Beyond the Arches #20: TikTok legislation & big tech earnings are causing a stir in the market, but social media is here to stay

Featured Story

Despite challenges, social media users still seek connection

The Internet was abuzz this week after the passage of legislation by Congress to force the divestiture of popular video app TikTok. The bill, which was into law by President Biden on April 24th, forces a sale of TikTok by ByteDance, a Chinese company that lawmakers fear could be leveraged by the CCP to gather sensitive information on Americans using the platform. Yet the bill is likely to face extensive legal challenges from ByteDance, as well as small businesses that rely on the TikTok platform to generate income.

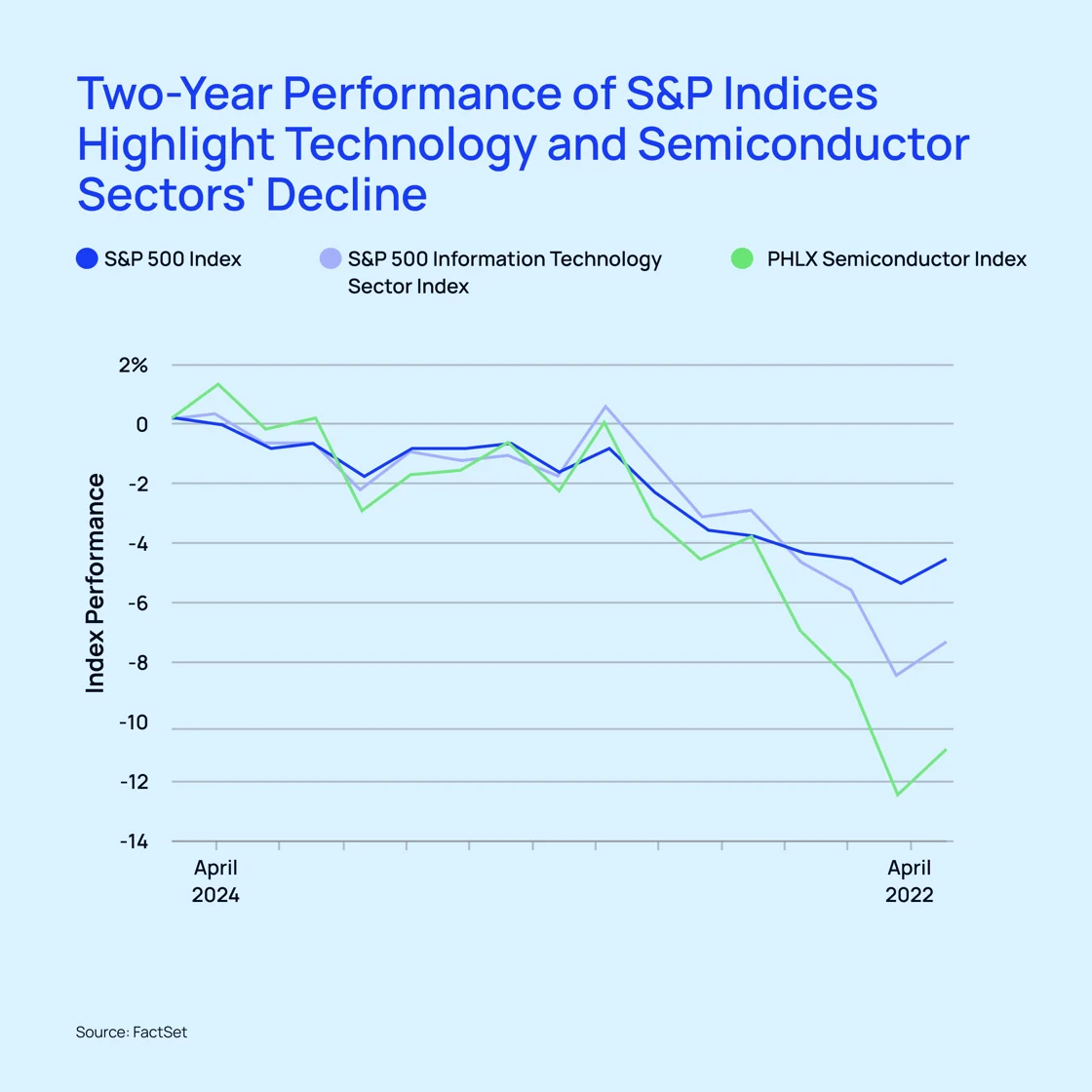

This news comes a week after Magnificent Seven tech stocks (Google, Apple, Meta, Microsoft, Tesla, Amazon, and Nvidia) lost nearly $1 trillion in combined market value, reflecting uncertainty around if and how these players can maintain their current pace of growth relative to other tech companies.

On Monday, UBS Investment Bank’s chief US equity strategist issued a research note downgrading six of the seven key stocks from Overweight to Neutral.

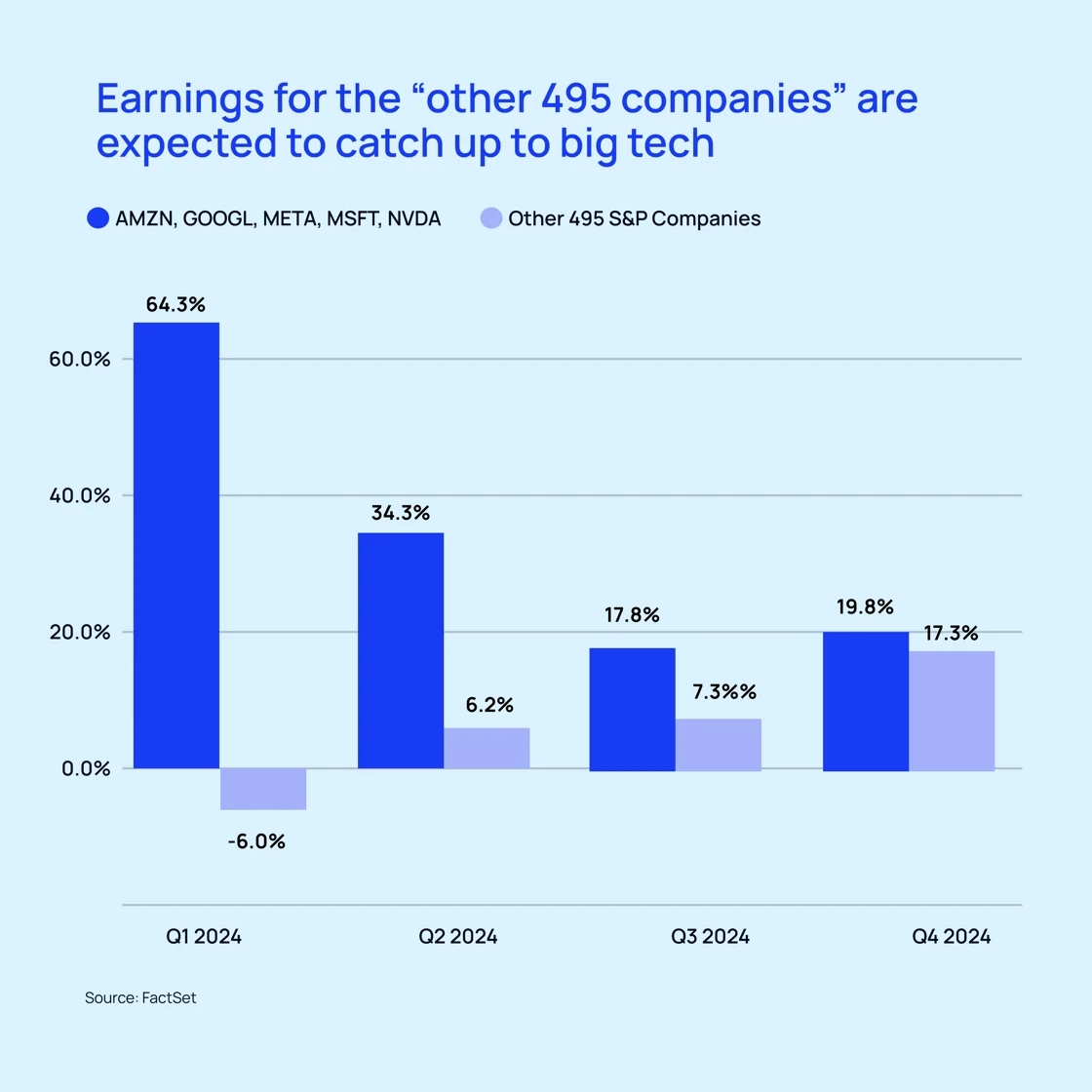

While on the surface these developments might seem detrimental to growth in the sector, the opposite may actually be true. USB’s downgrade of Magnificent Seven stocks reflects the potential for relatively robust growth from the other 495 companies in the S&P 500 in the coming months. In addition, social media continues to be enormously popular, used by an estimated 5 billion people – that’s 62.3 percent of the world’s population. This audience is projected to grow to approximately 6 billion people in the next three years – and innovators in the space are paying attention.

How to invest in social media

Here are three companies out to disrupt the social media sphere that you can invest in right now:

- Fanbase is a free-to-download, free-to-use, next-generation social network that allows any user to earn money from day one. The platform enables users to monetize their content charging from $2.99 to $99.99 a month per subscriber, for exclusive access to photos, videos, audio chat rooms, and long-form content. Fanbase also has virtual gifts, known as “LOVE,” that allow users to tip other users half a penny per LOVE.

- MeWe is one of the world’s largest privacy-first, decentralized social networks. Led by former executives from Apple, Disney, Yahoo!, and Myspace, MeWe leverages Frequency, a type of blockchain network known as “parachain” that’s connected to the Polkadot network, to efficiently deliver Web3 functionalities to MeWe’s 700,000+ users on-chain.

- Featured on Shark Tank and backed by Mark Cuban, Overplay allows users to turn their short-form videos into games in minutes. With no coding required, the app uses AI tools to transform videos. It integrates directly with Adobe Express, cutting down on thousands of hours of production time and millions of dollars in costs for brands that want to leverage this highly engaging ad format.

On Our Radar This Week

- Tesla has cut prices in China, Germany, and a number of other countries after doing the same in the US. The company is grappling with falling sales amid stubborn inflation and an intensifying price war for electric vehicles (EVs), especially against Chinese EVs. In Q1 of 2024, Tesla’s vehicle deliveries fell for the first time globally in nearly four years, and it is expected to lay off more than 10 percent of its workforce as competition in the EV markets heats up.

- Africa-focused VC TLcom Capital has closed its second fund at $154M to back early-stage startups. The oversubscribed round, initially targeted to close at $150 million, attracted participation from more than 20 international partners, including the European Investment Bank (EIB), Visa Foundation, Bertelsmann, and AfricaGrow, which is a joint venture between Allianz and DEG Impact. Venture capital activity in Africa has shown resilience over the past six months despite the ongoing funding winter elsewhere.

Macro Bites

- US mortgage rates hit a five-month high with the 30-year rate surging by 22 basis points on expectations that the Federal Reserve will hold off on cutting interest rates in the near term.

- The Bank of England is expected to start cutting interest rate cuts earlier than the US Federal Reserve, likely causing UK gilt yields to decline faster than US Treasury yields, according to ING analysts.

- Chinese manufacturing powerhouse and population center Guangdong has been hit by historic floods, threatening the country’s uneven economic recovery.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.