Beyond the Arches #22: Rising food prices and changing consumer trends are a challenge, but offer the potential to add new flavors to investor portfolios

Featured Story

High food prices spur comparison shopping, paring down

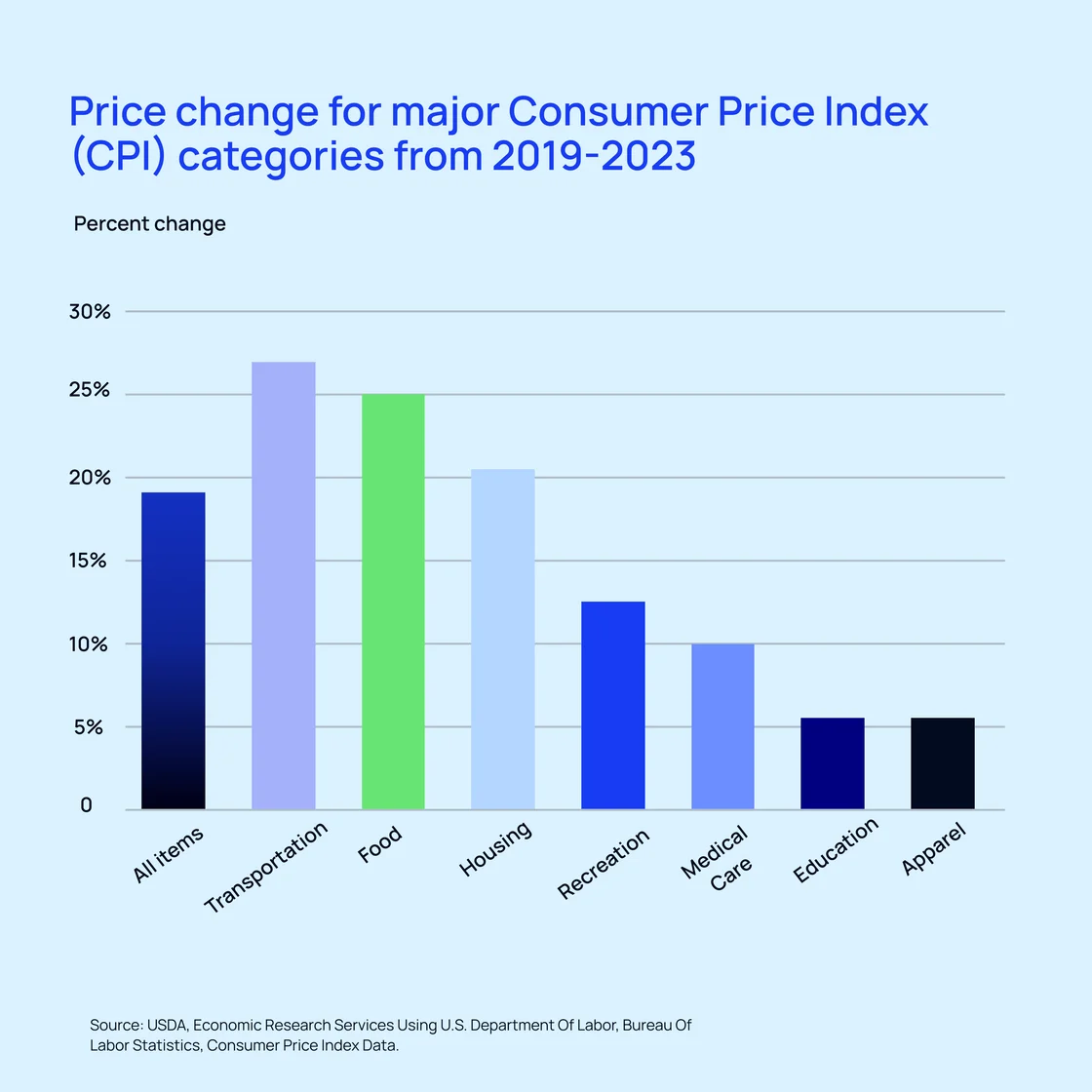

After years of increasing food prices and shrinking serving sizes, customers have had enough. Fast food retail and name-brand product sales are slipping as buyers curtail their trips to the drive-thru and consider store brands to dull the sting of post-pandemic food pricing. Fast food prices have risen more than 30 percent since 2019, while the USDA says grocery prices for some items are up as much as 26 percent.

Price increases are predicted to continue through 2024, with the cost of 12 categories in the USDA’s Consumer Price Index (CPI) food report showing likely increases. Overall, economy-wide inflation rose .6 percent from February to March 2024, with food prices up 2.2 percent YoY after a 5.8 percent increase in 2023. Only three categories within the CPI fell or remained unchanged.

Even if buyers have the money to weather higher prices, many are simply not interested in paying more – sometimes double – for their usual Big Mac or latte. Restaurants, a common bellwether of the larger financial outlook, seem less affected by inflationary concerns. However, consumers may be focusing their visits on special occasions rather than opting for everyday meals out. The slip in demand may help the Fed navigate the inflation equation since it uses consumer data, such as the CPI, to evaluate the path forward for interest rate cuts.

How to invest in food

Everyone needs to eat, and how we source our food plays a big role in industry innovation. Consumers fed up with price hikes at the order window turn to home-based meals and whole ingredients for better quality and lower prices. When they venture out for a meal, many consumers want new experiences – and iInvestors are taking note of this shift, investing in better ways to enjoy and produce good food from home. Here are three investments to consider in the food sector.

- Immigrant Food: Spending on experiences over “stuff” is a growing consumer trend. With its growing chain of restaurants, Immigrant Food wants to embrace this concept and help diners “transcend borders” and “unite flavors.” The immigrant-led startup has three DC-based locations that are focused on combining innovative gastronomy and social advocacy for a unique, empowering dining experience. Leaders Peter Schechter, Tea Ivanovic, and Michael Donlon have led the concept to 15 percent profitability and garnered nods from FastCompany and the Forbes 30 under 30.

- Seedsheet: Backyard cultivation is a burgeoning corner of the consumer food industry. This gardening startup is making it easier for the average person to grow food in their backyard and achieve the fulfillment of producing grocery-quality vegetables from home. The platform allows gardeners to curate their Seedsheet from more than 80 different edible, organic, non-GMO plants. The patent-pending mat arrives ready to unroll over prepared soil, and is complete with weed control and nutrients. Founder Cam MacKugler, CEO Rob Kennedy, and CMO Chris Stroud have driven over $7M in revenue through strong marketing, press attention, and a successful appearance on Shark Tank.

- Dice Cream:Autonomous treats may not be your first thought when considering the future of food – but robotic parlor Dice Cream aims to change that. The automated ice cream stand dishes out high-quality scoops without the traditional parlor setup. The streamlined delivery system will cut costs, reduce the store footprint, and eliminate the traditional challenges of running a brick-and-mortar shop. The company’s team, including CFO Chang Jy Richard Wu, CEO Jack Yang, and Chief Strategy Officer Kevin William Morris, bring over 30 years of combined experience in food, robotics, and automation to this fast-growing market sector.

On Our Radar This Week

- China’s Xi courts Europe as allies question U.S. support:President Xi Jinping met with leaders in France, Serbia, and Hungary to stave off a potential trade war with the European Union. The visit comes during a tense period in the long-standing China-U.S. rivalry. This marks Xi’s first visit to Europe since 2019. China hopes to solidify its tenuous ties with Europe, especially in light of uncertainty that the U.S. will maintain its past support for allies.

- A win for cannabis as DOJ plans risk reclassification: Long-time proponents of legal cannabis got one step closer to Federal legalization as the DOJ begins the process of making it a Schedule III drug. The reclassification moves cannabis away from Schedule I drugs like heroin and LSD, and Schedule II drugs such as cocaine and methamphetamine, recognizing its potential medical benefits and moderate to low dependence rates.

Macro Bites

- Higher-for-longer rates are forcing commercial property owners to rethink their options. The dwindling hope of interest rate cuts has borrowers considering other plans.

- The U.S. economy added just 175,000 jobs last month, and unemployment rose to 3.9%. After a booming March report, April’s report mirrors pre-pandemic performance.

- India’s April factory growth eases but still strong, PMI shows. Though growth slightly cooled, raw materials demand helped bolster GDP estimates.

Start passively investing in franchises today!

Accredited and non-accredited investors can invest in our latest offering, TNT Franchise Fund Inc., today!

TNT Franchise Fund Inc. is a diversified portfolio of up to 30 Smash My Trash locations and 25 Teriyaki Madness outlets throughout the United States.

With its patented waste compaction service, Smash My Trash is disrupting the $1.6 trillion waste management sector. By compacting waste in open-top dumpsters to reduce waste volume, customers save money (up to 20% of waste removal costs) and reduce their CO2 emissions by up to 65%.

Teriyaki Madness stands out with its fresh, made-from-scratch meals and a lively, inviting ambiance, revolutionizing the fast-casual Asian dining scene. Its surging popularity is evident on platforms like Yelp, Facebook, and Google, where an increasing community of enthusiasts sing its praises.

Highlights:

- Target locations: Up to 55

- Smash My Trash per-location economics: $885K in revenue with 28% EBITDA after 16 months of operation

- Teriyaki Madness per-location economics: $1.16M in revenue with 20% operating profit

As the Smash My Trash and Teriyaki Madness locations come to fruition, investors in TNT Franchise Fund Inc. can expect to receive excess cash flows from the business operations of the locations on a quarterly basis.

For more information on the offering, contact our team.