Beyond the Arches #18: Manufacturing gains cool Fed cut enthusiasm, but the demand for manufacturing tech is an opportunity for investors

Featured Story

Manufacturing gains cool hopes for fed cuts

U.S. manufacturing expanded for the first time since September 2022, surprising economists with the production gain. According to the most recent data, the Institute for Supply Management (ISM) manufacturing gauge rose 2.5 points to 50.3. Gains in key industries, including textiles, nonmetallic minerals, paper, and petroleum, contributed to the expansion. Other sectors, including furniture, plastics, rubber, and electrical equipment, contracted.

The strong ISM data, while encouraging news for the general economic outlook, cooled the odds of a June Fed rate cut to below 50%. Income and spending data from February show that consumer spending remains strong. The personal consumption expenditures (PCE) price index rose 0.3% in February, compared with the 0.4% increase that was projected. Progress toward lower inflation has cooled. The Fed cited the need for more data about inflationary trends to cement a decision on the first of its three planned rate cuts in 2024. Earlier in the week, Fed Governor Christopher Waller stated the recent economic data may show the need to delay or reduce planned cuts for the year.

The dollar also responded to manufacturing and Fed rate data, rising on the news of robust production and careful inflationary planning. The dollar index finished 0.507% higher than its six competitor currencies at 105.01. In contrast, the yen reached a 34-year low against the dollar, finishing at 151.975. The yuan faced similar pressures, though Chinese manufacturing also enjoyed gains in its latest reporting. Japanese and Chinese finance authorities have been working in recent months to stabilize their respective currencies.

How to invest in manufacturing technology

As manufacturing evolves with the help of better technology and AI enhancements, investors can participate in the tech that supports this backbone economic sector. Here are three companies that are working to make the future of manufacturing more efficient:

- Hempitecture: Housing and commercial real estate production rely on energy-efficient insulation to save costs and reduce construction’s carbon footprint. Hempitecture uses plant-based materials tech to create carbon-negative, hemp-derived construction insulation. It’s the first U.S. company to bring sustainable hemp insulation to market. CEO Matthew Mead founded Hempitecture in 2013, and it became a Public Benefit Corporation in 2019.

- Rayton: Semiconductor manufacturing enjoyed renewed domestic focus thanks to the CHIPS for America Act and the FABS Act in 2022. With this increased interest, the need for next-generation materials also increases. Materials science startup Rayton holds two patents for innovative semiconductor wafers and processes for manufacturing. The processes have the potential to produce 100x the material of traditional methods while reducing the price of wafer production by 25%. CEO Andrew Yakub, a Forbes “30 under 30” recipient in 2016, leads the company along with former UCLA Physics and Astronomy Chair, Dr. James Rosenzweig, and CFO Robert Julian.

- Live BFF: With home ownership prices climbing, bringing down the cost of construction is central to helping new buyers achieve the American dream. Live BFF is helping reduce those costs and expand access to sustainable, prefabricated homes through automation and robotic processes. In improving the home engineering process, the startup hopes to “solve the housing crisis, for good” with homes that can be built and occupied within two weeks for as little as $75,000 (for studio home models). President Justin Armendariz and Director of Design Sam Friesema lead the design and production of Live BFF’s prototype models.

On Our Radar This Week

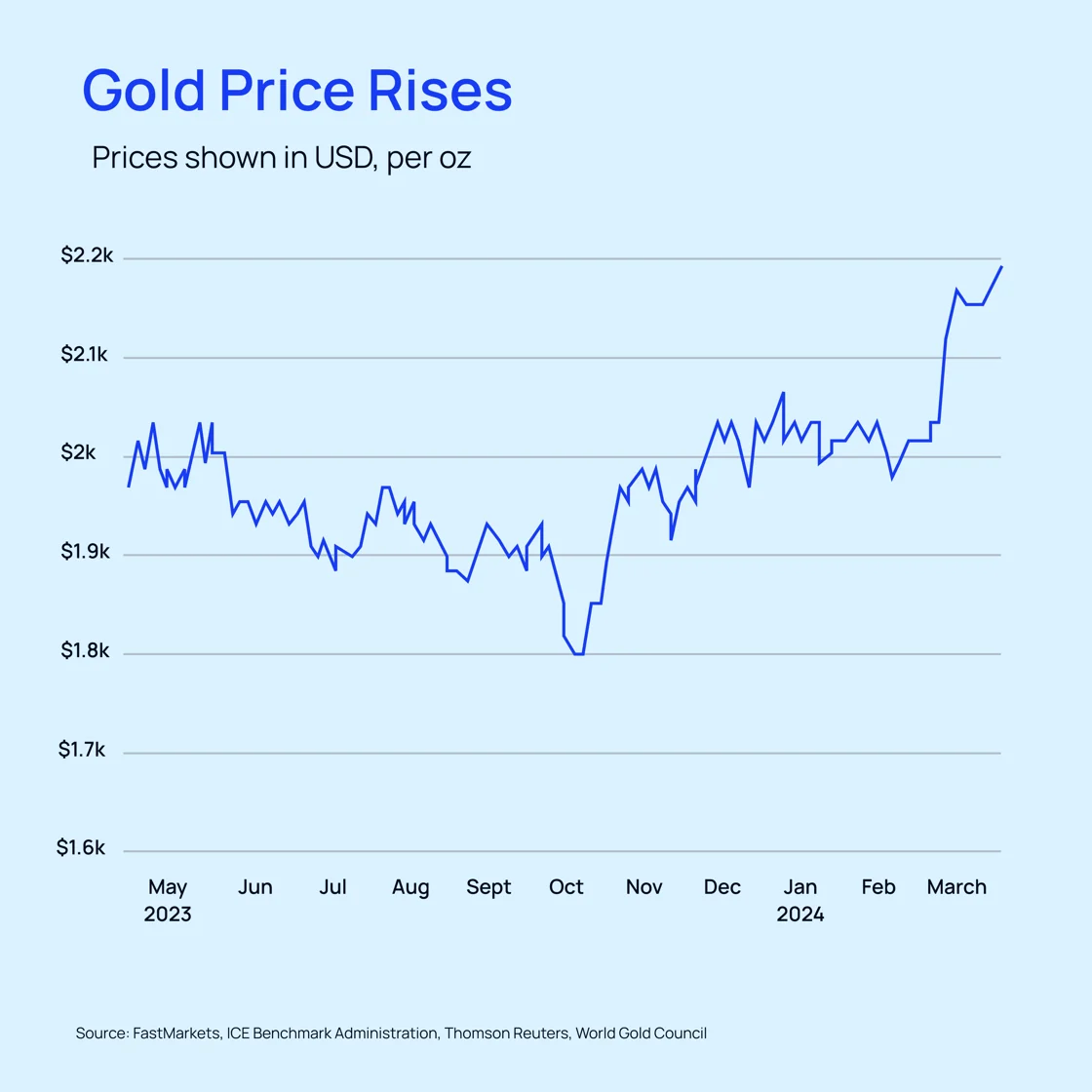

- Record high for gold values: Gold bullion jumped to over $2,265 per ounce on Monday, up 1.6% from the previous close. The Fed’s inflation commentary, elevated global tensions, and stronger buying rends from central banks have driven supply and pricing for consumer gold purchases.

- What will happen with commodities as central banks cut rates? Reduction in borrowing costs has a ripple effect across most economic activities. Fed rate cuts in non-recessionary conditions may lead to higher pricing in raw materials, crude oil, and precious metals like gold and copper. The performance in these sectors will rely on upcoming inflationary evidence, consumer confidence, and global tensions, among other factors.

- China’s March Manufacturing Growth Could ‘Dump Into Global Markets, Thus Triggering Deflation,’ Expert Warns: A 13-month peak of the Caixin China General Manufacturing PMI climbed to 51.1 in March, its fastest climb since February 2023. Like the U.S. index, manufacturing in China beat market expectations after a long-term lull in performance. While economists believe this could lead to global growth, according to veteran investor Ed Yardeni, it could also push factories to “produce more to dump into global markets, thus triggering deflation, threatening foreign manufacturers, and raising trade tensions.”

Macro Bites

- Visa and Mastercard Agree to Cap Their Swipe Fees in Settlement, leading to lower costs for retailers and the potential of passing those savings on to consumers.

- Crypto Market in Zen Mode as Bitcoin Remains Stable at $70K Ahead of Halving: In advance of the anticipated halving of mining reward prices, Bitcoin and coin-related ETFs have stabilized from last week’s sub-$65,000 dips.

- Data from 73M current, former customers leaked on dark web, AT&T confirms: A leaked dataset, including Social Security numbers, prompts security concerns and mass password resets to counter potential fraud activity.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.