected income: $11,894

- Monthly expected expenses: $9,809

- Monthly expected cash flow: $2,085

- Expected cash on cash return: 6.5%

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.